Overriding the Frequency of Benefit Deductions

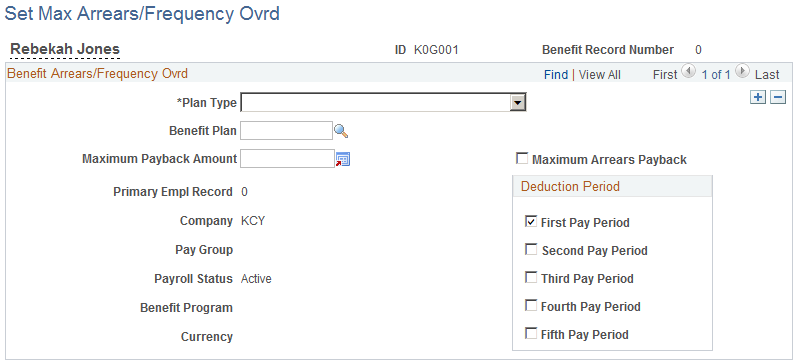

After the system has performed benefit deductions for your employees, you can override the frequency of a deduction amount for individual employees using the Set Max Arrears/Frequency Ovrd page.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BENEF_DED_OVERRIDE |

Manage overrides to benefit deduction frequency and arrears processing. |

Use the Arrears/Frequency Override (set maximum benefit arrears/frequency override) page (BENEF_DED_OVERRIDE) to manage overrides to benefit deduction frequency and arrears processing.

Navigation:

This example illustrates the fields and controls on the Arrears/Frequency Override page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Maximum Payback Amount and Maximum Arrears Payback |

When employee net pay is insufficient to cover a deduction and deducting all appropriate amounts is not possible, the employee is in arrears. That is, the employee owes the employer for a deduction that could not be made. Use these fields, to specify how the system handles the payback of arrears balances by indicating the maximum amount of arrears payback that can be taken out of an employee's paycheck. |

Deduction Period

This group box enables you to override the deduction frequency. Normally, the frequency with which a deduction is taken from an employee's paycheck is controlled through the deduction table and paygroup.