Recording ACA Data

This topic discusses how to record ACA data for an employee.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ACA_ELIGIBILITY |

Enter ACA eligibility details for an employee. |

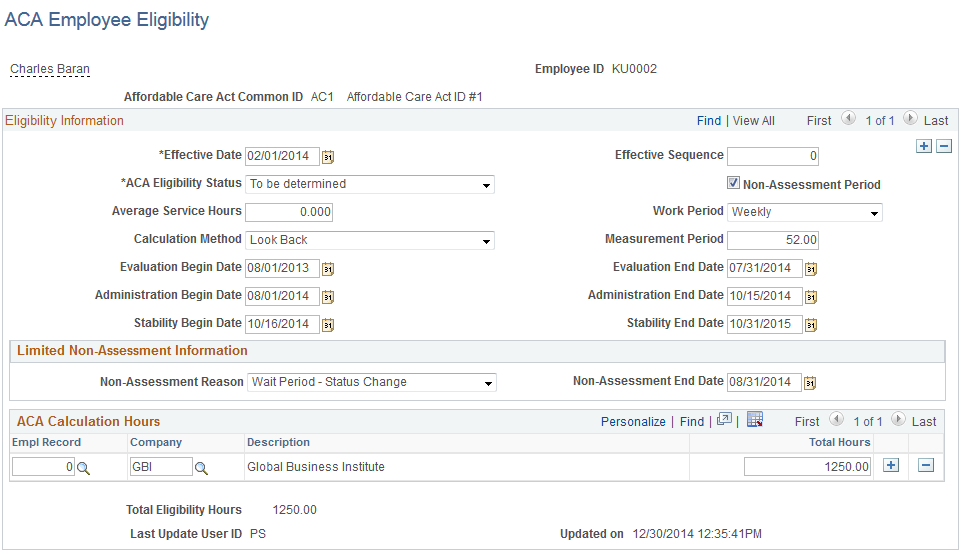

Use the ACA Employee Eligibility page (ACA_ELIGIBILITY) to enter ACA eligibility information for an employee.

Navigation:

Click the ACA Eligibility Details link on the Job Data - Benefit Program Participation page.

This example illustrates the fields and controls on the ACA Employee Eligibility page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the date on which the ACA eligibility status becomes effective. The effective date is usually the start of a stability period, but can be different if required. |

ACA Eligibility Status |

Choose the ACA eligibility status from the following values:

|

Non-Assessment Period |

Choose whether the employee is in a non-assessment period. On selecting the Non-Assessment Period checkbox, the Limited Non-Assessment Information section will be displayed to enter further information about the employee’s non-assessment period. The effective date represents the start of the non-assessment period. |

Average Hours of Service |

Enter the average hours based on all the jobs the employee has under the same ACA Common ID. |

Work Period |

Choose whether the work period for the average hours of service is Weekly or Monthly. |

Calculation Method |

Choose the calculation method used to determine ACA eligibility. The values are:

|

Measurement Period |

The measurement period corresponds to the Look Back calculation method. The measurement period should be between 3 to 12 months if the work period is Monthly, and 12 to 52 weeks if the work period is Weekly. |

Evaluation Period Begin Date |

Enter the start date of the Look Back period to be used to determine the employee’s average service hours. |

Evaluation Period End Date |

Enter the end date of the Look Back period to be used to determine the employee’s average service hours. The evaluation period cannot be less than three months or more than 12 months. |

Administration Period Begin Date |

Enter the next date after the evaluation period end date. |

Administration Period End Date |

Enter a date within 90 days from the administration period begin date. |

ACA Stability Period Begin Date |

Enter the start date of the stability period in which the ACA eligibility status or average hours of service is effective. The ACA stability period begin date must be after the evaluation period end date. |

ACA Stability Period End Date |

Enter the minimum end date that stability period has to be provided to the employee if ACA eligibility is yes, and the maximum end date that stability period provided to the employee if ACA eligibility is no, according to the rules of the Look Back method. The date must be later than six months after the ACA stability begin date. |

Non-Assessment Reason |

Enter the reason of the non-assessment period:

|

Non-Assessment End Date |

Enter the end date of the non-assessment period. The date must be after the effective date. |

Last Updated User ID/Updated On |

Review the timestamp to keep track of when and by whom the data was previously updated. This can be a system update, manual update by the HR Administrator, or data from template-based hire. |

The ACA Calculation Hours grid lists the Total Hours for the measurement period for multiple jobs handled by the employee (e.g. Employee Record) and companies that belong to the same parent ACA Common ID.

Note: Currently, no automatic BAS Activity trigger is generated when ACA Employee Eligibility Status is updated. Hence if an ACA Eligibility Status update needs to be accounted for in Benefits Administration Event processing, as a Benefits Administrator, you need to manually enter a BAS Activity trigger. It is recommended to set the Event Date to coincide with the Stability Begin Date or when the new coverage should begin, based on ACA requirements. Here, it is assumed that the BAS Action for the trigger is attached to the Event Rule where the Coverage Begin Date is set at ‘On the Event Date’.

This topic provides an overview of how to use the ACA component interface.

If you have third-party transaction data in a Microsoft Excel spreadsheet, you can use the CI_ACA_ELIGIBILITY component interface to load the data into the ACA_PERSON, ACA_PER_ELIG, and ACA_PER_DTL records. The component interface simplifies the process of loading your data and performs the required validations during the process.

For more information, see PeopleTools documentation for PeopleSoft Component Interfaces.