Reviewing Charges

This section discusses how to review charges.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BILL_CHRG_VW |

View how Benefits Billing charges and payments add up for a selected employee. |

|

|

BILL_CHRG_DET |

View details of charge actions. |

|

|

BILL_CSUM_BY_BPER |

Arranges a participant's charges by billing period. |

|

|

BILL_CSUM_BY_PTYPE |

Arranges a participant's charges by plan type. |

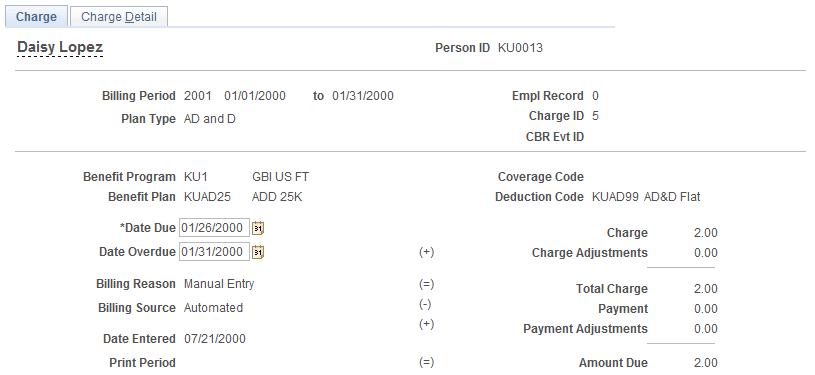

Use the Charge page (BILL_CHRG_VW) to view how Benefits Billing charges and payments add up for a selected employee.

Navigation:

This example illustrates the fields and controls on the Charge page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Charge ID |

A system-generated number that ensures the uniqueness of Billing Charge records. |

CBR Evt ID (COBRA event ID) |

If this coverage is calculated under COBRA, provides a link to the COBRA event. |

Benefit Program, Coverage Code, Benefit Plan, and Deduction Code |

Obtained from the participant's Manage Base Benefits business process records. These fields can be used to trace back to the rate tables and calculation rules that created the charge. |

(CAN) Sales Tax |

Appears if the charge is for Canadian sales tax associated with another benefits charge. |

Date Due and Date Overdue |

You can modify these dates. |

Print Period |

Indicates the begin and end dates of the billing calendar during which the statement for this charge was sent. |

Charge |

The original charge calculated by the batch calculation process or entered in the Charge Entry page. |

Charge Adjustments |

From the Adjust Charges page. |

Payment Adjustments |

From the Adjust Payments page. |

Note: Participants who are billed for more than one billing period, or who are billed for more than one plan type, employee record number, or COBRA event within a particular billing period, have multiple billing charge records.

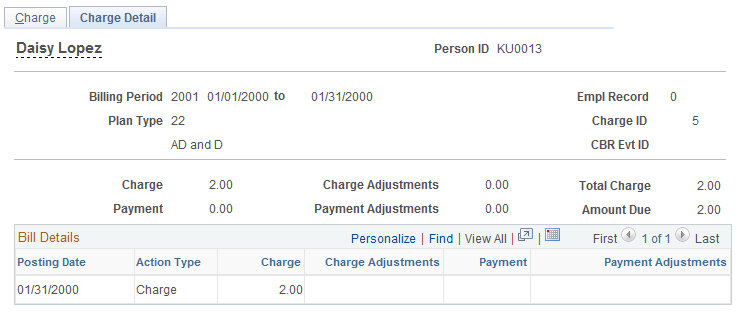

Use the Charge Detail page (BILL_CHRG_DET) to view details of charge actions.

Navigation:

This example illustrates the fields and controls on the Charge Detail page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Posting Date |

Displays the dates on which actions were entered into the system. For detail records with an action type of Charge, the posting date is the last day of the billing cycle. |

Action Type |

Possible actions include Charge, Charge Adjustment, Payment, and Payment Adjustment. |

Charge |

The amount of the original charge. If the charge is associated with a Canadian sales tax, the sales tax type (GST, PST, PSTI, and so on) is indicated as well. |

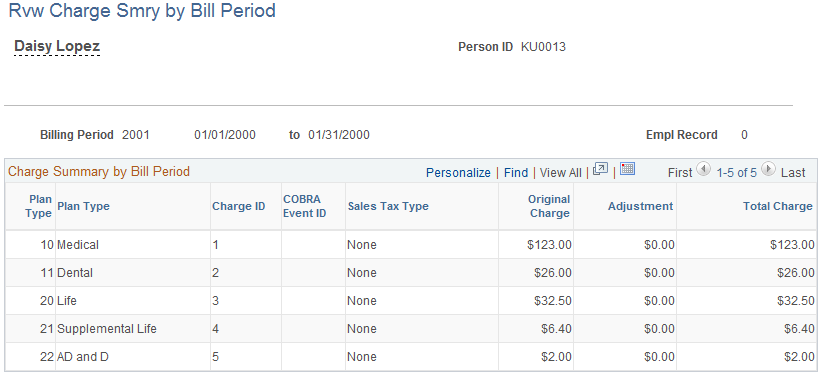

Use the Charge Summary by Bill Period page (BILL_CSUM_BY_BPER) to arranges a participant's charges by billing period.

Navigation:

This example illustrates the fields and controls on the Charge Summary by Bill Period page. You can find definitions for the fields and controls later on this page.

(CAN) If the charge is associated with a Canadian sales tax, the sales tax type (GST, PST, PSTI, and so on) is indicated before the Charge column.

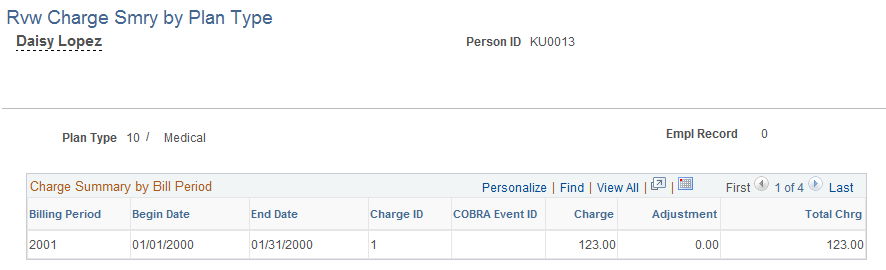

Use the Charge Summary by Plan Type page (BILL_CSUM_BY_PTYPE) to arranges a participant's charges by plan type.

Navigation:

This example illustrates the fields and controls on the Charge Summary by Plan Type page. You can find definitions for the fields and controls later on this page.

(CAN) If the charge is associated with a Canadian sales tax, the system displays the sales tax type (GST, PST, PSTI, and so on) of the charge to the left of the charge amount.