Reviewing U.S. Same-Sex Spouse Benefit Rates Setup

This topic describes the setup for U.S. same-sex spouse Benefit Rates.

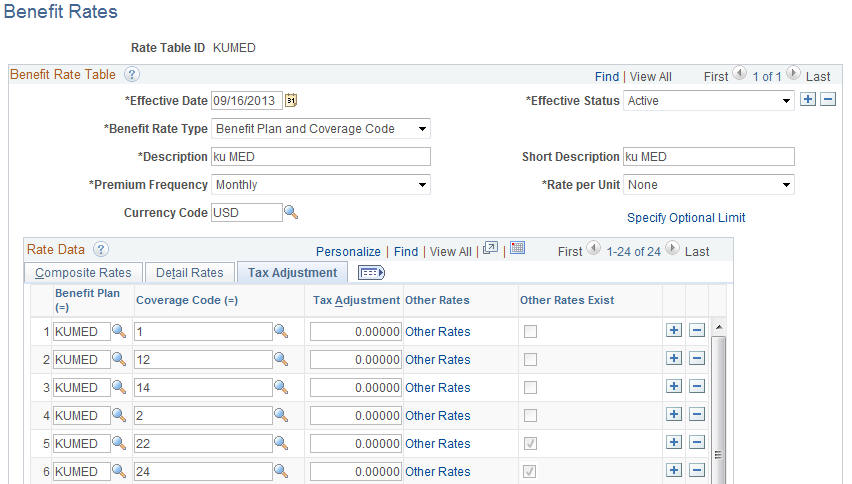

The Benefit Rates table enables additional tax adjustment rates to be defined for each row of rate data.

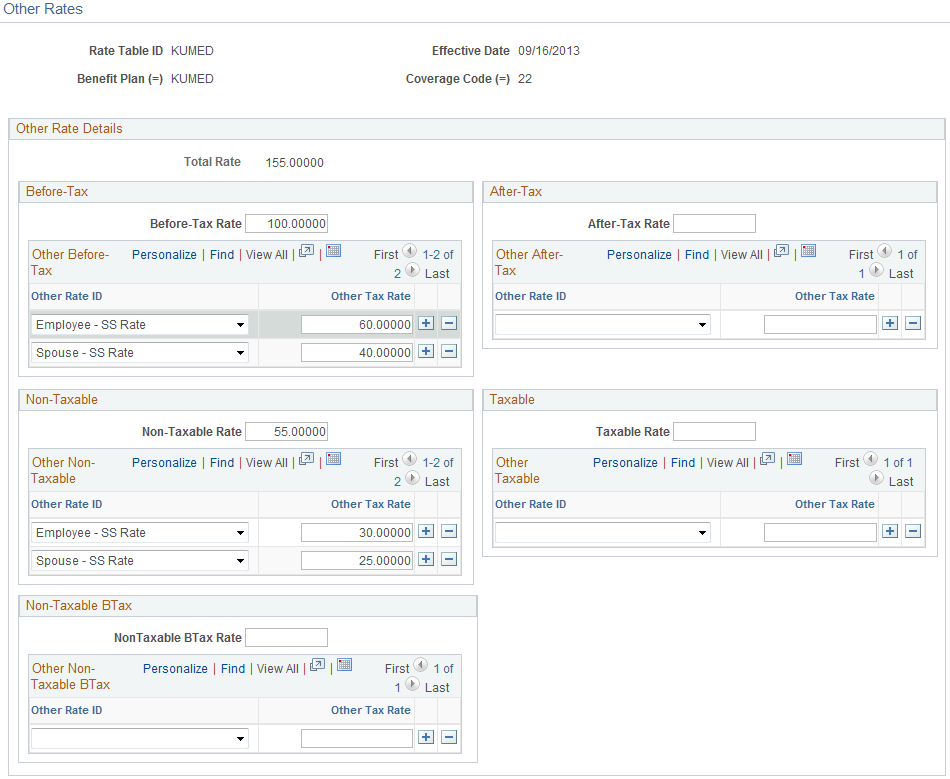

The Other Rates table enables defining tax adjustment amounts that are different for the before-tax spouse portion and the employer-contributed spouse portion of a benefit plan. Users can enter different tax adjustment rates for the same-sex employee, spouse, and children.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BN_RATE_TABLE |

Enter benefit rate information. |

|

|

BN_OTH_RATE_SEC |

Enter different tax adjustment rates for the Other Rate IDs Employee – SS Rate, Spouse – SS Rate and Children – SS Rate. |

You can enter more than one tax adjustment amount using the Benefit Rates Table. For each row of rate data in the Benefit Rate Table, additional tax adjustment rates can be defined using the ‘Other Rates’ link. This applies to all Benefit Rate Types. The ‘Other Rate’ will only apply to Detail Rates (by Deduction Classes) and not to Composite Rates (by Employee and Employer Rate).

Navigation:

Set Up HCM > Product Related > Base Benefits > Rates and Rules > Benefit Rates>Tax Adjustment

This example illustrates the fields and controls on the Benefit Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Adjustment |

The rates on this page is used for existing tax adjustments that do not require a different rate ID. If the TGCID entered on the TGCID Definition Table does not have a corresponding Other Rate ID, this amount will be used. |

Other Rates |

This links to the ‘Other Rates’ table where other tax adjustment rates are defined. |

Other Rates Exist |

This check box indicates whether other rates exist or not. |

Use the Other Rates page to enter tax adjustment amounts that are different for the before-tax spouse portion and the employer-contributed spouse portion of a benefit plan.

You can enter different tax adjustment rates for the Other Rate IDs Employee – SS Rate, Spouse – SS Rate and Children – SS Rate.

Navigation:

Click the Other Rates link in the Benefit Rates page — Tax Adjustment tab.

This example illustrates the fields and controls on the Other Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Other Rate ID |

Select the Other Rate ID. Other Rate IDs Employee – SS Rate, Spouse – SS Rate and Children – SS Rate are delivered with the system. Other Rate IDs per Deduction Class are linked to the TGCID entered on the Deduction Table and Taxable Gross Definition. |

Other Tax Rate |

Enter the tax rate for the Other Rate ID. If the TGCID entered on the Taxable Gross Definition has an Other Rate ID and Deduction Class that matches a row in Other Rates, then this rate will be used to adjust the base gross. |

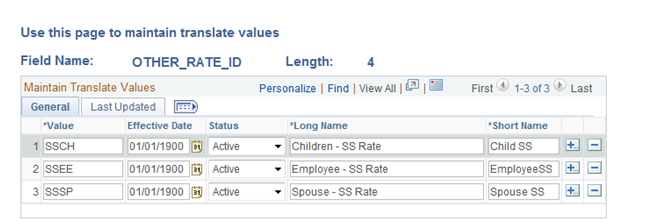

Use the translate values Employee – SS Rate, Spouse – SS Rate and Children – SS Rate delivered with the system, for the Other Rate ID.

This example illustrates the fields and controls on the Maintain Translate Values page for the Other Rate ID.