Setting Up ACA Consent Processing

This section provides an overview of U.S. ACA – electronic format for Form 1095-C – employee consent processing and discusses the setting up ACA Consent Processing in PeopleSoft HR Manage Base Benefits.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ACA_ALE_GRP |

Create an Aggregated ALE Group if ALE Member(s) need to be associated with an Aggregated ALE Group. |

|

|

ACA_ALE_TBL |

Ensure that there is a valid entry for the employer. To set up the consent process, an employer must have a valid entry on the ACA Applicable Large Employer Table. |

|

|

ACA_CMPY_TBL |

Add an ALE Member to the ACA Company Table where a Company is associated to ALE Member. Multiple Companies can be associated to same ALE Member if they all share the same Employee Identification Number (EIN). |

|

|

ACA_FORM_OPTS |

Enable the electronic option for Form 1095-C. |

|

|

HR_SSTEXT_TEXT |

Select the type of consent form or email text that you want to enter or update. |

Under the Affordable Care Act, Applicable Large Employers (ALEs) use Forms 1094-C and 1095-C to report information about offers of health coverage and enrollment in health coverage for their employees. Form 1095-C is used to report information about an individual employee. Employers that offer employer-sponsored self-insured coverage also use Form 1095-C to report information to the Internal Revenue Service (IRS) and to employees about individuals who have minimum essential coverage under the employer plan. Form 1094-C is used to report to the IRS summary information for each employer and to transmit Forms 1095-C to the IRS.

PeopleSoft HR Manage Base Benefits enables employers to track employee health coverage and comply with Form 1094-C and Form 1095-C reporting requirements on an annual basis.

Note: Employers are responsible for reviewing IRS instructions and reporting requirements to determine their specific reporting obligations under the Affordable Care Act.

Employees must affirmatively consent to receive their Form 1095-C in an electronic format instead of a paper copy. PeopleSoft HR Manage Base Benefits provides the set up to process employee consent to receive the Form 1095-C electronically.

The following terminology may be of use to understand ACA Consent Processing:

ACA full-time employee: An employee defined as working, or hired and reasonably expected to work at least 30 hours per week or 130 hours per month: (52 weeks x 30 hours)/12 months = 130 hours per month.

Applicable Large Employer (ALE): An ALE is, for a particular calendar year, any single employer, or group of employers treated as an Aggregated ALE Group, that employed an average of at least 50 full-time employees (including full-time equivalent employees) on business days during the preceding calendar year.

Aggregated ALE Group: An Aggregated ALE Group refers to a group of ALE Members treated as a single employer under section 414(b), 414(c), 414(m), or 414(o) of the Internal Revenue Code. An ALE Member is a member of an Aggregated ALE Group for a month if it is treated as a single employer with the other members of the group on any day of the calendar month.

Applicable Large Employer Member (ALE Member): An ALE Member is a single person or entity that is an ALE, or if applicable, each person or entity that is a member of an Aggregated ALE Group.

Designated Government Entity (DGE): A DGE is a person or persons that are part of or related to the Government Unit that is the ALE Member and that is appropriately designated for purposes of reporting requirements.

Use the ACA Aggregated ALE Group page (ACA_ALE_GRP) to create an Aggregated ALE Group. To identify which ALE Members belong to an Aggregated ALE Group, an ACA Aggregated ALE Group Table is delivered.

Navigation:

This example illustrates the fields and controls on the ACA Aggregated ALE Group page.

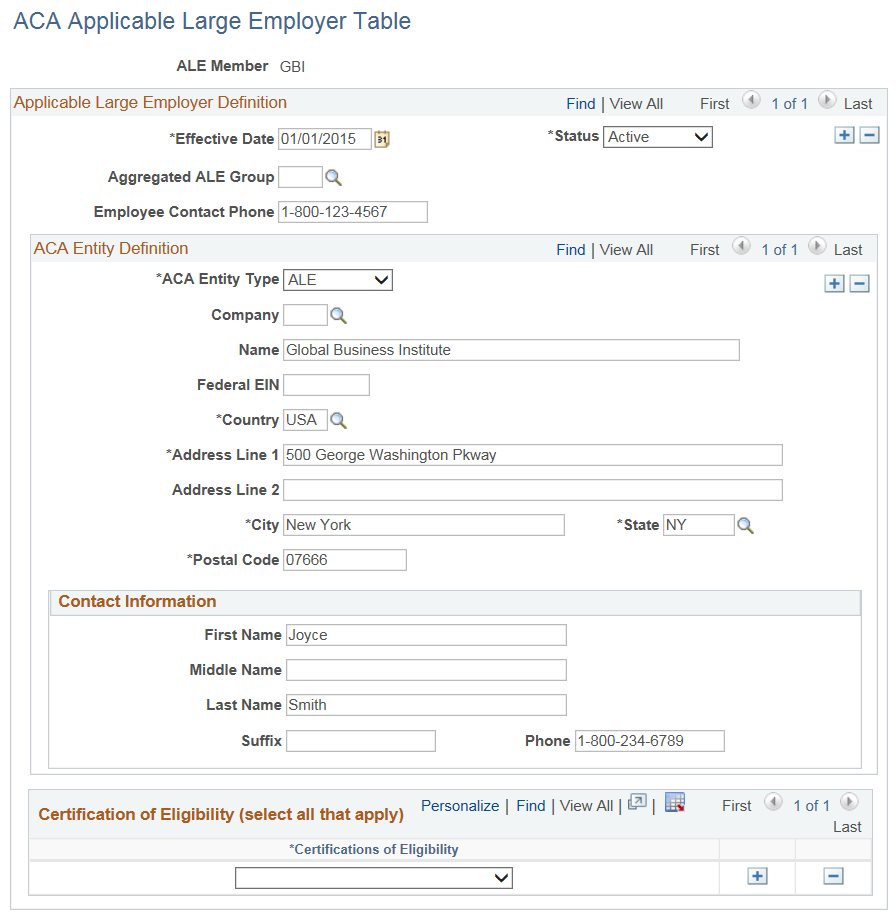

Use the ACA Applicable Large Employer Table page (ACA_ALE_TBL) to add a Company that is identified as an ALE (Applicable Large Employer) Member. There must be a valid entry in the ACA Applicable Large Employer Table for each employer that will use the employee consent process to provide Form 1095-C electronically. An entry can be added to the ACA Applicable Large Employer Table only for a Company that is identified as an ALE Member.

Navigation:

This example illustrates the fields and controls on the ACA Applicable Large Employer Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

ALE Member |

Applicable Large Employer Member is a single person or entity that is associated to Form 1094-C Reporting. Can be associated with one Company or group of Companies that share the same EIN. |

Aggregated ALE Group |

If the ALE Member is a member of an Aggregated ALE Group, the Aggregated ALE Group ID will be added here. Otherwise, blank. |

Employee Contact Phone |

This phone number will appear on the contact phone of Form 1095-C. |

ACA Entity Type |

‘ALE’ for ALE Member information. ‘DGE’ for Designated Governmental Entity information. Each ALE Member must have a business name, Federal EIN, address and contact information under ACA Entity Type ‘ALE’. If a Designated Governmental Entity is filing on behalf of a Governmental Unit, the Governmental Unit is an ALE Member and the Designated Governmental Entity information is entered under ACA Entity Type ‘DGE’. |

Same as Company/Agency Table |

If the Federal EIN and address of the ALE Member or Designated Governmental Entity is the same as in the Company Table, enter the Company here. The Company information from the Company Table will be populated onto the lines below and the fields will become display only. Otherwise, these fields can be entered manually. |

Name |

Employer’s name. |

Federal EIN |

9-digits including dash. |

Country |

Look up from Country Table. |

Address |

Employer’s complete address including address, city, state, and postal code. |

Contact Information |

Contact First Name, Middle Name, Last Name, Suffix and Phone are used on the Employer Form 1094-C transmittal file. |

Certification of Eligibility |

Enter all the applicable Certifications that the ALE Member applied for. This information will be included on the Employer Form 1094-C transmittal file. |

Use the ACA Company Table page (ACA_CMPY_TBL) to associate an ALE Member to a Company. Multiple Companies can be associated to same ALE Member if they all share the same EIN.

Navigation:

This example illustrates the fields and controls on the ACA Company Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

ALE Member |

Enter Applicable Large Employer Member that is associated with Company. |

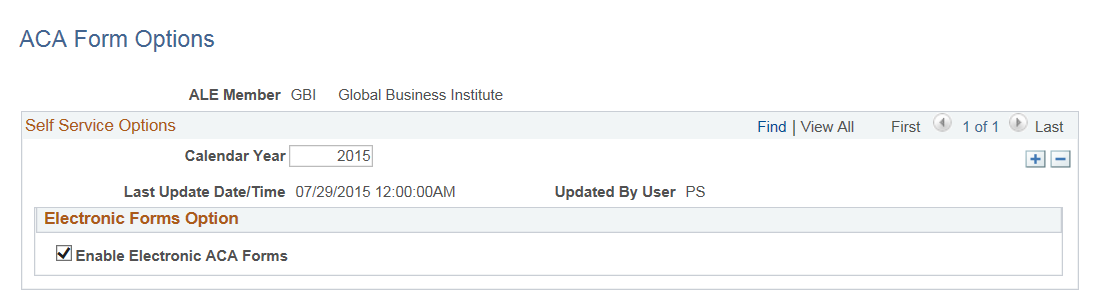

Use the ACA Form Options page (ACA_FORM_OPTS) to enable the electronic option for Form 1095-C. This step is required to enable employees to grant consent to receive electronic forms.

Navigation:

This example illustrates the fields and controls on the ACA Form Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Calendar Year |

Create a new row each tax year. |

Enable Electronic ACA Forms |

Select this check box to enable the ALE Member to provide XMLP PDF forms in the eBenefits Self Service transaction. If this check box is not selected, employees cannot request or withdraw consent or view Form 1095-C. After employees have granted/withdrawn consent, an administrator can disable this option by deselecting this check box and running the Reset 1095-C Consent Status process. |

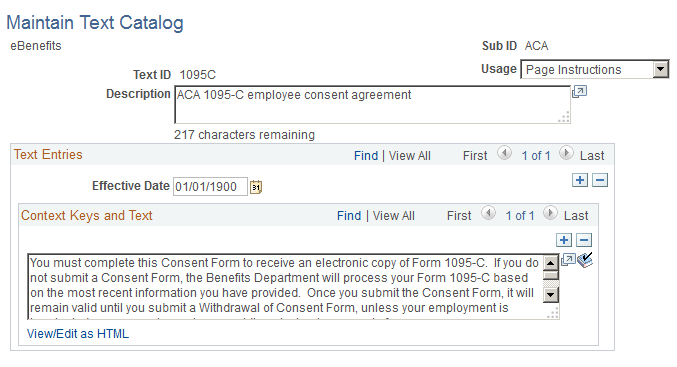

Use the Maintain Text Catalog page (HR_SSTEXT_TEXT) to select the type of consent form or email text that you want to enter or update.

Navigation:

This example illustrates the fields and controls on the Maintain Text Catalog page.

|

Text ID |

Usage |

Text Type |

Description |

|---|---|---|---|

|

1095C |

Page Instructions |

Consent Agreement |

Instructional text displayed on the Form 1095-C Consent page to request consent. |

|

1095R |

Page Instructions |

Consent Agreement after Reset |

Instructional text displayed on the Form 1095-C Consent page to request consent after the Consent has been reset by employer. |

|

1095W |

Page Instructions |

Withdrawal Agreement |

Instructional text displayed on the Form 1095-C Consent page to withdraw consent. |

|

CC |

Consent Confirmation |

Confirmation text displayed on the Form 1095-C Consent page after Consent is submitted. |

|

|

CW |

Withdrawn Confirmation |

Confirmation text displayed on the Form 1095-C Consent page after Consent Withdrawal is submitted. |

|

|

EMCS |

E-Subject |

Consent Email Subject |

Notification Email Subject to employee that Consent is received. |

|

EMC |

E-Body |

Consent Email Body |

Notification Email Body to employee that Consent is received. |

|

EMWS |

E-Subject |

Withdraw Consent Email Subject |

Notification Email Subject to employee that Consent is withdrawn. |

|

EMW |

E-Body |

Withdraw Consent Email Body |

Notification Email Body to employee that Consent is withdrawn. |

|

EMRS |

E-Subject |

Reset Consent Email Subject |

Notification Email Subject to employee that Consent is reset by employer. |

|

EMR |

E-Body |

Reset Consent Email Body |

Notification Email Body to employee that Consent is reset by employer. |

Consent Instruction Requirements

The instructional page text that you create for granting and withdrawing consent should include these details:

Notification that a paper copy will be provided if consent is not given.

The scope and duration of the consent.

Post-consent requests for paper statements.

Option to withdraw consent.

Conditions under which the employer will no longer furnish electronic statements.

Procedures for updating information.

Hardware and software requirements.

For example, inform employees that Adobe Reader is required to view the forms.

Contact information.