Setting Up and Managing Correction/Replacement of Forms 1094-C and 1095-C

PeopleSoft Benefits generates transmission ACA data to the IRS as two XML transmittal files: Request file and Manifest file. If these files are rejected by the IRS, then the Manifest file and a Correction Request file has to be re-generated as replacement files for re-submission. If the file is accepted by the IRS but there is error to a form, then a Correction Form 1095-C will be issued to the employee, and the Correction Request file along with a Manifest file will be submitted to the IRS.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ACA_IMPORT_ACK |

To upload the IRS Transmission Acknowledgement file. |

|

|

ACA_XMIT_ACK |

To view the ACA transmittal errors. |

|

|

ACA_XMIT_HIST |

To review a history of when the Create Transmittal File processes were run. |

|

|

ACA_ALE_XMIT_PART1 ACA_ALE_XMIT_PART2 |

To view or modify the employer transmittal data after the data extraction process. |

|

|

ACA_EMP_XMIT_PART1 ACA_EMP_XMIT_PART2 ACA_EMP_XMIT_PART3 |

To view or modify the employee transmittal data after the extraction process. |

|

|

ACA_RUN_BAC020 |

To generate the ACA transmittal files and the PDF version of Form 1095-C. |

|

|

ACA_SS_YE_FORM |

To view Form 1095-C as Administrator. |

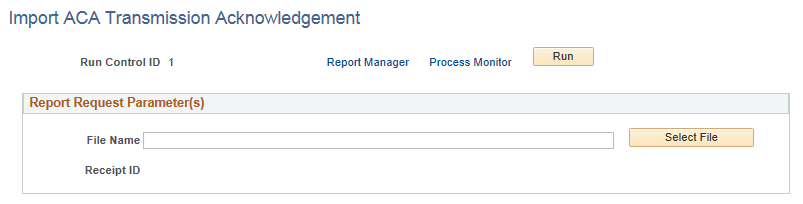

Use the Import ACA Transmission Acknowledgement page (ACA_IMPORT_ACK) to upload the IRS Transmission Acknowledgement file.

Navigation:

This example illustrates the fields and controls on the Import ACA Transmission Acknowledgement page.

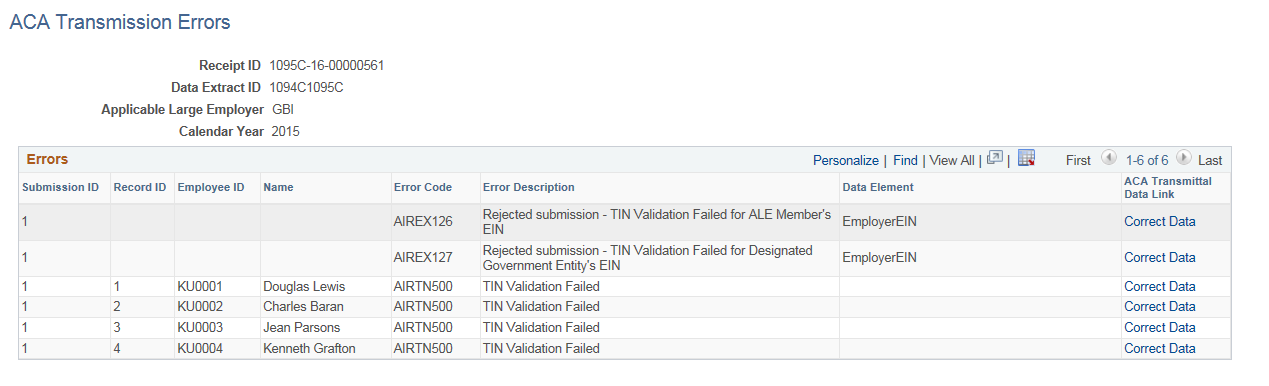

Use the ACA Transmission Errors Page (ACA_XMIT_ACK) to view the ACA transmittal errors.

Navigation:

This example illustrates the fields and controls on the ACA Transmission Errors page.

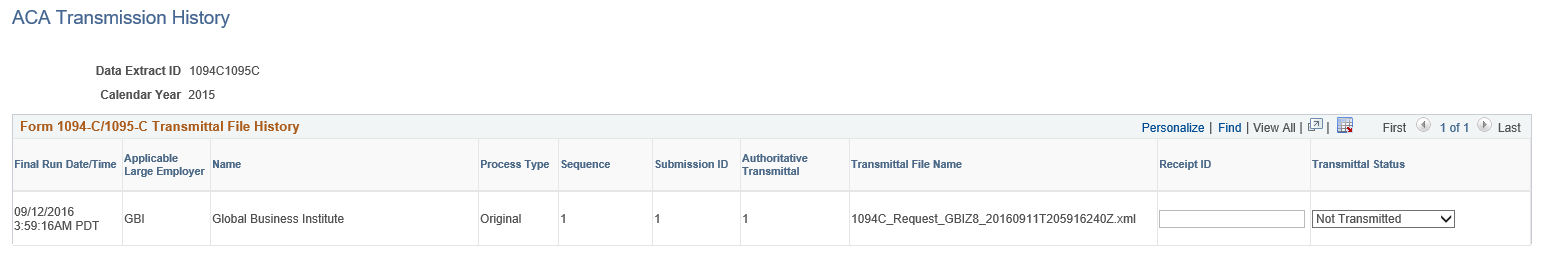

Use the ACA Transmission History page (ACA_XMIT_HIST) to review a history of when the Create Transmittal File processes were run. This page is also used for entering the Receipt IDs received from IRS after submission.

Navigation:

This example illustrates the fields and controls on the ACA Transmission History page.

Field or Control |

Description |

|---|---|

Process Type |

The Process Type field indicates whether the transmittal file is an original file, reissue file, replacement file, or correction file. |

Receipt ID |

Enter the Receipt ID received from the IRS on submission of the files |

Transmittal Status |

Enter the Transmittal Status of the files as mentioned in the Acknowledgement file from the IRS. The options available are: Accepted, Accepted with Error, Created in Error, Not Transmitted, Rejected. By default the Transmittal Status is displayed as Not Transmitted. |

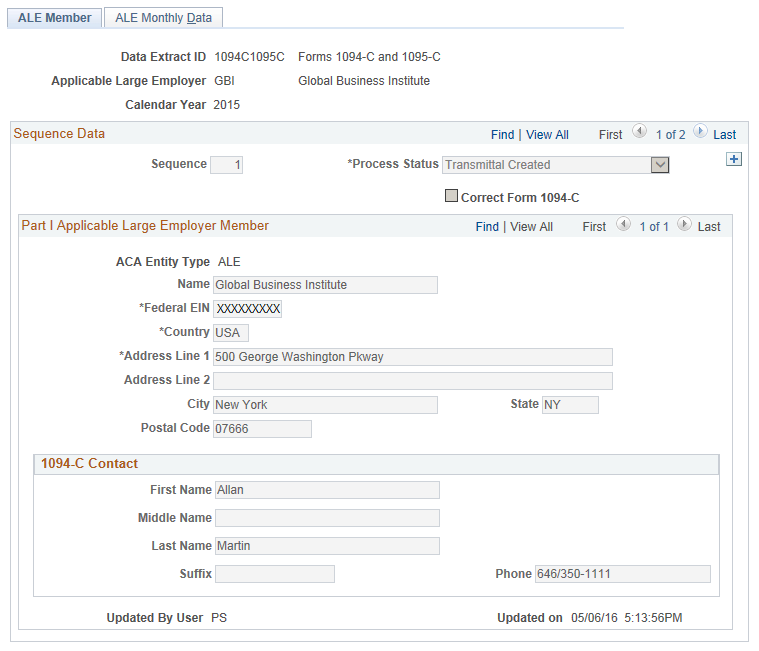

Use the ACA Employer Transmittal Data pages (ACA_ALE_XMIT_PART1 and ACA_ALE_XMIT_PART2) to view or modify the employer transmittal data after the data extraction process.

Navigation:

This example illustrates the fields and controls on the ACA Employer Transmittal Data page.

Field or Control |

Description |

|---|---|

Process Status |

Defines the status of Data Extract, such as, PeopleSoft Extracted, User Modified, Merged with Data Load, Created In Error, Merge Error, Finalized for Transmittal, and Transmittal Created. You can add a ‘User Modified’ row to modify data before creating the 1094-C transmittal file. |

Correct Form 1094-C |

Select this checkbox to make a correction to the Form 1094-C. |

Note: Address is extracted based on the country format.

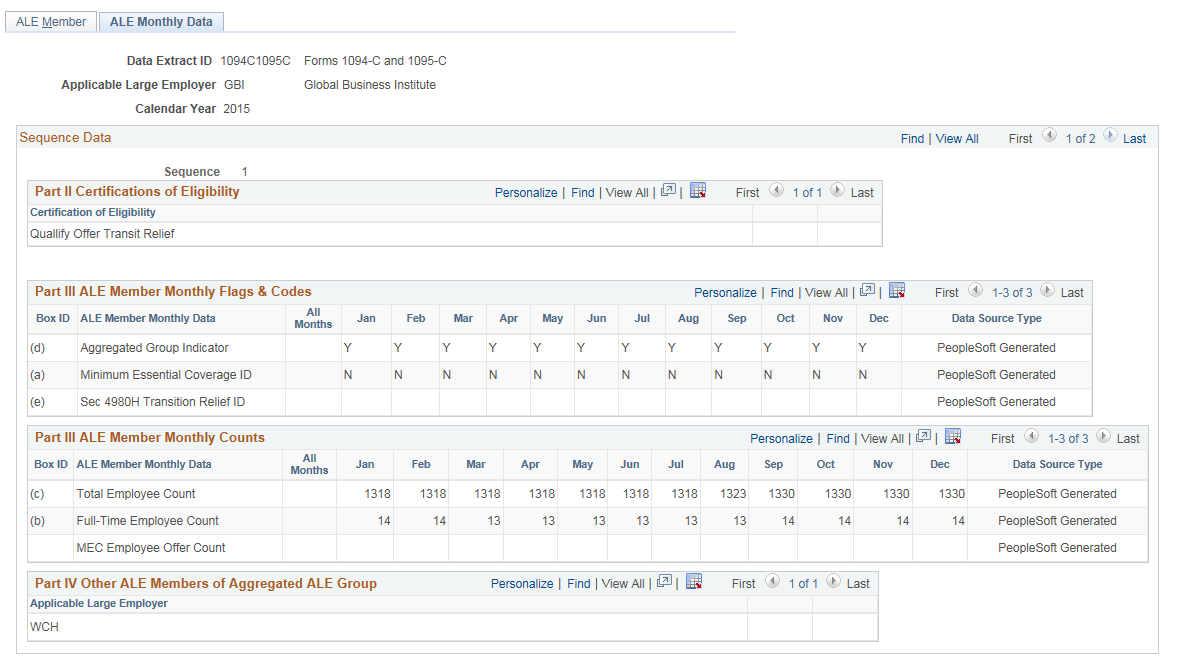

This example illustrates the fields and controls on the ACA Employer Transmittal Data page - ALE Monthly Data tab.

Use the ACA Employee Transmittal Data pages (ACA_EMP_XMIT_PART1, ACA_EMP_XMIT_PART2 and ACA_EMP_XMIT_PART3) to view or modify the employee transmittal data after the extraction process.

Navigation:

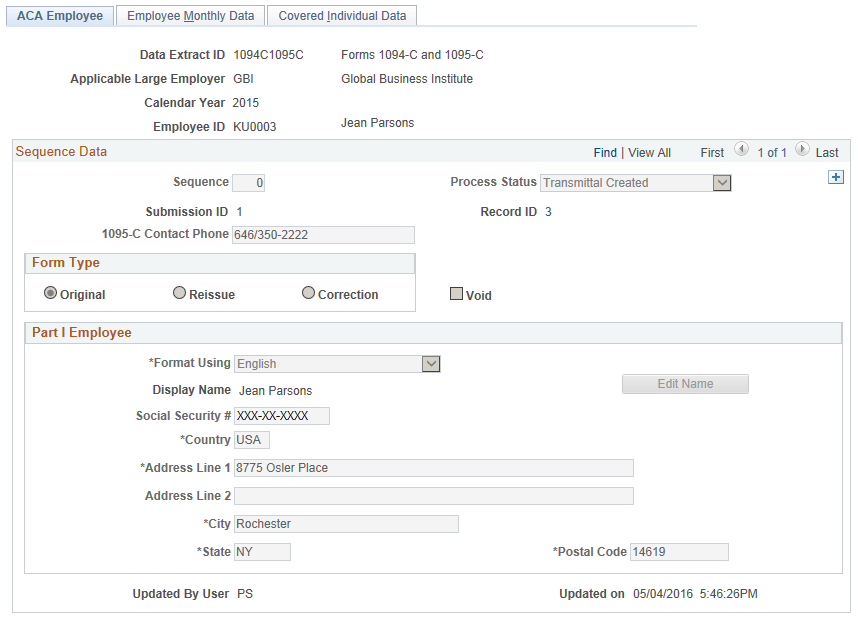

This example illustrates the fields and controls on the ACA Employee Transmittal Data page - ACA Employee tab.

Field or Control |

Description |

|---|---|

Process Status |

Defines the process status of data transmittal, such as, Created in Error, Finalized for Transmittal, Merge Error, Merged with Data Load, PeopleSoft Extracted, Transmittal Created, and User Modified. Note: The Created in Error option is used to remove data that were entered in error, before the form is transmitted. |

Submission ID |

Represents the system assigned Submission ID in an IRS transmission file. It is generated by the Create XML File Process during the Final run. |

Record ID |

Represents the system assigned Record ID within the above Submission ID, as referenced in an IRS transmission file. An IRS transmission file may contain one or more records in one submission. This is generated by the Create XML File Process during Final run. |

Form Type |

The options available are:

|

VOID |

To void a Form 1095-C, select the Reissue or Correction radio button and select the Void checkbox. |

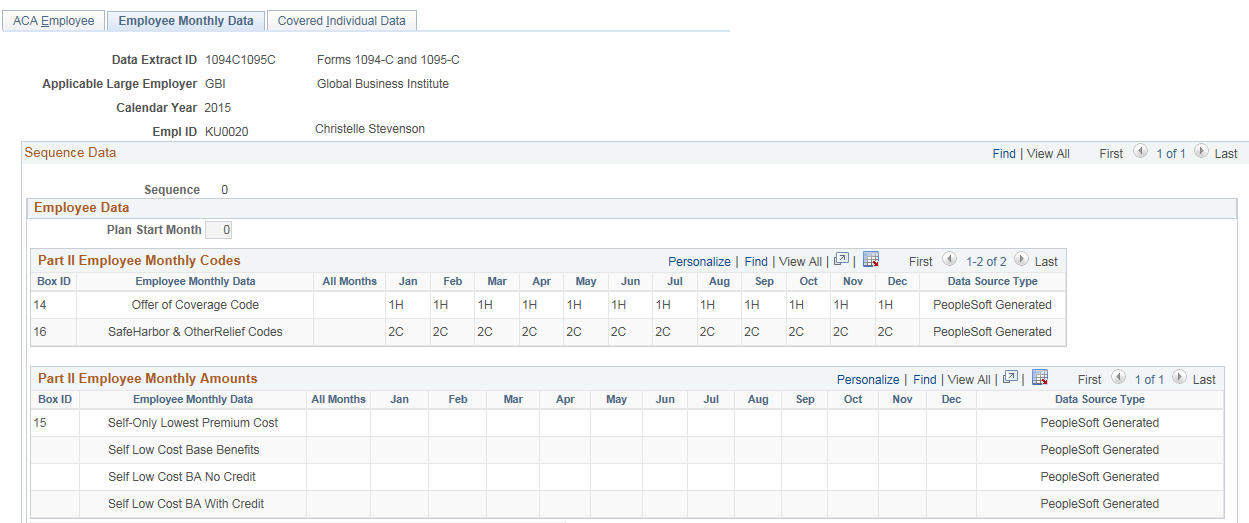

This example illustrates the fields and controls on the ACA Employee Transmittal Data page - Employee Monthly Data tab.

Field or Control |

Description |

|---|---|

Plan Start Month |

This is an optional field for 2015. The system defaults it to ‘00’. |

Box ID 15: Employee Monthly Data |

The data from the first row Self Only Lowest Premium Cost populates the corresponding box in the Form 1095-C. The Self Low Cost Base Benefits, Self Low Cost BA No Credit andSelf Low Cost BA With Credit are three working rows used to calculate cost and credits. |

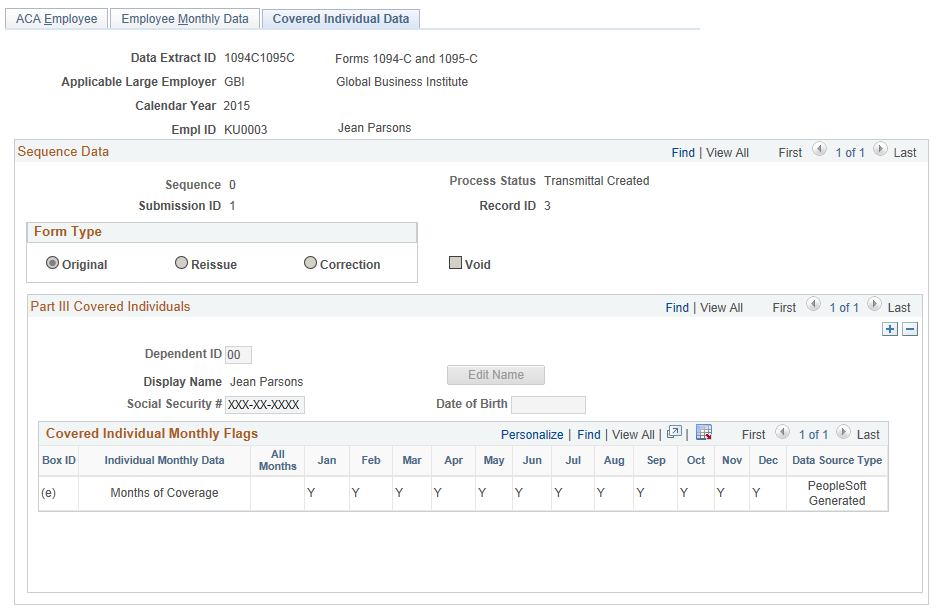

This example illustrates the fields and controls on the ACA Employee Transmittal Data page - Covered Individual Data tab.

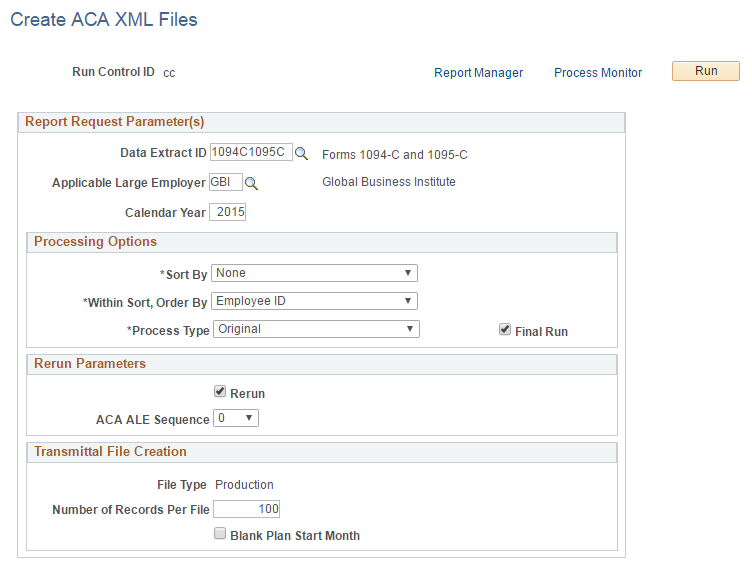

Use the Create ACA XML Files page (ACA_RUN_BAC020) to generate the ACA transmittal file(s) and the PDF version of Form 1095-C.

Navigation:

Benefits ACA Annual Processing Transmittal and Forms Create ACA Transmittal Files

This example illustrates the fields and controls on the Create ACA XML Files page.

Field or Control |

Description |

|---|---|

Data Extract ID |

Enter the Data Extract ID that was used to run the data extract. Data extracted using this rule will be used to generate the transmittal file(s) and the PDF forms. |

Applicable Large Employer |

The Applicable Large Employer for which data is being reported. |

Calendar Year |

The calendar year for which data is being reported. |

Sort By |

First sort option of the employees being reported. |

Within Sort, Order By |

Second sort option within the Sort By option, of the employees being processed. |

Process Type |

The options available are:

|

Receipt ID |

If Replace Submission or Replace Transmission is selected, select the Receipt ID of the file to be replaced. |

Final Run |

Select this check box to process the final run. For a preliminary run (when the Final Run checkbox is not selected), the Request file will be generated with a temporary file name. No Manifest file will be generated. Only the Benefits Administrator can view Form 1095-C records which are created in a preliminary run. For the final run, the Request file will be generated with the file name specified by the IRS. The Manifest file will be generated. Form 1095-C records which are created in the final run will be available for viewing in Self Service. Note: Perform Final Run only when the preliminary runs have been satisfactory and results have been verified. Once Final Run is processed for selected ALE employer and ACA employee data, the same data cannot be reprocessed in a subsequent Final Run. An exception to this is before the transmittal files from the Final Run have been transmitted to IRS and the reissue of Form 1095-C is required. In which case, new sequenced data can be added to prepare the employee data for reissue. |

Rerun |

Select this check box to rerun an Original, Reissue, or Correction process in Final Run. The Manifest and Request files will be re-generated with identical information. |

ACA ALE Sequence |

For Rerun and Original or Correction process, select the ACA ALE Sequence to which the rerun is to be processed. The ACA ALE Sequence is located on the ACA Transmission History. |

File Type |

Displays the File Type selection on the ACA Transmittal Parameters page. Once communication test is passed and IRS moved the ALE to production, file type should be changed from AATS to Production. |

Number of Records Per File |

Each file transmitted to the IRS must not exceed the 100MB file size limit imposed by the IRS. If the submission is larger than 100MB, it must be split into two or more separate file transmissions. The default Number of Records Per File is set at the ACA Transmittal Parameters page. Note: If the generated file exceeds 100MB during preliminary runs, reduce the number of records and re-generate the files. |

Blank Plan Start Month |

Select this check box to print blank Plan Start Month on Form 1095-C and to omit the data element equivalent in the transmittal file. This option is only visible when Calendar Year is 2015, when reporting of Plan Start Month is optional. |

Test Scenario ID |

Enter the number of a test scenario as prescribed by IRS. (This is only used with File Type AATS.) |

Total Form Filed for ALE |

Enter Total Form Filed for ALE that corresponds to the Test Scenario ID selected. (This is only used with File Type AATS.) |

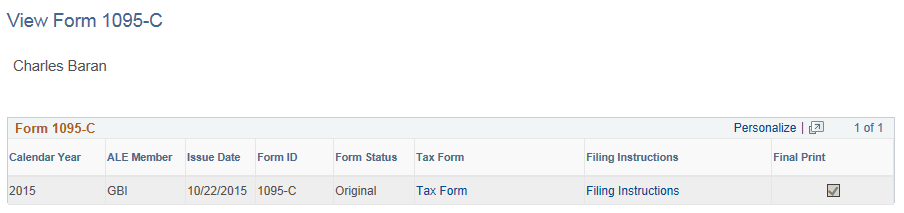

Use the View Form 1095-C page (ACA_SS_YE_FORM) to view Form 1095-C. A Benefits Administrator can view all employees’ Form 1095-Cs, irrespective of whether or not they are finalized.

Navigation:

Benefits ACA Annual Processing Transmittal and Forms View Form 1095-C

This example illustrates the fields and controls on the View Form 1095-C page.

Field or Control |

Description |

|---|---|

Form Status |

Form Status is either Original, Reissue, or Correction. |

Tax Form |

Click the Tax Form link to open a PDF version of Form 1095-C. |

Filing Instructions |

Click the Filing Instructions link to open a PDF document containing filing instructions. |

Final Print |

This check box identifies forms which are final and which are preliminary only. |