Setting Up COBRA Administration

To set up COBRA administration, use the COBRA Event Rules (CBR_EVENT_RULES) component.

This section lists prerequisites and discusses how to set up COBRA Administration.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

COBRA_EVENT_RULES1 |

Identify the events that result in the loss of health plan coverage for a qualified beneficiary. |

|

|

Administrative Contacts (benefit administrative contacts) |

BENEF_ADM_CONTACTS |

Define the COBRA administrator's name and address. This information will print on COBRA notification, enrollment, and termination letters. |

Before you can set up COBRA Administration, complete the following steps.

Activate COBRA Administration on the Installation table.

Access the Installation Table - Product Specific page.

Select the COBRA Administration check box under the Benefits Functions group box.

Identify your company's COBRA administrator.

Identify your COBRA administrative personnel using the Benefits Administrative Contacts page. When you have entered this information, you can reference these COBRA administrators within each benefit program. This is the contact information (name and address) that will be included in printed COBRA notification letters.

To link COBRA to your benefit package, use the Benefit Program Table to identify:

The age at which a dependent is no longer considered a dependent.

The age at which a dependent is no longer considered a student.

Whether a disabled person is excluded from the age limits.

Whether dependents are ineligible for regular benefits, if married.

Also identify any extra charges that you want added to the cost of the benefits for both disabled and nondisabled persons.

To identify which benefit plans offered within a benefit program are eligible for COBRA administration, use the Benefit Program Table. When you design your benefit program, if you designate Health (1x) and FSA (60) (flexible spending account) plan types as COBRA-qualified plan types, you must designate an option code for those plan types. The system uses the option codes for the enrollment of employees into COBRA benefit plans. This restriction applies only if you do not use PeopleSoft Benefits Administration.

In general, only medical and health plan types (plan types 1x and 6x) are designated as COBRA-qualified plan types. However, the PeopleSoft application allows you to identify nonmedical plan types as COBRA-qualified plans if your organization's policy is to offer them to your employees as part of their COBRA coverage. You will need to modify the COBRA COBOL for plan types other than Medical (1x) and FSA (6x) plan types.

For COBRA, medical coverage is a core benefit. COBRA administration defines non-core benefits such as dental and vision care benefits. If your benefits program combines core and non-core benefits, you may have to offer COBRA participants a core option that is not available to other active employees.

Nonqualified medical, dental, and vision plans are not currently supported for COBRA coverage. You should not designate these plans as COBRA-qualified plans.

Coverage codes are created on the Coverage Code page. PeopleSoft software has four coverage codes that work for COBRA Administration. You can add more codes as required by your organization; however, the coverage codes for nonqualified dependents are not for use by COBRA Administration.

The COBRA Coverage Set field on the Coverage Code page is used during COBRA processing to determine the type of coverage to offer a participant. To indicate that a coverage code is to be used during COBRA processing, enter a two-digit code in the COBRA Coverage Set field.

Example:

Assume you have the following coverage codes:

1 – Employee only

2 – Employee + spouse

3 – Employee + dependents

4 – Family

A – Employee only

B – Employee + spouse

C – Employee + dependents

D – Family

You want COBRA processing to consider only coverage codes A, B, C, and D as eligible codes and you have decided that CO will represent COBRA eligible coverage codes. You will enter CO in the COBRA Coverage Set field for coverage codes A, B, C, and D.

Oracle's PeopleSoft application delivers COBRA Administration with the following qualifying events:

Voluntary termination.

Involuntary termination.

Reduction of hours.

Death of an employee.

Divorce and legal separation.

Loss of dependent status (due to marriage or arrival at the age limit for benefit coverage).

Medicare eligibility.

Retirement.

According to federal government guidelines, employees and spouses of employees who undergo voluntary or involuntary termination for gross misconduct are not eligible for COBRA coverage. The PeopleSoft application does not deliver COBRA Administration with the capability to differentiate between terminations for gross misconduct and other termination types, but you can set up action reason codes and add PeopleCode to have the system perform this function.

You should review the set of events provided, change them, and add new events as necessary based on the qualifying events that your organization recognizes. Then, for each valid event:

Define when COBRA coverage begins and how long it will last.

Define any grace periods.

Define when the employee has to notify the organization of the event and when the organization has to notify the employee of COBRA benefits.

Define the qualified beneficiaries for the event.

Define the secondary event rules for the event.

If you want to set up additional COBRA event rule records for a particular COBRA event classification, insert a new row with a different effective date. The system will always use the record with the effective date that is closest to the current date.

You can set up COBRA event rule records with future effective dates. This allows you to have the definition of a COBRA event classification change on a predetermined date.

Determining COBRA Coverage Period

COBRA coverage begins the day following the last day of regular active coverage and generally extends for 18 or 36 months following a qualifying event. If an employee is terminated on the 15th, COBRA coverage begins on the 16th.

The determination of the COBRA period begin date depends on several factors. The first factor is whether the COBRA period includes alternative coverage. Alternative coverage is the grace period of continued active coverage beyond the date when an employee's active health coverage would normally terminate. Grace periods are provided either manually through the Manage Base Benefits business process or automatically with the Benefits Administration system.

Regardless of whether the COBRA period includes the alternative coverage, the COBRA coverage begin date is always set to the day following the last day of active coverage. The calculation of the COBRA coverage end date depends on the inclusion or exclusion of alternative coverage.

In the case of disabled COBRA participants, however, regulations allow an extension up to 11 months past the original 18 months for termination of employment and reduction in work hours events. You can extend the coverage for disabled participants by completing the Additional Months if Disabled field on the Event Rules page.

The date on which COBRA coverage ends is defined as the COBRA period begin date plus the number of months of coverage plus any additional months if disabled.

Providing Grace Periods

Situations may occur when you want to provide grace periods for your employees that begin on the day following the last day of regular coverage. During these grace periods, your organization pays all or part of the employee benefits premiums. Extending the termination dates of an individual's health benefit plans past the COBRA-qualifying event date sets grace periods. You can do this manually or arrange for it to happen automatically through PeopleSoft Benefits Administration processes. To provide a grace period, select the Include Alternative Coverage check box and specify when you want the COBRA period to begin, which will be the day after the grace period ends. The system includes grace periods in the COBRA coverage period. You can select to have COBRA begin on the day of the event, on the first day of the month after the event, or on the first day of the pay period after the event day.

If you do not want a grace period to be included in the COBRA period, do not select Include Alternate Coverage.The COBRA period begin date will be the same and COBRA coverage will start on the day after the grace period ends. This means that if your organization paid for all or part of the employee premiums during a grace period, the COBRA period does not begin until after the conclusion of alternative coverage. The length of continued coverage from the qualifying event is the length of the grace period plus 18 months of COBRA continuation coverage.

The system calculates the COBRA coverage end date according to a formula derived from the parameters defined in the COBRA event rules.

Here are examples showing how COBRA can calculate COBRA coverage end dates for an employee who experiences a COBRA qualifying event on March 15 and has a pay period on March 22, whose last day of active coverage is on June 30, and who is allowed 18 months of COBRA coverage.

|

Last Day of Active Coverage |

Include Alternative Coverage |

COBRA Period Begins Code |

COBRA Period Begin Date |

COBRA Coverage Begin Date |

COBRA Coverage End Date |

|---|---|---|---|---|---|

|

June 30 |

N |

NA |

July 1 |

July 1 |

December 31 |

|

June 30 |

Y |

Event Date |

March 15 |

July 1 |

September 14 |

|

June 30 |

Y |

Month After |

April 1 |

July 1 |

September 30 |

|

June 30 |

Y |

Pay Period |

March 22 |

July 1 |

September 21 |

The coverage end date will always be equivalent to the COBRA period begin date plus the months of coverage for each plan type, with two exceptions:

For employees and spouses, COBRA coverage will end before the scheduled coverage end date on the date that the employee or spouse turns 65 and becomes eligible for Medicare.

For dependents of employees who become eligible for Medicare, the COBRA coverage end date will be the latter of the COBRA period begin date or the employee's Medicare entitlement date plus 36 months.

Setting Rules for Secondary COBRA Events

Secondary COBRA-qualifying events are events that extend the amount of time a participant is eligible for COBRA coverage

An event must fulfill the following basic qualifications for it to qualify as a COBRA secondary event:

The initial COBRA event must be a COBRA event classification associated with a change to an employee's job status, such as a reduction in hours, termination, or retirement.

The employee and dependent must currently be participating in an active initial COBRA event and have COBRA coverage.

The secondary event must be one of the COBRA event classifications that involves loss of coverage for the employee's dependent, such as divorce, marriage of dependent, overage dependent, death of employee, or a Medicare entitlement.

For example, suppose a married employee is terminated. The employee and his spouse will receive 18 months of COBRA coverage after the termination. If the employee and spouse divorce, the divorce would be considered a secondary event for the ex-spouse. If the divorce occurred before the termination, the termination would not be a secondary event for the ex-spouse.

The classification of the event determines the amount of time for which coverage is extended and the method by which coverage is extended. In the previous example, the secondary event would cause the coverage of the ex-spouse to be extended from 18 to 36 months from the coverage begin date of the initial event. In general, even with secondary events, a dependent's coverage cannot exceed 36 months.

The exception would be a case in which the secondary event is a Medicare entitlement. When a qualified COBRA beneficiary turns 65, and is Medicare entitled, COBRA coverage ceases. In this case, the system adds the 36 months to the COBRA event date (the Medicare entitled date), thereby extending the dependent's COBRA coverage past 36 months.

COBRA-Qualified Beneficiary

The following chart illustrates how the Benefit Lost Level and COBRA-Qualified Beneficiary relate to one another. For each COBRA Event Classification, it displays the Benefit Lost Level and COBRA-Qualified Beneficiaries typically associated with that event.

|

COBRA Event Classification |

Benefit Lost Level |

COBRA-Qualified Beneficiaries |

|---|---|---|

|

TER, RET, RED, MIL |

Employee |

Employee, Spouse, Child |

|

DEA, MED |

Employee |

Spouse, Child |

|

OVG, DEP |

Dependent |

Child |

|

DIV |

Dependent |

Ex-spouse |

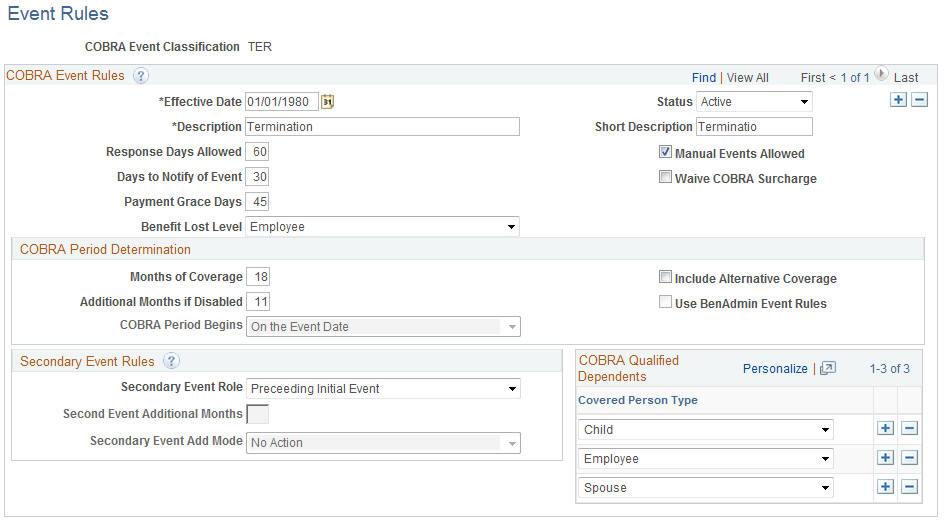

Use the Event Rules page (COBRA_EVENT_RULES1) to identify the events that result in the loss of health plan coverage for a qualified beneficiary.

Navigation:

This example illustrates the fields and controls on the Event Rules page. You can find definitions for the fields and controls later on this page.

COBRA Event Rules

Field or Control |

Description |

|---|---|

Effective Date |

Enter or select the date on which this COBRA event goes into effect. The system always uses the record with the effective date that is closest to but not past the current date. |

Status |

Select whether this COBRA event is Active or Inactive. |

Description |

Enter a description of the COBRA event using up to 30 characters. |

Short Description |

Enter a brief description of the COBRA event using up to 10 characters. |

Response Days Allowed |

Specifies the maximum number of days that a beneficiary has to elect coverage from the date of notification. COBRA eligibility expires after the response period. |

Days to Notify of Event |

Identifies the number of days an employee or dependent has to notify the organization following a qualifying COBRA event. |

Payment Grace Days |

Enter the number of payment grace days employees will be given to submit a payment after they send in an election. |

Manual Events Allowed |

Select if you want to allow manual entry of the event. |

Waive COBRA Surcharge |

Select if, for this event classification, you want the system to disregard the COBRA surcharge percentages defined in the Benefit Program Table. |

Benefit Lost Level |

Define whether the COBRA event affects the employee only, the dependent only, or both. Values are Employee, Dependent (a COBRA-qualified beneficiary), and neither. |

COBRA Period Determination

Field or Control |

Description |

|---|---|

Months of Coverage |

Identifies how long coverage will extend for a particular qualifying event. COBRA coverage generally extends for 18 or 36 months following a qualifying event. |

Additional Months if Disabled |

Enter the extension for disabled participants. Regulations allow an extension up to 11 months past the original 18 months for termination of employment and reduction in work hours events for disabled participants. |

Include Alternate Coverage |

Select to set up a grace period. |

COBRA Period Begins |

Select a value to define when COBRA coverage begins. Values are: On the Event Date: The COBRA period begin date is the same as the day of the event. COBRA coverage actually begins the day after the event date or the day after the grace period ends. On Month-Begin After Event: The COBRA begin date is on the first day of the month after the event. On PayPeriod Begin After Event: The COBRA begin date is on the first day of the pay period after the event day. |

Secondary Event Rules

Field or Control |

Description |

|---|---|

Secondary Event Role |

Indicates whether the displayed COBRA event classification can be considered a secondary event. Values are: Succeeding Second Event (S): This indicates that the COBRA event classification is a secondary event. Preceding Initial Event (P): If this field has a value of P, then the other two secondary event rules fields will be unavailable for data entry. |

Second Event Additional Months |

If Secondary Event Role is selected, the Second Event Additional Months field defines the number of months that the original COBRA coverage will be extended. |

Secondary Event Add Mode |

Defines whether the system adds second event additional months to the original coverage begin date of the initial event or to the COBRA event date of the secondary event. In the event classifications that the PeopleSoft application delivers, the Death, Divorce, Married Dependent, and Overage Dependent events have a Second Event Add Mode value of E (Extended) while the Medicare Entitlement event has a Second Event Add Mode value of A (Added). Note: For the Divorce COBRA Event Classification, the sole-defined COBRA qualified beneficiary is X (Ex-Spouse). |

COBRA Qualified Dependents

Field or Control |

Description |

|---|---|

Covered Person Type |

Select from the following values to define the relationship you have to the dependent. Child, Domestic Partner, Employee, ExSpouse, Non-Qualified Dependent, Other Qualified Dependent, Spouse. |