Setting Up the Credit Allocation Table

To set up credit allocations, use the Credit Allocation Table (CDN_HIERARCHY) component.

This section provides an overview of the Credit Allocation table and discusses how to set up the Credit Allocation table.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CAN_BA_HIER_TBL |

Set up Credit Allocation tables. |

You use the Credit Allocation table to:

Identify your variable taxation benefit plans.

Associate variable taxation benefit plan deductions with their corresponding tax alteration deductions.

Create a credit allocation hierarchy that the system will use to prioritize the allocation sequence of credits to your employees' benefit plans.

Use the Credit Allocation Table page (CAN_BA_HIER_TBL) to set up Credit Allocation tables.

Navigation:

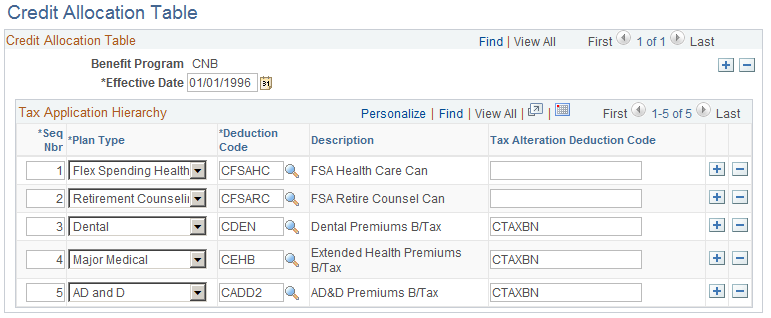

This example illustrates the fields and controls on the Credit Allocation Table page. You can find definitions for the fields and controls later on this page.

Use this page to enter credit allocation hierarchy records and assign the priority sequence order of the allocation of flexible credits to benefit plans; link benefit plan deduction codes with their corresponding tax alteration deduction codes.

Field or Control |

Description |

|---|---|

Seq Nbr (sequence number) |

The system's tax optimization feature assesses the credit usage of the deductions in the order they are listed here. For example, credits are applied first to sequence number 1 (perhaps the variable taxation plan type Dental), second to sequence number 2 (perhaps the variable taxation plan type Medical/Dental), third to sequence number 3 (perhaps the variable taxation plan type AD/D), and so on. If insufficient credit earnings are available during payroll processing to cover the entire premium costs of the Dental, Medical/Dental, or AD/D plan types, taxable benefit deduction amounts are automatically processed for the amounts of the shortages, using the applicable tax alteration deduction code. |

Deduction Code |

Specify one of the before-tax variable-taxation benefit-plan deduction codes that you defined on the Deduction Table - Tax Class page. |

Tax Alteration Deduction Code |

Specify a taxable benefit general deduction that you defined on the General Deduction Table page. |