Running the Process Interest and Payment Application Engine Process (HR_WP_PAYMT)

This section provides an overview of the Process Interest and Payment process, lists prerequisites, and discusses how to run the Process Interest and Payment process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_WP_PAYMT |

Run the process for a selected agreement and reference period. |

The Process Interest and Payment process is the final process that you run before you approve the reference period. The Process Interest and Payment process calculates deductions and interest, and processes payments. The process is run at least once a year, but is most likely run at intervals during the year to process employee fund releases. Fund status and interest amounts are more accurate if you run the process often throughout the year.

This process:

Calculates deductions for employees' funds, and the net global fund after deductions have been deducted from the gross amounts.

Profit sharing and worker's participation amounts are liable to CSG and CRDS deductions. The rates of these deductions are stored in the variables KFCSG (for CSG) and KFCRDS (for CRDS).

Calculates interest for employees whose profit-sharing agreements have an investment method of Company Investment.

Interest is calculated yearly on employees' funds during the period that funds are unavailable. The interest rate is defined in the agreement definition and employees can select to reinvest interest or receive interest payments.

Note: For worker's participation agreements, interest payments are paid only in exceptional circumstances when payment of funds is delayed. The Process Interest and Payment process does not calculate interest for this agreement type.

Calculates deductions on interest payments, and the net interest amount.

Interest payments are liable to CSG, CRDS, and Participation Sociale deductions. The rate of the Participation Sociale deduction is stored in the variable KFSOC.

Sets the reference period status to Computed.

Processes payments for profit-sharing funds with Company Investment as the investment method and worker's participation funds with Employee's Bank Account as the investment method.

Payments are processed only if the reference period is Approved and the fund status is Request Payment. The process changes the fund status to Sent to payroll.

Receives information from Global Payroll for France or another payroll system about the status of payments previously sent, and updates fund status accordingly.

Payments that were processed successfully are assigned a status of Paid. If a payment was not processed, the process changes the fund status to Error.

Workflow occurs when the Process Interest and Payment process updates employees' fund status to:

Available or Paid, which triggers an email to employees informing them that their funds are available or paid.

Error, which triggers an email to the compensation administrator who must investigate the error.

See Setting Up Workflow for Profit Sharing.

Integrating with Global Payroll for France

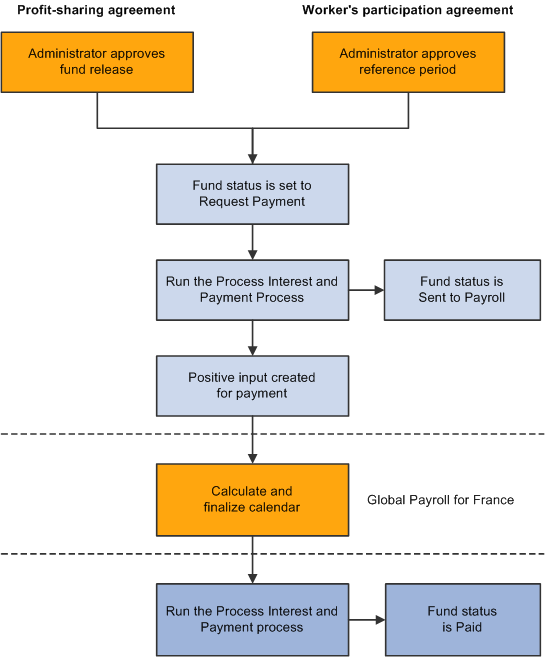

If you installed Global Payroll for France, you can use it to automatically process payments. The following diagram illustrates the payment processing with Global Payroll for France:

Payment processing with Global Payroll for France

Integrating with Other Payroll Systems

To integrate the Manage French Profit Sharing business process with a payroll system other than Global Payroll for France, you must set up the integration points that enable payment information to be exchanged.

See Interactive Services Repository in the Implementation Guide section on My Oracle Support.

Before you run the Process Interest and Payment process for the first time for a reference period, you must run these processes:

Extract Eligible Employees.

Compute Global Fund.

Distribute Global Funds.

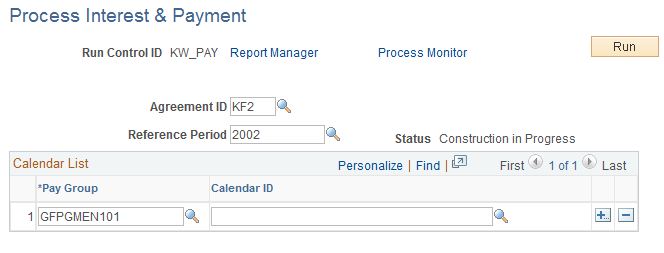

Use the Process Interest & Payment page (RUNCTL_WP_PAYMT) to run the process for a selected agreement and reference period.

Navigation:

This example illustrates the fields and controls on the Process Interest & Payment page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Agreement ID |

Select the agreement for which you want to run the process. |

Reference Period |

Select the reference period for which you want to run the process. |

Calendar List

Field or Control |

Description |

|---|---|

Pay Group |

The system populates this field with the pay groups for all eligible employees, based on the selected agreement and reference period. Check the list of pay groups, and add additional pay groups if there were changes since you ran the Extract Eligible Employees process. For example, you need to add pay groups if:

|

Calendar ID |

Select the calendar for each pay group selected. |