Creating the ComSuper Payroll Interface File

This topic provides an overview of the Payroll Interface File (PIF) and discusses how to generate the PIF.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_RC_SUPEREC |

Generate the PIF for delivery to ComSuper. |

|

|

Deduction Recipient List Page |

GPAU_SUPEC_RCP_RC |

Add deduction recipients to be included in the PIF. |

ComSuper provides an online superannuation service that enables employers to submit, correct, and validate superannuation data using a secure online login. ComSuper worked with employers and payroll providers to replace the Superannuation Exceptions Data (SED) and Continuous Contributions Data (CCD) files with a single file—the Payroll Interface File. Global Payroll for Australia enables you to define PIF data and generate the PIF for delivery to ComSuper.

To define and generate the PIF:

Set up a deduction recipient as a Super Fund Administrator on the Deduction Recipients page. Select a Super Reporting Format and ComSuper Agency ID for that deduction recipient. Ensure that the correct pay entity is added to the deduction recipient.

Enter all required SuperEC information on the SuperEC Detail page.

Access the Deduction Recipient page using the Super Reporting link on the Payee Recipient page. Enter all required Super Reporting information.

Ensure that the TFN Disclose to Superannuation check box is selected on the Payee Tax Data page for all employees to be included in the PIF.

Run and finalize the calendar groups for which you are generating the PIF.

Run and finalize the payment preparation process for the calendar groups to be included in PIF.

Generate the PIF using the Create Super Rpt File run control page.

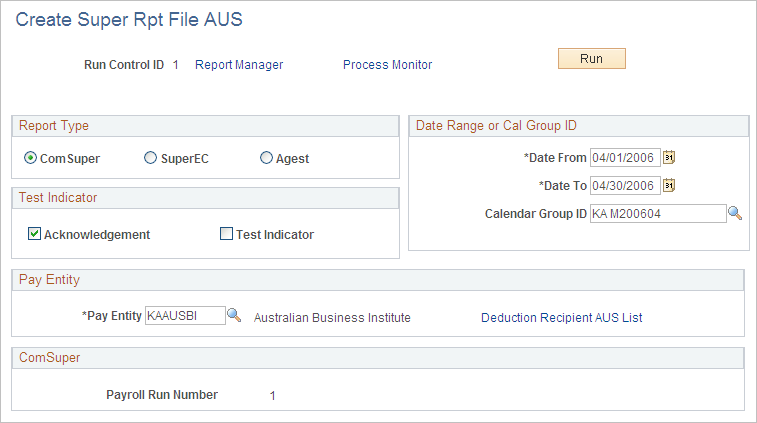

Use the Create Super Rpt File page (GPAU_RC_SUPEREC) to generate the PIF for delivery to ComSuper.

Navigation:

This example illustrates the fields and controls on the Create Super Rpt File AUS page. You can find definitions for the fields and controls later on this page.

Report Type

Select the type of report you are creating. You can use this page to generate a report file for ComSuper, SuperEC, or Agest.

Placeholder

Field or Control |

Description |

|---|---|

Date From and Date To |

Enter a date range for the report file. The system populates these fields automatically if you select a calendar group in the Calendar Group ID field. |

Calendar Group ID |

Select the calendar group to be included in the report file. |

Note: If you generate the EFT payment file before running this process, the calendar group for which you created the EFT payment file will not be available in the Calendar Group ID field. You must use enter a date range for the PIF file in that case.

Test Indicator

Field or Control |

Description |

|---|---|

Acknowledgement |

Select to receive an acknowledgement after sending a SuperEC message file. |

Test Indicator |

Select to indicate that the SuperEC message file that you are creating is for test purposes only. |

Pay Entity

Field or Control |

Description |

|---|---|

Pay Entity |

Select the pay entity to be included in the report file. |

Deduction Recipient AUS List |

Click to access the Deduction Recipient List where you can add deduction recipients to the report file. |