Entering Information for Reporting Tax

To set up tax reporting, use the Pay Entities AUS (GPAU_PYENT_DTL) and Supplier Information AUS (GPAU_SUPPLIER) components.

Tax reporting varies depending on the information that the system stores about the organization.

This topic lists the pages used to enter information for reporting tax.

Note: You use the pages discussed in this section to create the following files, which you submit to the ATO: the Group Tax file, the Payment Summaries file, and the TFN declaration.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Pay Entities AUS Page |

GPAU_PYENT_EXT |

Enter pay entity information that the ATO requires in various reports or electronic files. |

|

GPAU_SPPLR_DATA1 |

Enter information about the organization submitting the fortnightly TFN declaration. The information entered on this page is included in the electronic file that is generated. |

|

|

Supplier Address Page |

GPAU_SPPLR_DATA2 |

Enter supplier address information. |

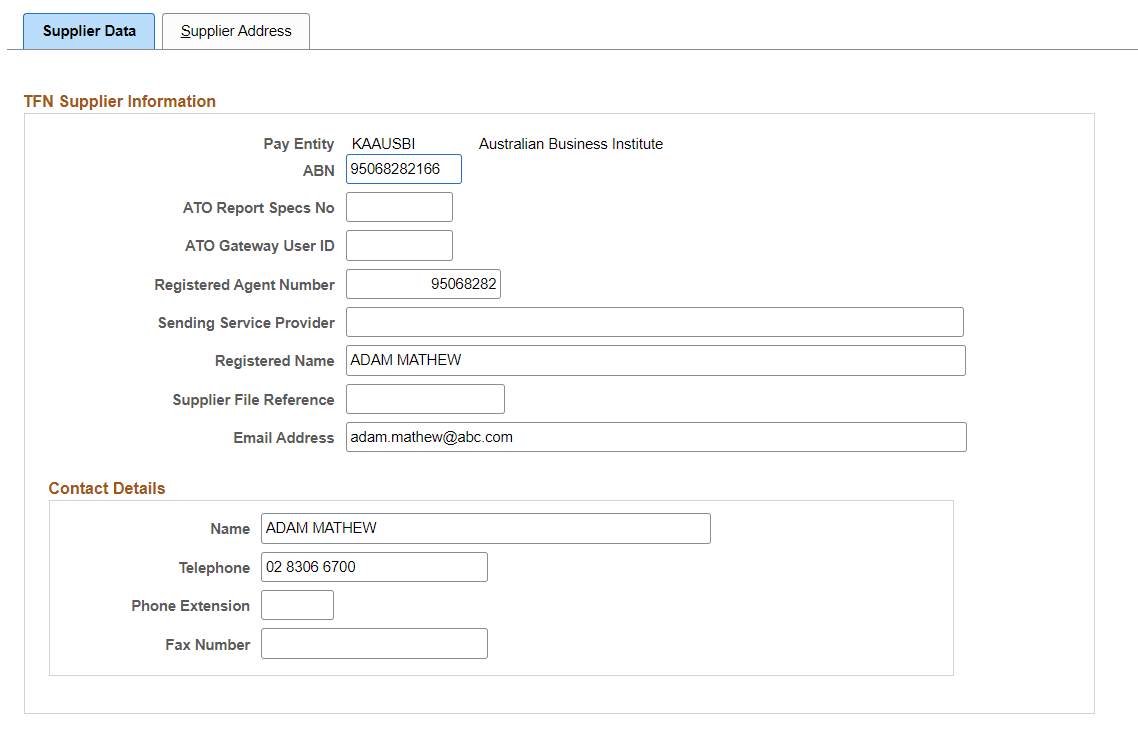

Use the Supplier Data Page page (GPAU_SPPLR_DATA1) to enter information about the organization submitting the fortnightly TFN declaration. The information entered on this page is included in the electronic file that is generated.

Navigation:

This example illustrates the Supplier Data page.

|

Field or Control |

Description |

|---|---|

|

Registered Agent Number |

An external identifier issued by the ATO on behalf of the Tax Agent's Board. It used to uniquely identify an individual who has registered by the Board as a Tax Agent. Existing Component ‘GPAU_SUPPLIER’ is modified to accommodate the new field ‘GPAU_STP_TAN’. It is an optional field. The Registered Agent Number issued by Tax Practitioners Board that is associated with Intermediary ABN. |

|

Sending Service Provider |

An entity (including sole trader), directly connected to the ATO, that only provides the technical service for one or multiple employers, registered agents or payroll software providers to deliver payroll reports to the ATO in the correct technical format or through a permitted technical channel. This information is used as part of Declaration Statement in STP Payroll Event File AUS Run Control as required by ATO to authorize Sending Service Provider for lodgement and receive STP Payroll Reports on behalf of Employer. |

|

Income Type |

This field determines the income type. |

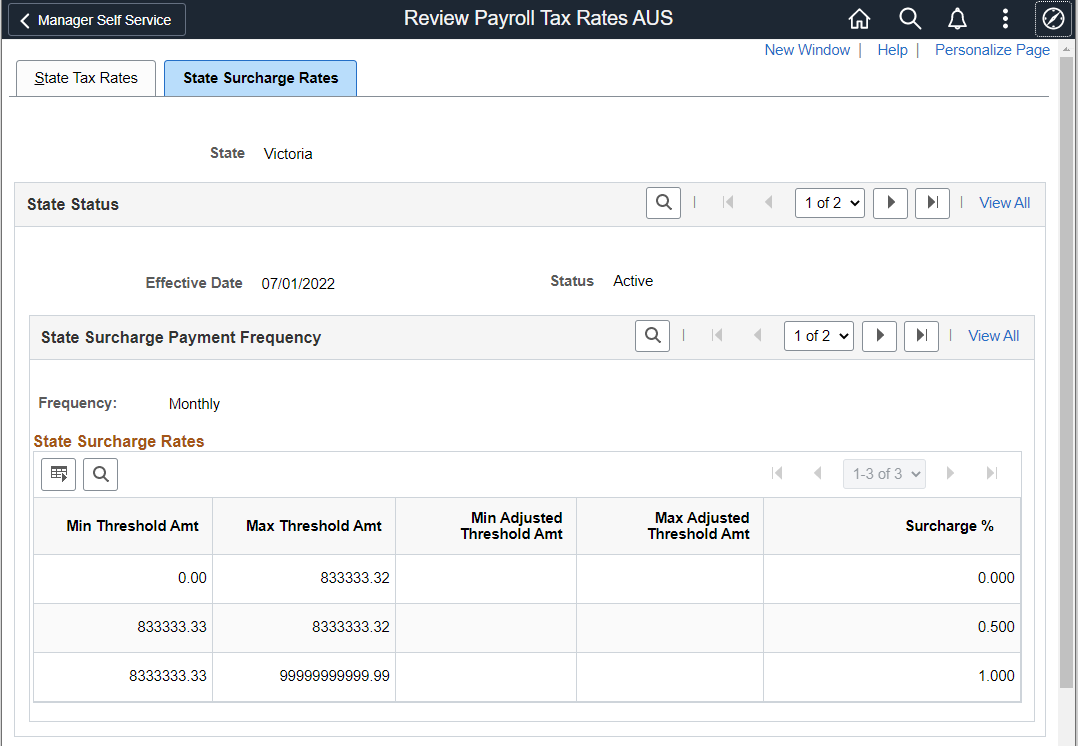

The mental health and well-being surcharge for employers is a new revenue mechanism introduced by State of Victoria to provide stable and dedicated form of additional funding to aid and strengthen the mental health system.

The mental health and well-being surcharge is applicable for employers as per the conditions mentioned below:

Any employer paying Victorian taxable wages and has Australian wage above first annual threshold of $10 million (i.e. monthly threshold of $833,333) will pay 0.5% of Victorian taxable wages.

Any employer paying Victorian taxable wages and has Australian wage above second annual threshold of $100 million (i.e. monthly threshold of $8,333,333) will pay additional 0.5% of Victorian taxable wages.

Use State Surcharge Rates tab in Review Payroll to Review Tax Rates AUS (GPAU_SPT_SC_RT) page.

Navigation:

This example illustrates the fields and control of Review Payroll Tax Rates_State surcharge Rates page.

|

Field or Control |

Description |

|---|---|

|

State |

Name of the Australian state. |

|

Effective date |

Date from when this is effective. |

|

Status |

Status set to active or inactive. |

|

Min Threshold Amt |

Standard minimum monthly and yearly legislative threshold value |

|

Max Threshold Amt |

Standard maximum monthly and yearly legislative threshold value. |

|

Min Adjusted Threshold Amt |

Populated using a DMS Script for adjusted minimum monthly and yearly threshold value (if required) |

|

Max Adjusted Threshold Amt |

Populated using a DMS Script for adjusted maximum monthly and yearly threshold value (if required). |

|

Surcharge % |

Surcharge percentage. |