Separating Eligible Termination Payment Data

If the system detects Lump Sum C ETPs during the Create Payment Summary process, it stores the data separately.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_EE_ETP |

View the breakup of Lump Sum C ETP payments by employee name and ID, Pay Entity, Balance Group ID and Tax Year. |

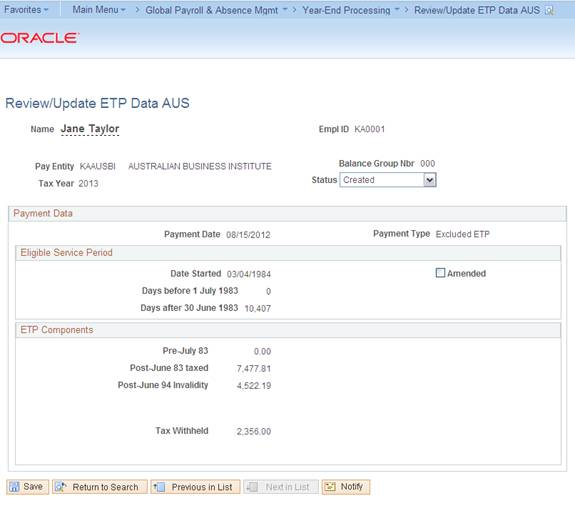

Use the Review/Update ETP Data AUS page (GPAU_EE_ETP) to view the breakup of Lump Sum C ETP payments by employee name and ID, Pay Entity, Balance Group ID and Tax Year.

Navigation:

This example illustrates the fields and controls on the Review/Update ETP Data AUS page. You can find definitions for the fields and controls later on this page.

You can print ETP certificates using the ETP Payment Summary printing option on the Print Payments Summary page.

Field or Control |

Description |

|---|---|

Status |

Values are: Created: The Create Payment Summary process has been run. Issued: The ETP certificate has been printed. You can change the status from Issued to Created to regenerate the data through the Create Payment Summary process. Entered and Processed: These are not applicable statuses for ETP certificates. |

Payment Date |

The date that the ETP was made. The date appears by default as the payment check date of the employee's last pay. |

Payment Type |

Identifies the payment as either a transitional or non-transitional payment. Positive input to the earning elements ETP TRA TAX (Transitional ETP – Taxable) and ETP TRA NTAX (Transitional ETP – Non Taxable) are shown as transitional payments. While positive input to the earning elements ETP TAX (Life Benefit – Taxable) and ETP NONTAX (Life Benefit – Non Taxable) are shown as non-transitional ETP Payments. |

Eligible Service Period

Field or Control |

Description |

|---|---|

Date Started |

The payee's hire date. |

Days before 1 July 1983 |

If the hire date is before July 1, 1983, this is the difference between the hire date and July 1, 1983. |

Days after 30 June 1983 |

If the hire date is on or before June 30, 1983, this is the difference between June 30, 1983 and the termination date. If the hire date is after June 30, 1983, this is the difference between hire date and termination. |

ETP Components

Field or Control |

Description |

|---|---|

Pre-July 83 (X) |

System-calculated based on the Days before 1 July 1983 result. |

Post-June 83 taxed (Y) |

System-calculated based on the Days after 30 June 1983 result. |

Post-June 83 untaxed |

System-calculated based on the Days after 30 June 1983 result. |

Post-June 94 Invalidity (Z) |

System-calculated based on any post June 1994 invalidity payments made. |

Gross Amount |

Sum of X, Y, and Z |

Tax Withheld |

Tax deducted from ETP. |

Assessable Amount |

If the Death Benefit check box is selected, the assessable amount is 0.00. Otherwise, it is based on the following formula: (0.05 × Pre-July 83) + Post-June 83 taxed or (0.05 × X) + Y |