Setting Up Group Pay Entities

To set up group pay entities, use the Group Pay Entities AUS (GPAU_GRP_ENT) component.

The various state revenue offices define group pay entities to prevent parent and subsidiary organizations from avoiding payroll tax by splitting. The PeopleSoft system does not determine groupings or membership of pay entities in groups. Some members of the group might be administered outside the PeopleSoft system.

To calculate payroll tax, you must define at least one group and make all appropriate pay entities members of that group—even if the organization consists of only a single pay entity.

Payroll tax has a deduction threshold that is payable if taxable earnings don't exceed the specified amounts in each state. Only one pay entity within a group can claim this deduction. You can, however, have the threshold apportioned equally between all the pay entities within the group that you define.

You create the mandatory State Payroll report by running by the Group Pay Entity process.

When you create a group pay entity, you select from the existing pay entities. The pay entity that becomes the group entity is a member of its own group.

This topic discusses how to group pay entities.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_GRP_ENT |

Consolidate pay entities in a group pay entity; apportion the deduction threshold across all pay entities or designate one pay entity for the threshold. |

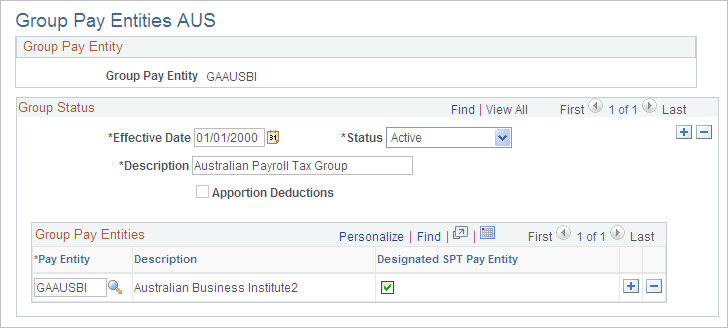

Use the Group Pay Entities AUS page (GPAU_GRP_ENT) to consolidate pay entities in a group pay entity; apportion the deduction threshold across all pay entities or designate one pay entity for the threshold.

Navigation:

This example illustrates the fields and controls on the Group Pay Entities AUS page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Apportion Deductions |

Select to have the whole deduction threshold apportioned equally across all group members. If the Apportion Deductions check box is selected and there is no designated company for the threshold deduction, the system apportions the threshold deduction across all the states of each company. |

Group Pay Entities

Field or Control |

Description |

|---|---|

Pay Entity |

Add the members of the group. |

Designated SPT Pay Entity |

Select one of the pay entities to receive the full deduction threshold. You can leave them all cleared and have the threshold apportioned equally between all members by selecting the Apportion Deductions check box. After you designate an SPT pay entity, the system deselects the Apportion Deductions check box (if it was selected) and makes it display-only. |