Entering Alimony Information

Here is an example of entering alimony information for an employee:

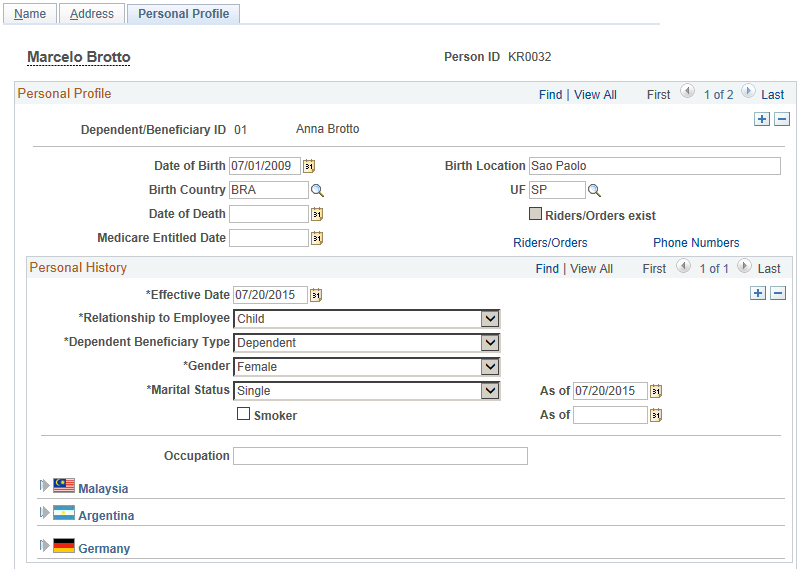

Enter personal profile information of the employee’s dependents on the Dependent Information - Personal Profile Page. In this example, the employee has two child dependents.

This example illustrates the fields and controls on the Personal Profile page (1 of 2).

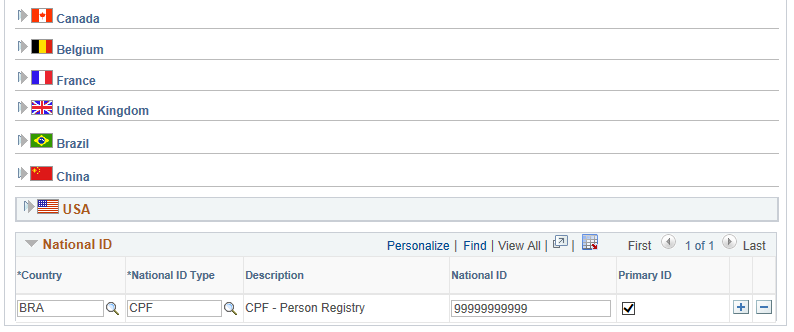

This example illustrates the fields and controls on the Personal Profile page (2 of 2).

Note: Be sure to specify the CPF number for each dependent. It is required for legal reports such as IREN and DIRF reports (collective health plan information).

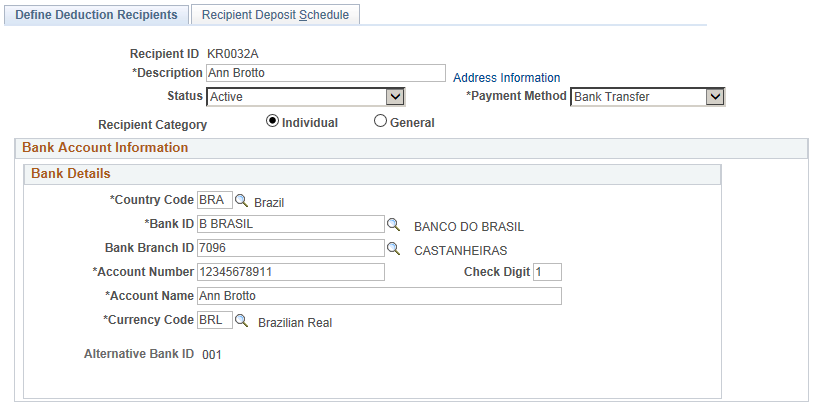

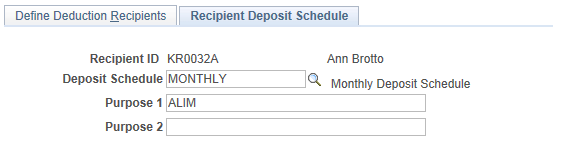

Create one or more deduction recipients as needed. A deduction recipient contains the bank account information for individuals to receive payments, as well as the corresponding deposit schedule. Specify this information on the Define Deduction Recipients Page and Recipient Deposit Schedule Page.

This example illustrates the fields and controls on the Define Deduction Recipients page.

This example illustrates the fields and controls on the Recipient Deposit Schedule page.

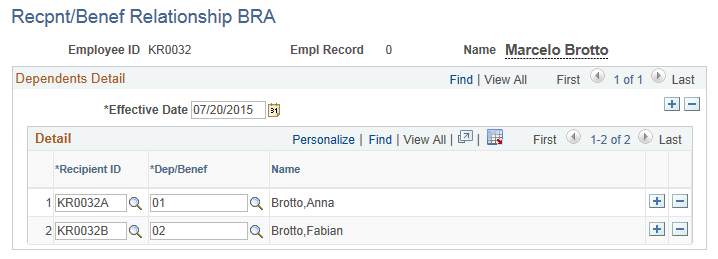

Associate deduction recipients with employee’s dependents on the Recpnt/Benef Relationship BRA Page. A deduction recipient can be linked to one dependent (in a case where the dependent has his or her own bank information) or more dependents (in a case where dependents are children of an employee and the deduction recipient contains bank information of the employee’s ex-spouse who takes care of the children).

This example illustrates the fields and controls on the Recpnt/Benef Relationship BRA page.

This information is used in the IREN report.

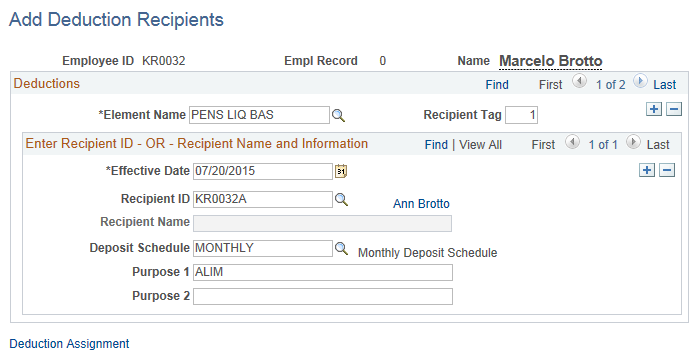

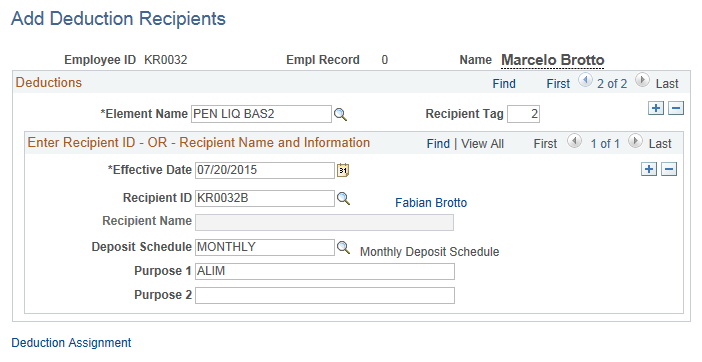

Associate alimony deduction elements with deduction recipients on the Add Deduction Recipients Page. In this example, use PENS LIQ BAS and PEN LIQ BAS2 (Gross-Net Alimony Base) for employee’s two deduction recipients.

This example illustrates the fields and controls on the Add Deduction Recipients page.

This example illustrates the fields and controls on the Add Deduction Recipients page.

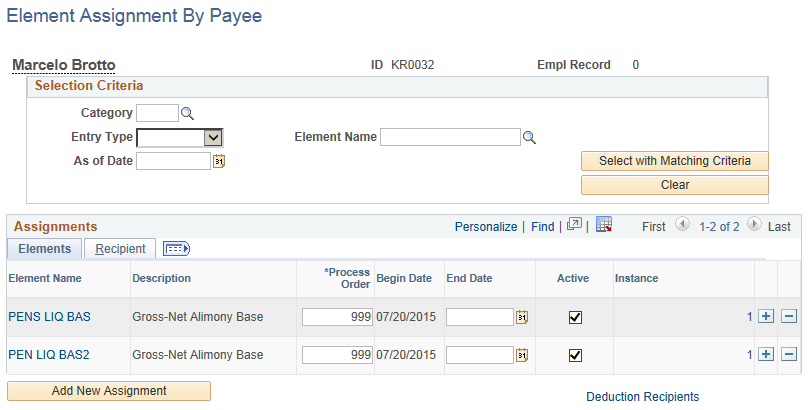

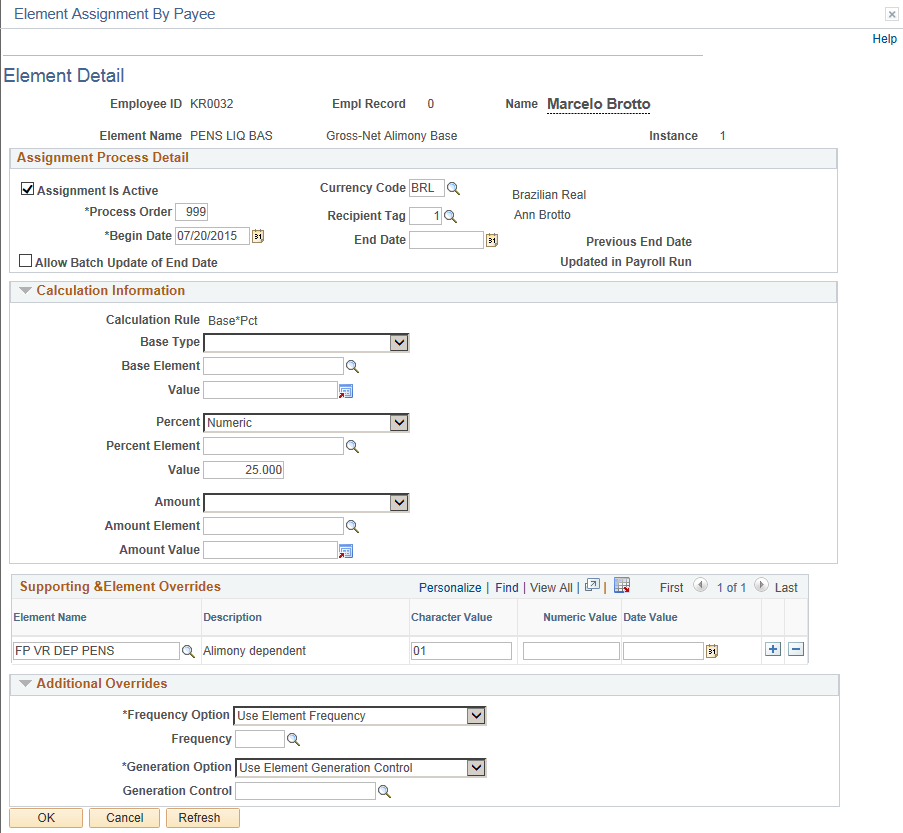

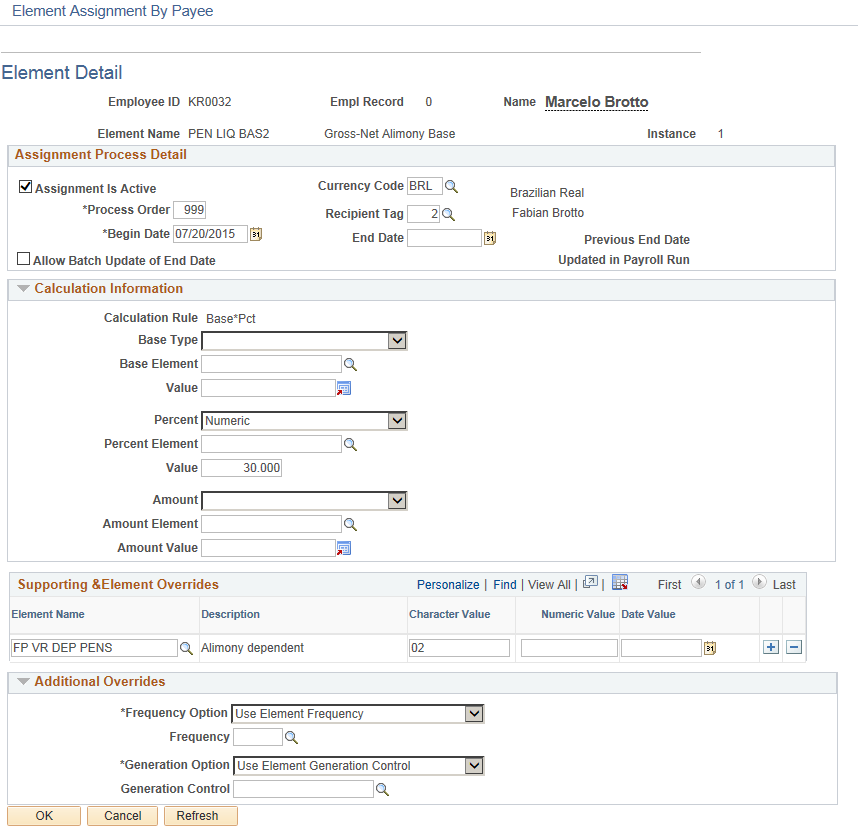

Select and assign values in each added alimony element for your dependents on the Element Assignment By Payee Page and Element Detail Page.

In this example, select PENS LIQ BAS and PEN LIQ BAS2.

This example illustrates the fields and controls on the Element Assignment By Payee page.

Assign these values on the Element Detail page:

Element Name: PENS LIQ BAS

Recipient Tag: 1 (the deduction recipient for the first dependent)

Calculation rule percent: Numeric

Calculation rule amount: 25

Add element FP VR DEP PENS, and enter 01 as the character value, which is the ID of the first dependent.

This example illustrates the fields and controls on the Element Assignment By Payee - Element Detail page.

Assign these values for the other element on the Element Detail page:

Element Name: PEN LIQ BAS2

Recipient Tag: 2 (the deduction recipient for the second dependent)

Calculation rule percent: Numeric

Calculation rule amount: 30

Add element FP VR DEP PENS , and enter 02 as the character value, which is the ID of the second dependent.

This example illustrates the fields and controls on the Element Assignment By Payee - Element Detail page.

Run the payroll calculation and review the results. Note that separate rows are displayed for the alimony deductions that are calculated, one for each of the employee’s dependents.