Entering FAK Data

This topic discusses how to enter FAK data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_TX_FAK_STAX |

Enter the company-specific FAK and source tax data that is allocated to your company by the cantons. |

Use the FAK/Source Tax (Company) CHE page (GPCH_TX_FAK_STAX) to enter the company-specific FAK and source tax data that is allocated to your company by the cantons.

Navigation:

Note: The fields on this page enable you to combine the XML for various cantons into one provider - FAK (FAK Provider) - LAW (LAW Provider).

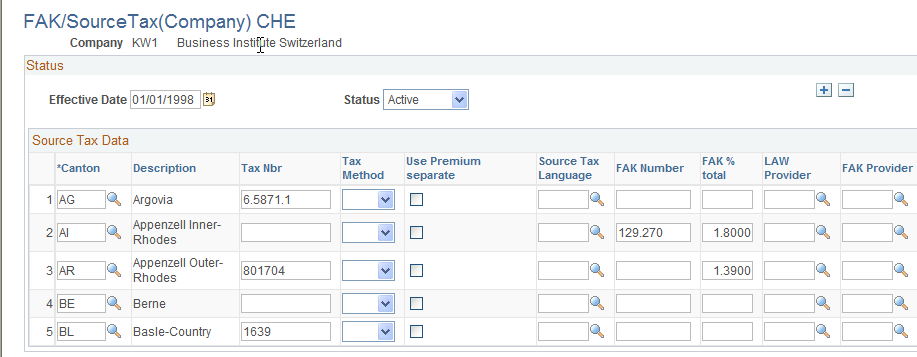

FAK/Source Tax (Company) CHE page (1 of 2)

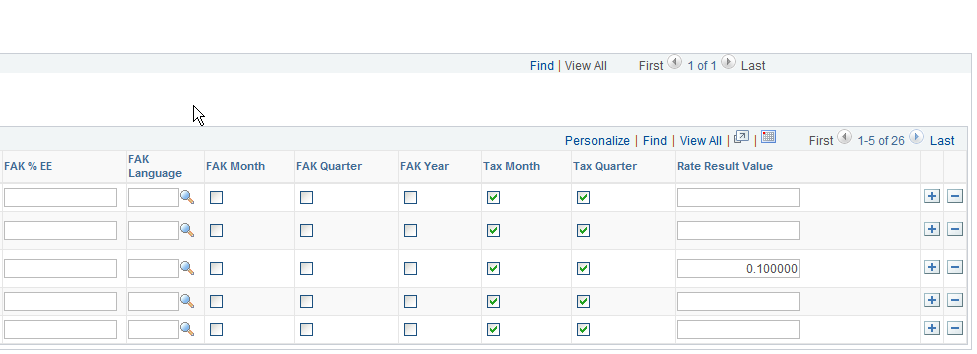

FAK/Source Tax (Company) CHE page (2 of 2)

Use this page to record FAK and source tax data, which including source tax and FAK numbers, which are allocated to your company by the cantons. These fields enable you to combine the XML for various cantons into one provider – FAK (FAK Provider) - LAW (LAW Provider).

Source Tax Data

Field or Control |

Description |

|---|---|

Tax Nbr (tax number) |

Enter the number assigned to your company by your canton's tax office. |

Tax Method |

Select another canton method, if calculation shall not follow the default method for this canton. More details about methods see ‘Managing Source Tax’ chapter. |

Source Tax Language |

Select a language for the canton source tax report. This option allows you to print the tax report for each canton in a different language. If there is no value in this field all the reports will print in the default language. The available options are: German, French, and Italian. |

FAK Number |

Enter the number that has been assigned to your company by the FAK. For XML Global Payroll for Switzerland uses the FAK Number from the CHE Company. Note: The system uses the language for the canton. This is important if you run reports for several cantons at once, where the language selection on the run control is not sufficient. |

FAK % Total |

Enter the current contribution rate that employers must make to the FAK for each canton, expressed as a percentage. For cantons with employee portion, this shall include the employee portion. Note: If there is no value in this field, the system doesn't support payments to the FAK in that canton. |

LAW Provider |

Select the company which generates the taxes. |

FAK Provider. |

Select the agency that is paying the monthly contributions towards family allowances, such as child allowances and maternity benefits. |

FAK % EE |

Some cantons defines employee portion as well for FAK contribution. For these cantons, enter employee (included in Total). |

Tax Month and Tax Quarter |

Select to enable monthly and/or quarterly source tax report generation for a canton. |

Note: PeopleSoft doesn't maintain the data on this page, because it contains information about the tax ID and FAK number, which the government assigns to your company.