Maintaining Swiss Payroll Salary Bases

Calculations for salary bases are contained in the standard version of the application. You can, however, add or change salary bases in some cases. Intern bases, which are maintained only by the producer, are not discussed here.

For the recommended accumulators buildup, use the normal types of salary via CH_00_0. For all standard accumulators we provide a custom entry, which is already a member of the standard accumulator.

The naming convention for the custom entry is CH_XX_CYY, where XX stands for positions 4 to 5 and YY stands for the positions 8. For example, CH_00_C0 is the custom entry for CH_00_0.

This enables you can add customer earnings to custom accumulators to avoid any overlap with any additional delivery of standard accumulators. For example, if you had a customer earning called Cust_Salary, which contributes to all legal bases, then you would add this earning to accumulator CH_00_C0, which is the custom entry for standard accumulator CH_00_0.

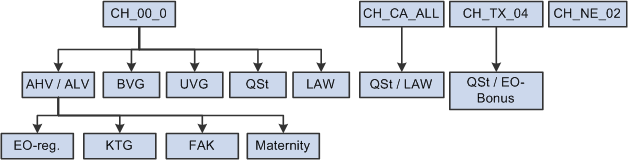

Refer to the illustration below for a graphical representation of how accumulators are used in the Global Payroll for Switzerland application:

Illustration showing how accumulators are used in the Global Payroll for Switzerland application

Global Payroll for Switzerland Accumulators provides an overview by functional category of the accumulators that you need to maintain.

The list of accumulators for these functional categories are:

Subtotals

Social Insurances

Source Tax

Tax Statement 2006 (and later)

Statistics

Source Tax Reporting

Other Reporting Controls

The salary bases delivered in the standard version of the application are sufficient in most cases. You, however, can further define salary bases and their respective accumulators to meet your own needs.

See also Understanding Global Payroll for Switzerland Accumulators