Net to Gross (Gross Up)

Global Payroll for Switzerland supports gross up calculations. It is not an iterative approach. It follows the formulas as provided by the former SUVA (document 1922.d).

Here are the pages you would access to make adjustments for gross up calculations:

|

Page Name |

Object Name |

Usage |

|---|---|---|

|

GPCH_SI_DATA |

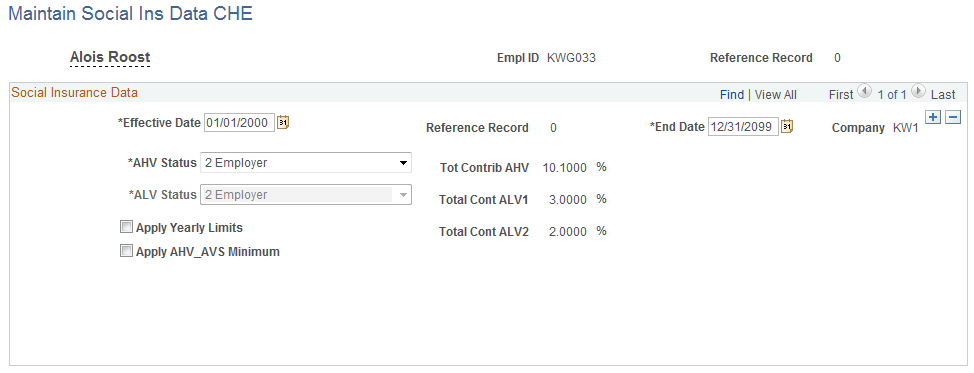

Set AHV and ALV status to 2. |

|

|

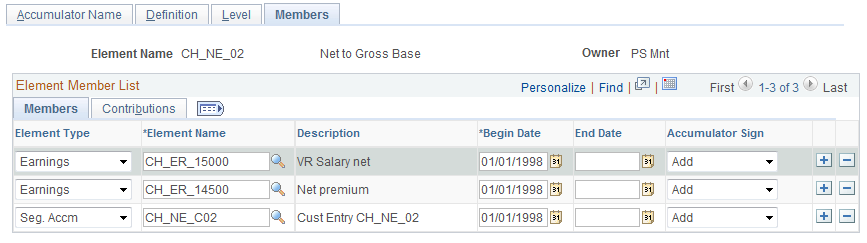

GP_ACCUMULATOR_3 |

Assign net earnings to accumulator CH_NE_02 |

Gross up for all earnings is triggered by assigning AHV and ALV a status of 2 – employer pays all on employees social insurance data. Then all contribution for AHV, ALV and UVG are grossed up. Gross up happens by default and the gross up amount is shown in generated earnings CH_NE_XXX.

Use the Maintain Social Ins Data CHE page (GPCH_SI_DATA) to Set AHV and ALV status to 2.

See the example here:

Navigation:

Maintain Social Ins Data CHE page

Gross up for dedicated earnings is managed by assigning earnings to the CH_NE_02 accumulator. For testing you might just use the sample earnings CH_ER_15000 and CH_ER_14500. Based on the Swissdec certification of this module we provide the standard Gratuity earnings (1201) as a gross up earning. A limitation of using this earning is that it does not include source tax in the gross up.

Use the Accumulator - Member page (GP_ACCUMULATOR_3) to assign net earnings to accumulator CH_NE_02.

See example here:

Navigation:

Accumulator - Member page