Payment Frequencies

This section discusses:

Frequencies and payout periods.

Annual, monthly, and hourly payment rules.

Frequencies and Payout Periods

The Global Payroll for Switzerland application provides calculation processes for employees that are paid annually, monthly, weekly, daily and hourly. The system, however, only supports payout periods on a monthly and weekly frequency.

The system supports hourly, daily, monthly, and annual payment rules for the monthly pay frequency and weekly payment rules for the weekly pay frequency. By default the status is taken from pay frequency on the Job record.

The statuses include:

D = Daily

H = Hourly

W = Weekly.

You can override theses statuses in the customer exit CH_00_CHOURLY (called in formula CH_00_SYS_RES).

Annual, Monthly, and Hourly Payment Rules

Most common payment methods use the hourly and monthly payment rule with a monthly pay frequency. Although the proration rules for child allowances expired in 2009, there is no difference regarding the legal calculations between a monthly and an hourly paid employee.

However, for gross calculations, the automated creation of compensation for vacation and holiday is controlled by the pay frequency status and happens only for employees paid on an hourly basis. Annual payments either get assigned on the job and compensation levels and then automatically the appropriate monthly rate gets calculated and handled in the payroll the same way as a monthly payment. In addition, you can designate the employee as a person who receives yearly payments, where the payout happens only in a few dedicated months. In this case the limits for the social insurance are immediately taken as yearly limits and not accumulated month by month.

See Swissdec, Richtlinien der Lohndatenverarbeitung, chapter 2.12, Modul Unperiodische Zahlungen

Daily Payment Rules

There is a special treatment for employees paid on a daily basis in these domains:

Unemployment, accident insurance (limits).

Source tax (percent per day).

Additional insurances (upper and lower limits).

These calculations apply for employees being paid on a daily basis based on reported working days:

Limits for ALV-AC and UVG-LAA

Limit = Reported Working Days * Daily Rate (this number comes from the Company table).

Source tax lookup

Lookup = Taxable Amount * Reported Working Days / Average Working Days (this number comes from the Company table).

Additional insurances lower and upper limits

Limit = Reported Working Days * Yearly Rate / 365 (you can customize, if the company reports work days) Roundup to full CHF (for example, 126,000 / 365 = 346).

To enable the daily calculation, you need to maintain these values in the company setup:

Daily Limit and Average Work Days

An example of how working days and limit per day depend from each other:

Assume working days get reported as calendar days. We expect to see as company values:

ALV-AC: 345

For 2 weeks of work c.p. 15 days * 345 = 5475 CHF.

Source Tax: 30

In the same scenario with assumed earnings of 1700 CHF there is a tax lookup of 3400 CHF in additional insurances: 15 days * 345 for 126,000 CHF and 15 days * 685 for an upper limit of 250,000 CHF.

If assumed working days get reported as real working days and the average is 21, then we expect to see these company values:

ALV-AC: 500

For 2 weeks of work 10 days * 500 = 5000 CHF.

Source Tax : 21

In the same scenario with assumed earnings of 1700 CHF there is a tax lookup of 3570 CHF in additional insurances (probably customized to 252 working days). 15 days * 500 for 126,000 CHF and 15 days * 992 for an upper limit of 250,000 CHF.

See Rates Page.

Weekly Payment and Payout Rules

Other than employees that are paid on an hourly, daily, and monthly basis, employees paid on a weekly basis receive their paycheck each week. Nevertheless, at the end the full legal calculation and the legal reporting is based on a monthly view on the result. Therefore, the weeks need to get assigned to a dedicated month. Some months will have 4 weeks and some 5 weeks.

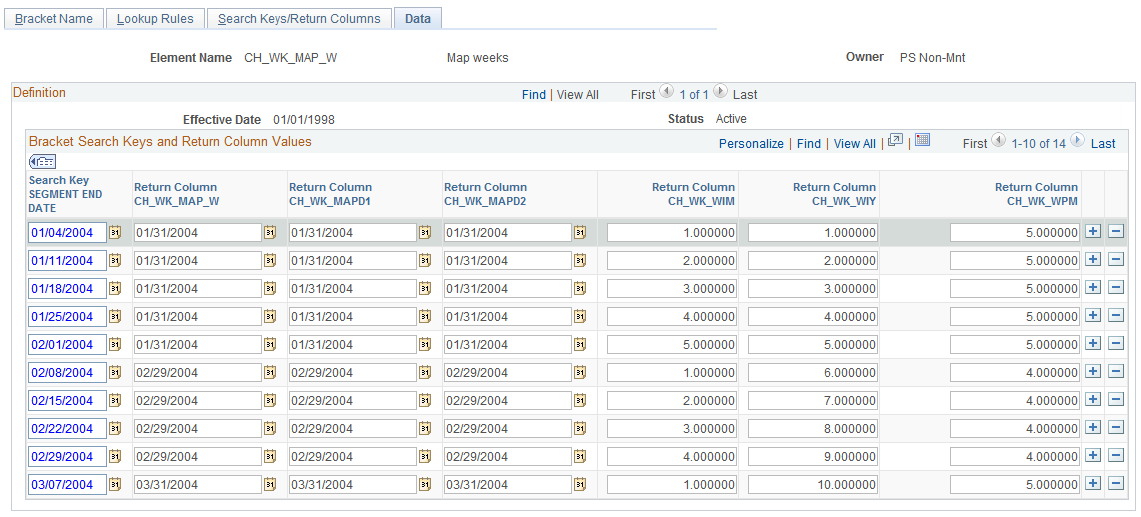

This mapping is managed by setting up the CH_WK_MAP_W bracket (select Set Up HCM, Product Related, Global Payroll & Absence Mgmt, Elements, Supporting Elements, Brackets, Data).

This example illustrates the fields and controls on the Bracket Element: Data page. You can find definitions for the fields and controls later on this page.

Term |

Definition |

|---|---|

Search Key SEGMENT END DATE |

Displays the 1st day of the week. |

Return Column CH_WK_MAPD2 |

Displays the last day of the mapped month. |

Return Column CH_WK_WIM |

Displays the number of the week in the month. |

Return Column CH_WK_WIY |

Displays the number of the week in the year. |

Return Column CH_WK_WPM |

Displays the number of weeks assigned to the month. |

Calculations

For employees that get paid on a weekly basis, these calculations apply:

Child allowance.

Employee receives the portion of child allowance according to the hours worked in the week with the weekly payment. In the last week of the month the remainder is paid out.

Source tax (% per day).

Each week the lookup gets calculated by dividing the reported weeks by the total weeks of the month. Then the tax for that week is calculated as: Newly Calculated Taxes – Already Paid Taxes = Taxes Owed.

Unemployment, accident insurance (limits).

Limits get adjusted to days. Weekly limit = 10,500 CHF divided by 7 = 1,500 CHF.

Garnishments.

Garnishments get deducted first until the monthly amount is covered. As such, the employee might not have any payments the first week or first few weeks in the month.