Setting Up Pay Entities and Pay Groups

Before setting up Swiss options, you need to define the pay entity and pay group on the Pay Entities and Pay Groups pages. The simplest setup is to keep company and pay entity as a one-to-one relationship, where the keys are identical. However, the pay entity can also be designated as a legal entity.

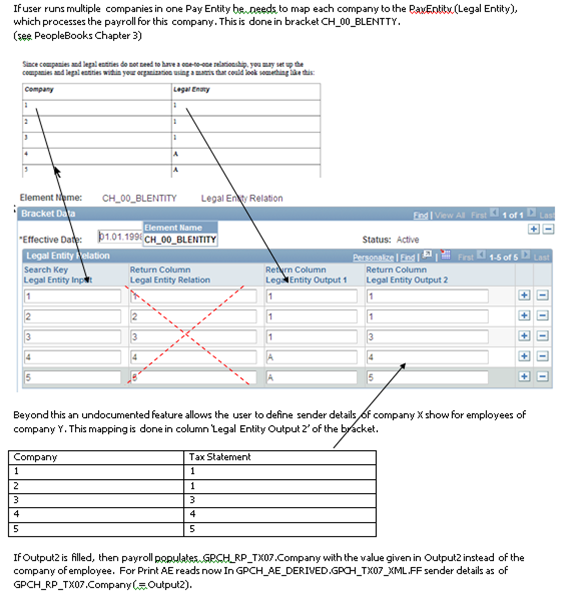

A company with the features of the legal entity must exist. If you have several companies combined into one legal entity, than you can associate additional companies with the Bracket element (CH_00_BLENTTY) of the legal entity (select Set Up HCM, Product Related, Global Payroll & Absence Mgmt, Elements, Supporting Elements, Brackets).

These companies obtain their payroll features from the leading legal entity. The system only displays these associated companies on selected reports for the purposes of sorting, selecting or for stating the related company.

Since companies and legal entities do not need to have a one-to-one relationship, you may set up the companies and legal entities within your organization using a matrix that could look something like this:

|

Company |

Legal Entity |

|---|---|

|

1 |

1 |

|

2 |

1 |

|

3 |

1 |

|

4 |

A |

|

5 |

A |

|

6 |

6 |

|

7 |

B |

Setting Up Pay Entities and Pay Groups