Understanding ELM and eGovernment for Global Payroll for Switzerland

This section discusses:

eGovernment Overview

eGovernment Reporting

Additional XML Reporting

Managing Governmental Data

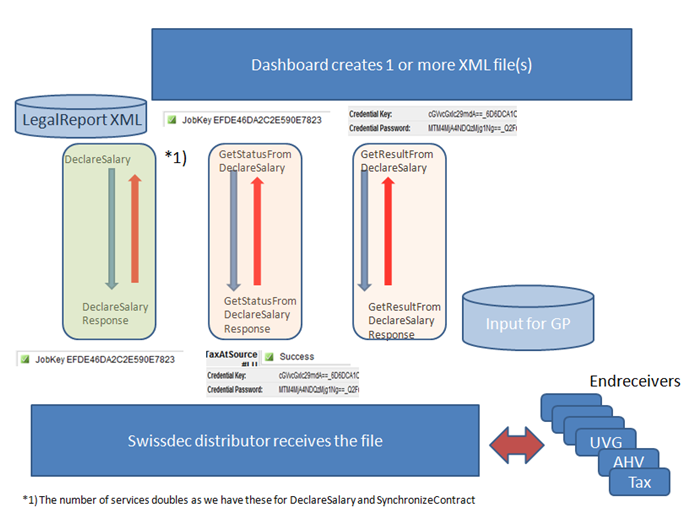

Swiss eGovernment, or ELM (einheitliches Lohnmeldeverfahren), is the secure electronic transmission of salary declaration for social insurance, taxation and statistical reporting.

Increasing demand for electronically submitted data is currently spreading across Europe. Approximately 300,000 companies operating in Switzerland report information relating to social insurance registration, taxation, and statistical data to government agencies and insurance providers. An estimated 90 percent of all salary-related information is already in electronic form. In Switzerland SUVA, Swissdec, and other Swiss social insurance and software providers have been working together to define an XML-based electronic submission standard under the umbrella project initiative called Lohnstandard-CH.

Delivered eGovernment functionality enables you to run year end and monthly legal reporting using a single dashboard, simplifying the process. Governmental data is taken from the existing set of legal reports and stored in separate XML records.

eGovernment creates the ELM records using the following reports:

GPCHSI07 - UV Yearly.

GPCHSI08 - AHV Year and NON AHV/ALV.

GPCHSI8X – AHV E(M)A

GPCH_AE_TX07 - Tax Statement.

GPCHAL5X - FAK Yearly.

GPCH_AE_INS - BVG Pension, KTG Health, and UVGZ Additional Accident insurance.

GPCHST2X – BFS Salary Statistics

GPCHTX2X – Source Tax.

Besides the year end and monthly processes that create the XML according to the ELM Swissdec format, we included these XML reports that can also be processed using the dashboard:

GPCHTX01 - Source Tax Year for GE.

GPCHAL4X – FAK_CAF monthly for Ausgleichskasse Banken and Ausgleichskasse Versicherungen (Pool Inside).

GPCHAL5X – FAK_CAF YearToDate as of eAHV format (e.g. Pools Globaz and IGAKIS).

GPCHEOX1 – EO_APG Military service for Ausgleichskasse Banken and Ausgleichskasse Versicherungen (Pool Inside).

GPCHAL8X – XML Audit

GPCHB2X – Bank Transfer format ISO 20022

By selectively processing eGovernment reports you can breakup data reporting and submission in discrete parts as necessary. For example, consider an organization with four entities of varying sizes: one large and three smaller entities. You may choose to process data from the large entity separately from the other three, which may then be processed together as a group. The data for all four entities may then be sent to the government in two transmissions.

Managing Governmental Data

ELM Year End processes (AHV_AVS, BFS_OFS, FAK_CAF, UVG_LAA, UVGZ_LAAC, KTG_AMC, LAW_CDS, BVG_LPP) can be run as single domain or combined. Yearly process for Source Tax GE (ISEL) and all monthly processes (incl. source tax Swissdec) need to run in a single domain. The dashboard includes a group of pages called Prepare Files and Process Files. This is where you can select a previously defined domain set to run the defined reports all at the same time for domains defined in the selected domain set and only for providers within the domains, which are mapped on the company level.