Declaring Tax Allowances

To set up tax allowance details, use the Tax Allowance Declaration THA (GPTH_TAX_ALLOW) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPTH_TAX_ALLOW |

Declare tax allowances. |

Use the Tax Allowance Declaration THA page (GPTH_TAX_ALLOW) to declare tax allowances.

Navigation:

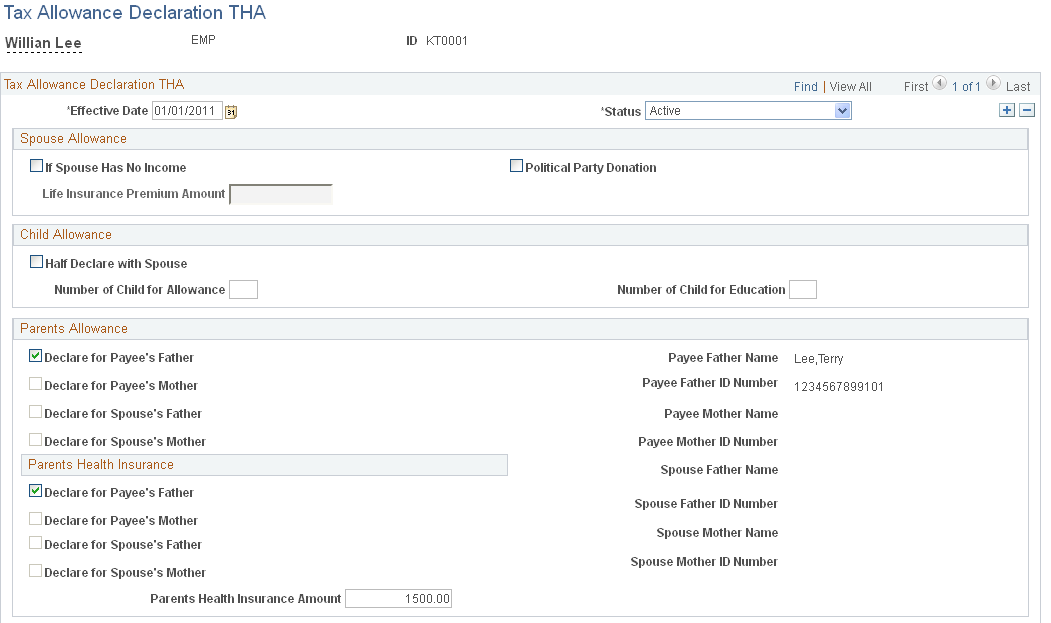

This example illustrates the fields and controls on the Tax Allowance Declaration THA page. It is the first of two page shots.

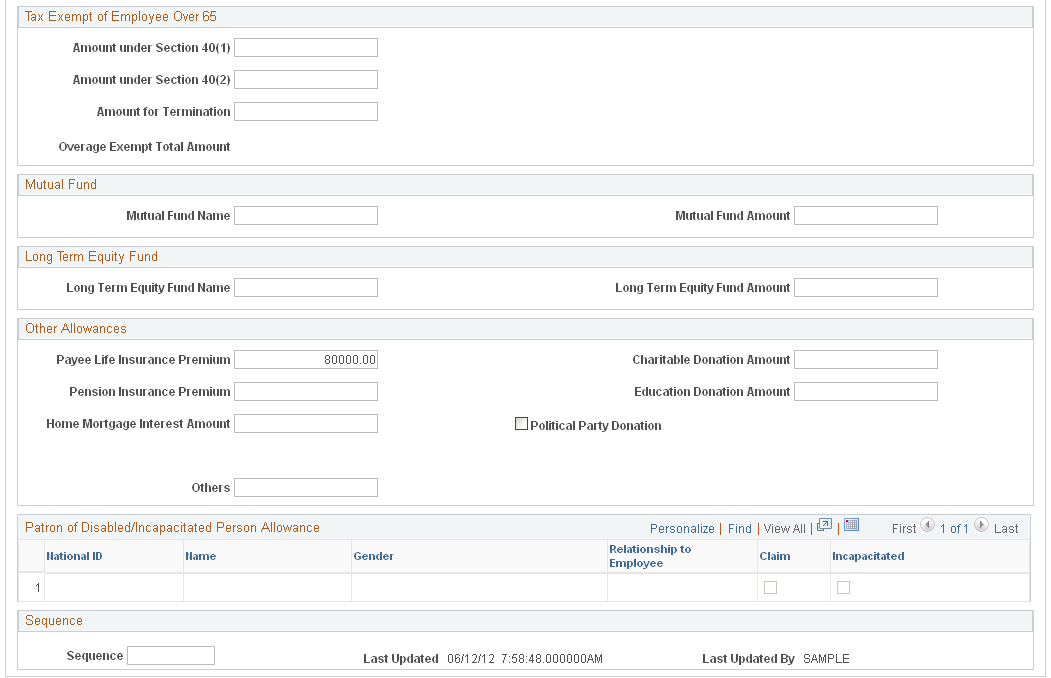

This example illustrates the fields and controls on the Tax Allowance Declaration THA page. It is the second of two page shots.

Field or Control |

Description |

|---|---|

Effective Date and Status |

All tax allowance declaration information is effective dated. You can create a new record or update the existing record. Global Payroll for Thailand selects the most recent active tax allowance declaration record prior to the payroll period end date. |

Spouse Allowance

If a payee's spouse has no income, the payee can declare an allowance for the spouse and his or her insurance. The spouse allowance amount is fixed at 30,000 THB.

Field or Control |

Description |

|---|---|

If Spouse Has No Income |

This check box indicates whether to declare a spouse allowance since the payee's spouse does not have income. |

Spouse Life Insurance Premium Amount |

Enter the amount of the life insurance premium paid by the payee. |

Child Allowance

Specify whether the current payee wants to declare only one-half of the child allowance, and enter the actual number of children and the actual number of children in school. Global Payroll for Thailand compares and adjusts this number with the number in the law of Revenue Department.

Field or Control |

Description |

|---|---|

Half Declare with Spouse |

Select this check box if the payee wants to declare only one-half of the child allowance. This would occur when the payee's spouse has income and declares the other half of the child allowance. |

Number of Child for Allowance |

Enter the number of children for the child allowance. |

Number of Child for Education |

Enter the number of children studying in an educational institution in Thailand. |

Parents Allowance

Before you can declare a parents allowance, you must enter the parents' information in the Dependent Information component

Note: When you define the dependent information, you must select Beneficiary as theDependent Beneficiary Type so that the tax allowance page can query related data.

Field or Control |

Description |

|---|---|

Declare for Payee's Father |

Select to declare the parents allowance for the payee's father. You must enter the father's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Declare for Payee's Mother |

Select to declare the parents allowance for the payee's mother. You must enter the mother's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Declare for Spouse's Father |

Select to declare the parents allowance for the father of the payee's spouse. You must enter the father's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Declare for Spouse's Mother |

Select to declare the parents allowance for the mother of the payee's spouse. You must enter the mother's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Parents HI Amount |

Enter the annual amount of the parents' health insurance. |

Declare for Payee's Father |

Select to declare the cost of the parents' health insurance for the payee's father. You must enter the father's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Declare for Payee's Mother |

Select to declare the cost of the parents' health insurance for the payee's mother. You must enter the mother's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Declare for Spouse's Father |

Select to declare the cost of the parents' health insurance for the spouse's father. You must enter the father's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Declare for Spouse's Mother |

Select to declare the cost of the parents' health insurance for the spouse's mother. You must enter the mother's name and ID number in the Dependent Information component before the system enables you to select this check box. |

Tax Exempt of Employee Over 65

Enter the payee's assessable Section 40(1), Section 40(2), and termination income. The system calculates the value of the Overage Exempt Total Amount field based on the assessable income entries in this region of the Tax Allowance Declaration page. The total amount of the three types of tax exemptions for an employee over the age of 65 should not exceed the amount specified in the TAX VR OVERAGE EMT variable.

Field or Control |

Description |

|---|---|

Amount under Section 40(1) |

Enter the payee's assessable Section 40(1) income. |

Amount under Section 40(2) |

Enter the payee's assessable Section 40(2) income. |

Amount for Termination |

Enter the payee's assessable termination income. |

Mutual Fund

Field or Control |

Description |

|---|---|

Mutual Fund Name |

Enter the mutual fund name. You can add multiple fund names by separating each name with a comma. |

Mutual Fund Amount |

Enter the amount of the mutual fund. If the user holds multiple mutual funds, input the total amount of the funds. |

Long Term Equity Fund

Field or Control |

Description |

|---|---|

Long Term Equity Fund Name |

Enter the name of the long term equity fund. You can add multiple fund names by separating each name with a comma. |

Long Term Equity Fund Amount |

Enter the long term equity fund amount. If the user holds multiple mutual funds, input the total amount of the funds. |

Other Allowances

Field or Control |

Description |

|---|---|

Payee Life Insurance Premium |

Enter the annual premium amount for the payee's life insurance. |

Pension Insurance Premium |

Enter the pension insurance premium amount. |

Home Mortgage Interest Amount |

Enter the home mortgage interest amount. |

Charitable Donation Amount |

Enter the total amount of charitable donations. |

Education Donation Amount |

Enter the education donation amount. |

Political Party Donation |

Select this check box if the employee has a political party donation routinely taken from his pay check. When selected, the Party ID and Amount fields appear. |

Party ID and Amount |

These fields appear only when the Political Party Donationcheck box is selected. Enter the ID of the political party to which the employee’s donation is to be made. The value in the Amount field is the amount allowed by Thailand Revenue Department. You cannot change this. |

Others |

If the employee has other allowances not listed, enter the total amount here. |

Sequence

Field or Control |

Description |

|---|---|

Sequence |

Enter the sequence number to use for tax reports. If this field is left blank, the system uses the employee number as the sequence number for tax reports. You can maintain this field manually, or create a program to automatically enter data into this field in the database. |

Last Updated andLast Updated By |

Displays information about the last update made to the Tax Allowance page. |