Defining Company Tax ID and Branch Information

To set up company tax ID and branch details, use the Company Tax ID/Branch THA (GPTH_TAX_ID_BRN) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPTH_TAX_ID_BRN |

Enter and maintain company tax ID and branch information. |

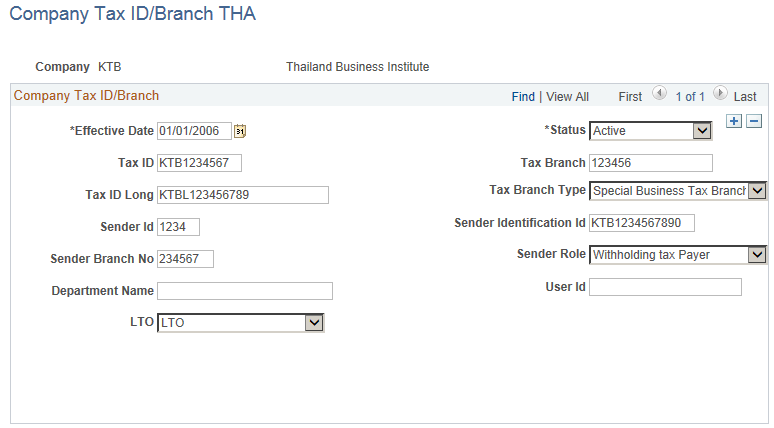

Use the Company Tax ID/Branch THA page (GPTH_TAX_ID_BRN) to enter and maintain company tax ID and branch information.

Navigation:

This example illustrates the fields and controls on the Company Tax ID/Branch THA page.

Field or Control |

Description |

|---|---|

Tax ID |

Enter the employer's tax ID. |

Tax Branch |

Enter the employer's tax branch. |

Sender Id |

Enter the Bank ID or ID issued from the Revenue Department. |

Sender Role |

Specify who submitted the report (Agent, Filing Jointly, Representative, or Withholding tax Payer). |

LTO |

Specify whether or not the company is part of LTO (Large Business Tax Administration Office). Note: If the company is LTO, the Income Tax Form report must be submitted to Thailand Revenue Department. |

User id |

Identify the ID who provided the Company Tax ID/Branch THA page data or the ID who entered the data into your system. |