Setting Up Termination Processing

The logic of handling terminations depends on the LOS. If the LOS is less than 5 years, the termination income and tax calculation is handled as normal irregular income. If the LOS is greater than 5 years, specify the tax method for each termination income through positive input, with the following calculations:

Calculating taxable income.

The total taxable income is composed of:

Government pension.

Provident fund or government pension fund (Kor Bor Kor).

Severance pay.

One time payments.

Total Assessable Income = Government Pension + Provident Fund or Government Pension Fund (Kor Bor Kor). + Severance Pay.

Calculating exempted income.

Total Exempted Income = First part of expenses + Second part of expenses.

First part of expenses = Termination Yearly Expense * LOS.

Note: The TAX VR YEARLY EXP element is used for storing the Termination Yearly Expense value. The valid values are 7000, the default, or 3500.

This value can be overridden.

Second part of expenses = ((Min (One time payments, Min (Salary of last month, Average salary of last 12 months * (1+10%)) * LOS) + Total Assessable Income) - First part of expenses) * 50%

Calculating the termination tax.

Calculate the termination tax according to the tax rate table on the Brackets - Data Page (GP_BRACKET3)

Generally, a payee is terminated some time within the current period. There are two options for calculating the tax in the current period:

Based on the payee's annual income using normal periods.

Based on the payee's income for the current period, or the period in which the payee is terminated.

For example, assume a payee is terminated on July 7, 2007. The payee's basic salary is 80,000 THB. So the payee's prorated salary is 80000 * 6 / 31 = 15483.87. In July, when processing the tax, the annual income can be 480,000 +15,483.87+ 80,000 * 0, or 480,000 +15,483.87+ 80,000 * 5. The key point is that the projection for the remaining periods could be 80000 * 0, or it can be 80000 * 5.

Global Payroll for Thailand supports either option by enabling you to set the TAX VR PROJ variable. If the value of the variable is E, then the projection for the remaining periods is required, if the value of the variable is T, then the projection for the remaining periods is zero.

When a payee is terminated within a period, the system only calculates the salary from the beginning date of the period to the termination date. If you want the payee be paid for the entire period, you need to delete the delivered trigger definition.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_TRGR_SETUP |

Define iterative, segmentation, and retroactive triggers. To create a retroactive or segmentation trigger, first define the appropriate event ID on the Retro Event Definition page or Segmentation Event Definition page. |

|

|

GP_TRGR_SETUP_SEC |

Indicate which field values initiate actions. |

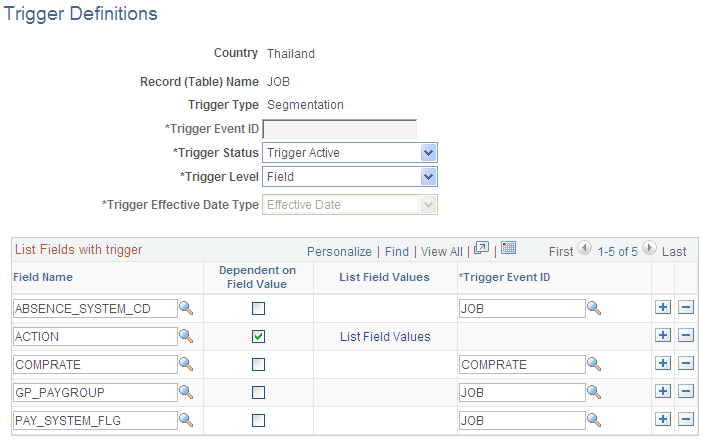

Use the Trigger Definitions page (GP_TRGR_SETUP) to define iterative, segmentation, and retroactive triggers.

To create a retroactive or segmentation trigger, first define the appropriate event ID on the Retro Event Definition page or Segmentation Event Definition page.

Navigation:

This example illustrates the fields and controls on the Trigger Definitions page.

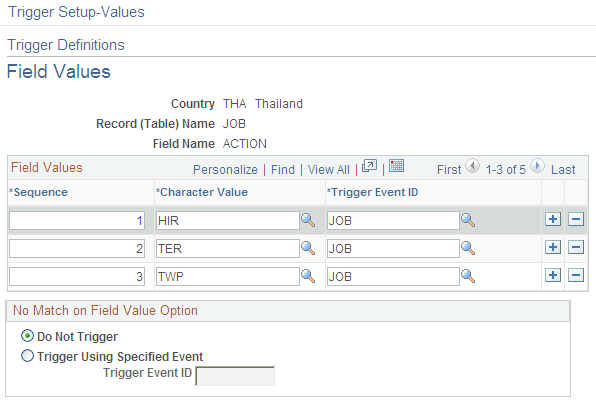

Use the Trigger Definitions - Field Values page (GP_TRGR_SETUP_SEC) to Indicate which field values initiate actions.

Navigation:

Click the List Field Values link on the Trigger Definitions page.

This example illustrates the fields and controls on the Trigger Definitions - Field Values page.

To add period segmentation for termination with pay, you need to define the trigger. The action TERMINATION is added to the THA trigger definitions so that is a payee is terminated within a period, the trigger occurs.

For example: If a payee with a basic salary of 95,000 THB is terminated on April 10, the payee will receive a salary amount calculated as follows: 9/30 * 95,000 = 28,500. The payroll process does not handle the remainder of the period from April 10 through April 30.

If you do not want the trigger to occur, you can delete the definition from the trigger definitions. You may also need to delete any generated triggers on the Review Triggers - Segmentation page