Setting Up the Provident Fund Contribution Rate

To set up a provident fund contribution rate, use the Company Provident Fund THA (GPTH_PF_COMP) and Payee Provident Fund Setup THA (GPTH_PF_PAYEE) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPTH_PF_COMP |

Define company level provident fund data. |

|

|

GPTH_PF_PAYEE |

Define payee level provident fund data. |

|

|

Provident Fund Setup Page |

GPTH_SS_PF_PAYEE |

Define payee level provident fund data. |

|

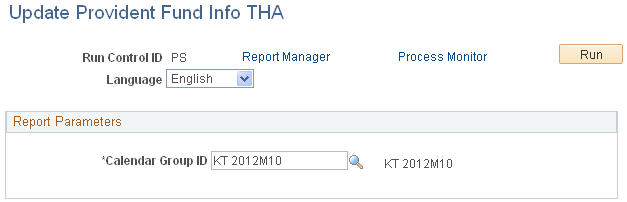

GPTH_RC_PF |

Update provident fund information for a calendar group. |

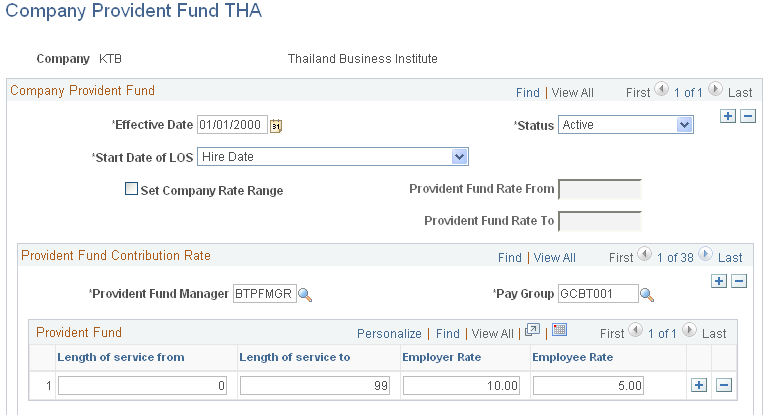

Use the Company Provident Fund THA page (GPTH_PF_COMP) to define company level provident fund data.

Navigation:

This example illustrates the fields and controls on the Company Provident Fund THA page.

Field or Control |

Description |

|---|---|

Start Date of LOS (start date of length of service) |

Enter the starting date for the length of service calculation. Select the appropriate start date for your company, valid selections are: Completion of Probation and Hire Date. |

Set Company Rate Range |

Select this check box to specify the rate range for your company in the Provident Fund Rate From and Provident Fund Rate To fields. |

Provident Fund Rate From andProvident Fund Rate To |

Enter the provident fund employer contribution rates. The employer rate should fall between the values in these two fields. These fields are only available if the Set Company Rate Range check box is selected. |

Provident Fund Manager |

Enter the name of the provident fund manager. |

Pay Group |

Select a pay group for this company. |

Length of service from andLength of service to |

Enter the starting and ending period, in years, for each rate specified in the Employer Rate andEmployee Rate fields. The system uses the values in these fields to determine the correct provident fund contribution rate. |

Employer Rate |

Enter the employer contribution percentage for each length of service range. |

Employee Rate |

Enter the employee contribution percentage for each length of service range. |

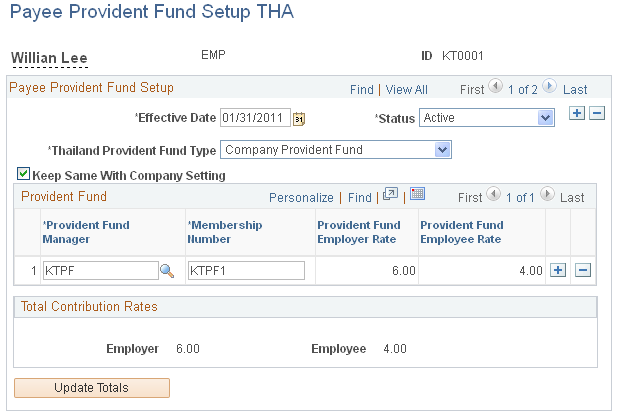

Use the Payee Provident Fund Setup THA page (GPTH_PF_PAYEE) to define payee level provident fund data.

Navigation:

This example illustrates the fields and controls on the Payee Provident Fund Setup THA page.

Note: The Provident Fund Setup self-service page (GPTH_SS_PF_PAYEE) has the same fields as described here.

Field or Control |

Description |

|---|---|

Keep Same With Company Setting |

Use this check box to control whether employees can change their provident fund contribution rates or can only contribute a rate based on LOS as defined on the Company Provident Fund THA Page Select the check box to keep the employee contribution rate the same as the company-defined employee contribution rated based on LOS. . When the check box is selected, the Provident Fund Employee Rate field is display only. Deselect the check box to allow employees to modify their Provident Fund contribution rates with any value equal to or less than the company contribution rate. An error message appears when you try to save the page if a value greater than the company contribution rate is entered in the Provident Fund Employee Rate field, and the change cannot be saved. By default, the check box is deselected. |

Provident Fund Manager |

Select the provident fund manager for this payee. |

Membership Number |

Enter the membership number for the provident fund manger. |

Provident Fund Employer Rate |

Displays the employer contribution percentage when you enter the name of the provident fund manger |

Provident Fund Employee Rate |

Enter an employee contribution percentage if you want to change this value from the default established on the Company Provident Fund THA page. |

Employerand Employee |

The system displays the total employer and employee contribution rates. |

Update Totals |

If you make changes to the page, select the Update Totals button to recalculate and display the current contribution rate totals. |

Use the Update Provident Fund Info THA page (GPTH_RC_PF) to update provident fund information for a calendar group.

Navigation:

This example illustrates the fields and controls on the Update Provident Fund Info THA page.