Setting Up the Tax Log Flag

By default, Global Payroll for Thailand does not gather and store any tax log information, since this significantly impacts the performance of the payroll process. Global Payroll for Thailand uses the Tax Log flag, TAX VR LOG FLAG, to control the gathering of this data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_PIN |

Define a variable element. |

|

|

GP_PAYEE_SOVR |

Override the value of a supporting element for a payee. |

|

|

GP_PYGRP_SOVR |

Define supporting element overrides for a pay group. |

|

|

GP_PYENT_SOVR |

Define supporting element overrides for a pay entity. |

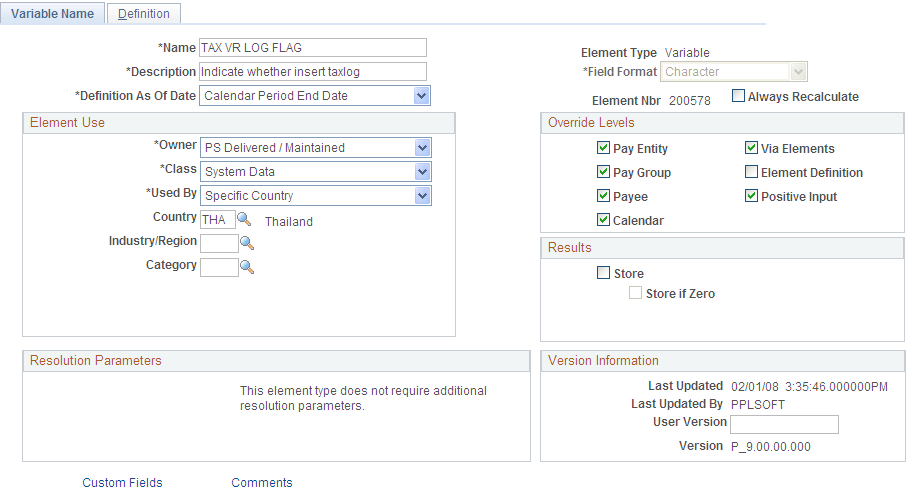

Use the Variable Name page (GP_PIN) to define a variable element.

Navigation:

This example illustrates the fields and controls on the Variable Name page.

The default value of the TAX VR LOG FLAG variable is N. Use this variable to control whether or not data gathering is enabled at different levels:

To enable data gathering for all payees in an instance, update the default value to Y.

To enable data gathering for a single payee, use the supporting element override at the payee level to override this variable to Y.

To enable data gathering for all payees in one pay group, change this variable to Y using the supporting element override at pay group level.

To enable data gathering for all payees in one pay entity, change the variable using the supporting element override at the pay entity level.

Note: Lower-level settings can override or inherit higher-level settings. For example, if the value of this variable for a pay group is set to Y, then payees that belong to the pay group default to Y. You can change the variable to N at the payee level, then the payee's tax log data is not retrieved by the payroll process.

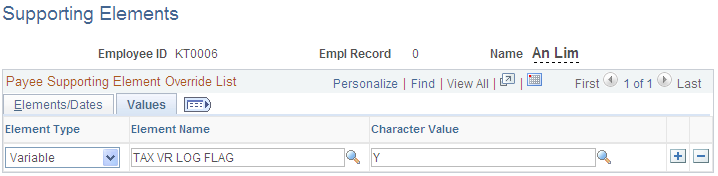

Use the Supporting Elements page (GP_PAYEE_SOVR) to override the value of a supporting element for a payee.

Navigation:

This example illustrates the fields and controls on the Supporting Elements page, Values tab.

After assigning this variable to a payee, the tax calculation details for the payee are recorded and can be printed in the Tax Log report or the Termination Tax Log report.

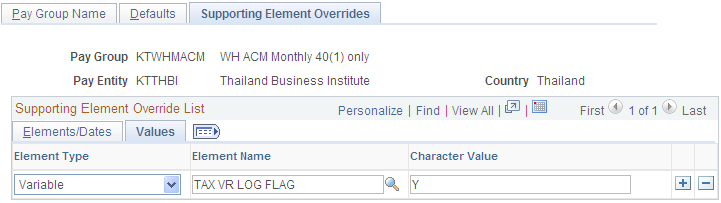

Use the Pay Groups - Supporting Element Overrides page (GP_PYGRP_SOVR) to define supporting element overrides for a pay group.

Navigation:

This example illustrates the fields and controls on the Pay Groups - Supporting Element Overrides.

After assigning this variable to a pay group, the tax calculation details for all of the payees that use the pay group setting in this pay group are recorded and can be printed in the Tax Log report or the Termination Tax Log report.

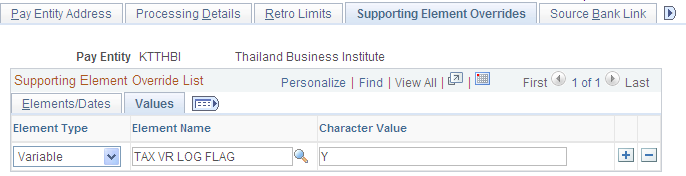

Use the Pay Entities - Supporting Element Overrides page (GP_PYENT_SOVR) to define supporting element overrides for a pay entity.

Navigation:

This example illustrates the fields and controls on the Pay Entities - Supporting Element Overrides page, Values tab.

After assigning this variable to a pay entity, the tax calculation details for all of the payees that use the pay entity setting are recorded and can be printed in the Tax Log report or the Termination Tax Log report.

Note: If the Tax Log flag is set to Y, the tax calculation details are recorded, which can significantly affect the performance of the payroll process, so you should not change this setting if it is not required. You need to enter the proper begin date and end date, then reset the flag to N, or remove the override record after you have reviewed the Tax Log or Termination Tax Log report.