Understanding Tax Log Reporting

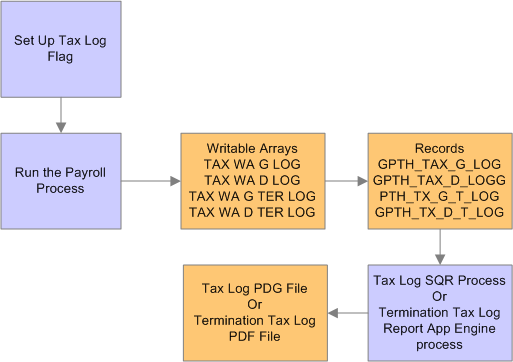

Global Payroll for Thailand provides a Tax Log report. Payroll administrators can use this report to track the process of tax calculation in detail when necessary. The following diagram illustrates the overall Tax Log process flow:

This diagram illustrates the overall Tax Log process flow.

The following steps describe the Tax Log process:

Set up the Tax Log flag.

You establish the Tax Log flag variable and then set up the Tax Log flag for each payee, for entire pay groups, or for a pay entity.

Run the payroll process.

The payroll process checks the Tax Log flag for every identified payee, and then stores the Tax Log data in the TAX WA G LOG and TAX WA D LOG writable arrays. The payroll process stores termination Tax Log data in the TAX WA G TER LOG and TAX WA D TER LOG writable arrays. Global Payroll for Thailand uses the following records for these writable arrays:

GPTH_TAX_G_LOG is used for the TAX WA G LOG writable array.

GPTH_TAX_D_LOG is used for the TAX WA D LOG writable array .

GPTH_TX_G_T_LOG is used for the TAX WA G TER LOG writable array.

GPTH_TX_D_T_LOG is used for the TAX WA D TER LOG writable array.

Run the tax log reports.

The Tax Log SQR report process retrieves the detailed tax calculation data from the appropriate records and then prints the information into a PDF file.

The Termination Tax Log Report process (GPTH_T_TX_AE ) retrieves the detailed tax calculation data from the appropriate records and then uses the PeopleTools Business Intelligence Publisher (PeopleSoft BI Publisher, or BIP) to print the Termination Tax Log report into a PDF file.

See the product documentation for PeopleTools: BI Publisher for PeopleSoft.