Adjusting Tax Estimation

This topic discusses how to:

Select labor agreements for tax estimation adjustment.

Define tax estimation adjustment rules.

To adjust tax estimation, use the Tax Estimation Adjustment ESP (GPES_TAX_FLX) component.

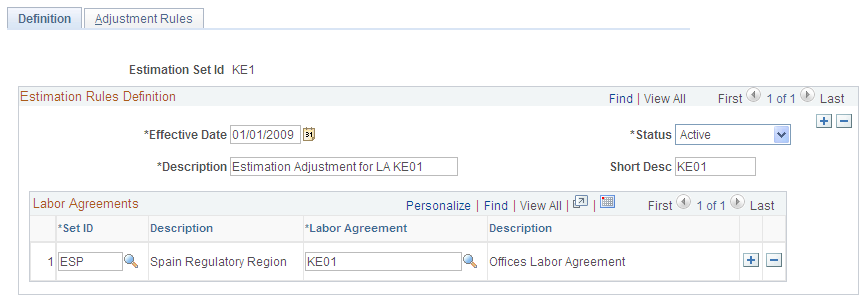

Use the Tax Estimation Adjustment ESP - Definition page (GPES_TAX_FLX_LBR) to select labor agreements for tax estimation adjustment.

Navigation:

This example illustrates the fields and controls on the Tax Estimation Adjustment ESP - Definition page. You can find definitions for the fields and controls later on this page.

Labor Agreements

Select the labor agreements to which your tax estimation adjustment rules apply. You should link a labor agreement to only one estimation set ID.

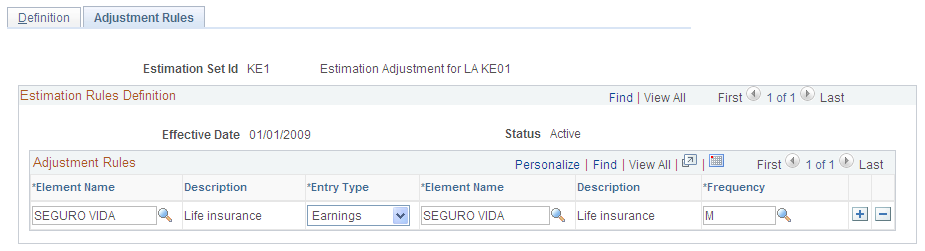

Use the Adjustment Rules page (GPES_TAX_FLX_ERN) to define tax estimation adjustment rules.

Navigation:

This example illustrates the fields and controls on the Adjustment Rules page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Element Name |

Enter the earning that you want the system to include in the tax estimation process, which is performed based on the resolved amount during payroll calculation. The system uses the accumulators to which the earning is assigned to determine whether the earning counts as fixed income, variable compensation, or in kind income. |

Entry Type and Element Name |

Select the type and name of the element that represents the value that the system uses to calculate tax estimation. Typically, you would select the automatically assigned rate component of the earning because it normally contains the daily value of the earning. |

Frequency |

Select the frequency by which the system annualizes the value you enter in the second Element Name field. After determining the annual value, the system calculates a daily value by dividing the annual amount by the total number of days in the year. When determining the total number of days in the year, the system also considers the extra periods that the earning defined in the first Element Name field belongs to. Finally, the system calculates the estimation for the remaining par of the year by multiplying the daily calculated amount by the remaining number of days. When determining the remaining number of days, the system also considers the pending extra periods in the estimation period, but counts only the ones in which the earning is included. When the specified frequency type is daily, the system uses the value of the Entry Type element name as the daily amount and multiplies it by the remaining days of the estimation period (including extra period days). This bypasses the normal annualization and deannualization processes. |