Entering Absence Events

Use the Absence Event ESP (GPES_ABS_EVENT) component to enter and update absences, start the Absence Forecasting process, and record information for the FDI medical report text file.

Note: The Absence Event ESP component is identical to the Absence Event (GP_ABS_EVENT) component in the core Global Payroll application, except for the inclusion of the FDI Additional Data page, which enables you to incorporate information that is specific to temporary disability absences. Spanish users should use the Absence Event ESP component in place of the Absence Event (GP_ABS_EVENT) component to enter all absence event data.

This topic discusses absence event entry and FDI medical report data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_ABS_EVENT |

Enter, update, and void absences. Start the Absence Forecasting process. |

|

|

GP_ABS_EVENT_SEC |

Enter detailed information for an absence, including the reason, processing action, manager approval, user-defined data, entitlement adjustment, and partial hours. Also, use this page to override relapse days. |

|

|

GP_ABS_EVT_FCS_SEC |

Review the results of the Forecasting process for a specific absence event and any take elements that are mapped to it. |

|

|

GP_ABS_FCST_MSG |

Review the messages that are generated during the Forecasting process. |

|

|

Forecast Message Detail |

GP_ABS_FCS_MSG_SEC |

Review the text of a selected error or warning message. |

|

GPES_ABS_EVENT_ADD |

|

When entering absences events for employees using PeopleSoft Global Payroll for Spain, use the pages of the Absence Event ESP component (except the Additional Data page) to:

Enter, update, and void absence events.

Enter detailed information about an absence.

Review absence entitlement balance forecasting results.

Review forecasting messages.

Use the Additional Data page (GPES_ABS_EVENT_ADD) to enter sick note, confirmation note, or medical discharge note data prior to generating the FDI medical report text file for the social security agency.

Navigation:

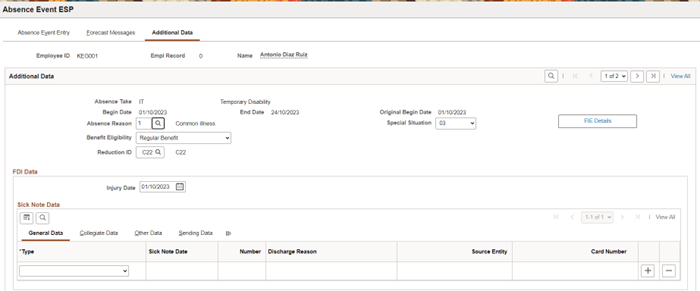

This example illustrates the fields and controls on the Additional Data page.

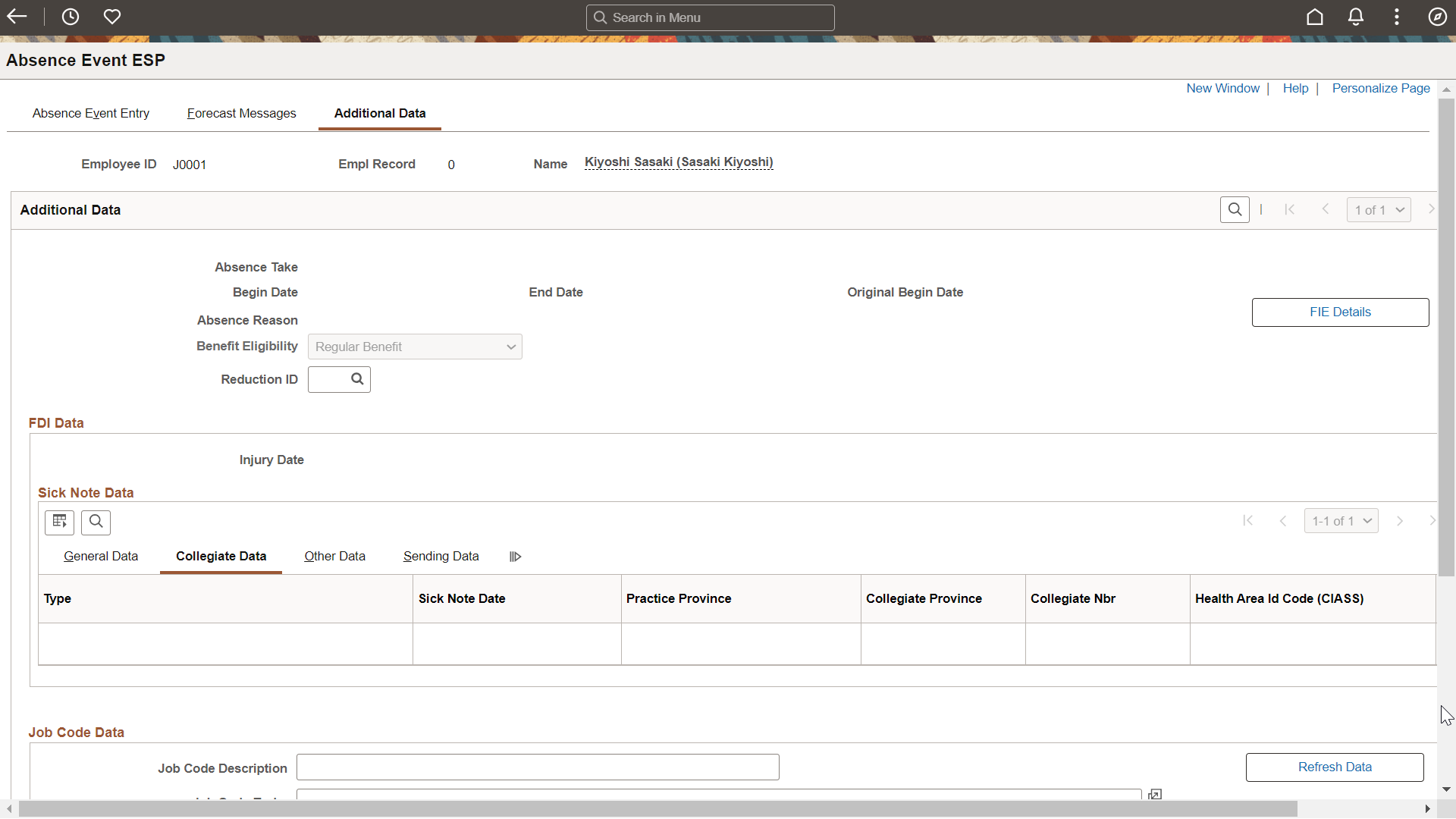

This example illustrates the fields and controls on the Additional Data - Collegiate Data tab. You can find definitions for the fields and controls later on this page.

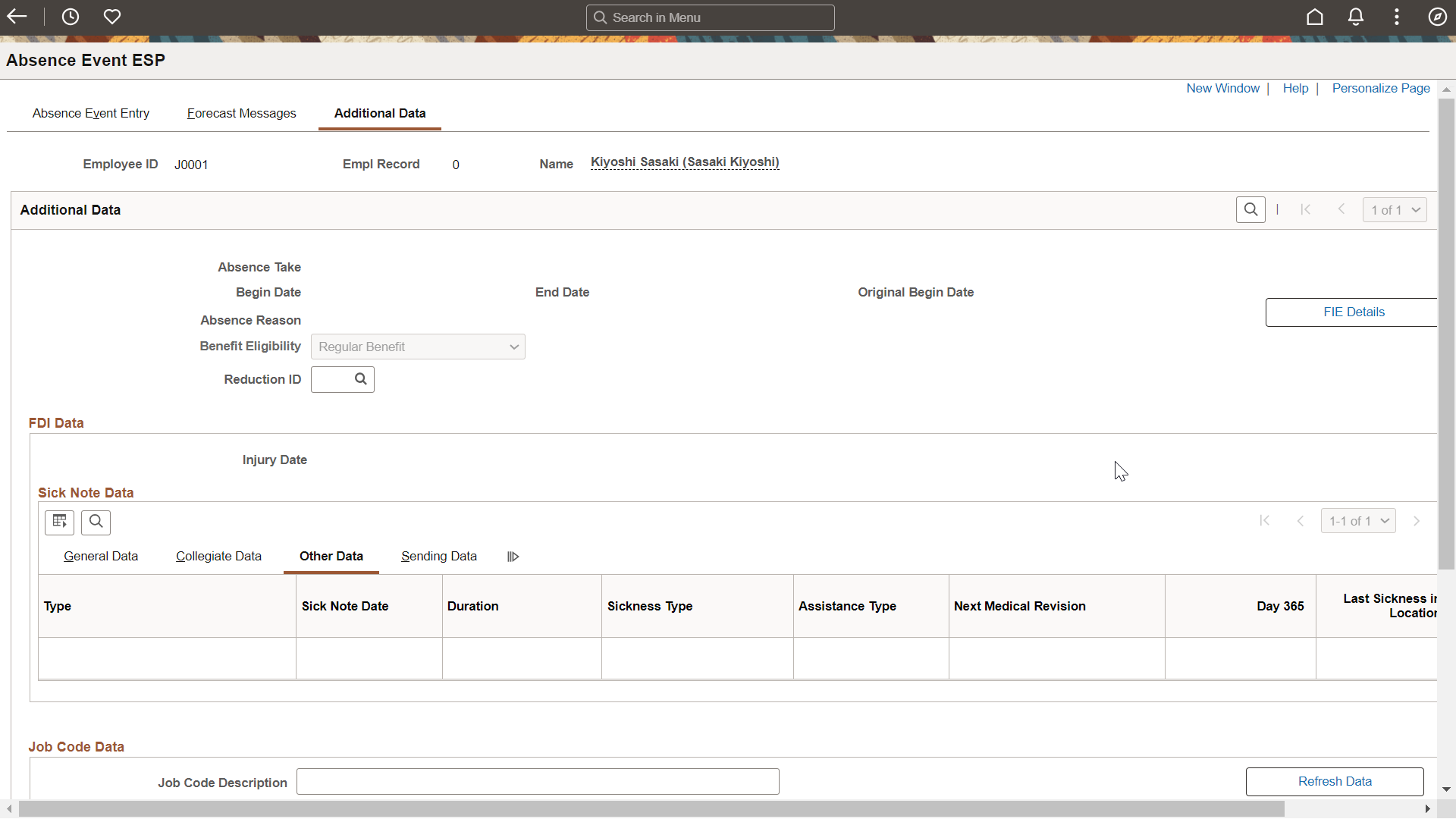

This example illustrates the fields and controls on the Additional Data page - Other Data tab. You can find definitions for the fields and controls later on this page.

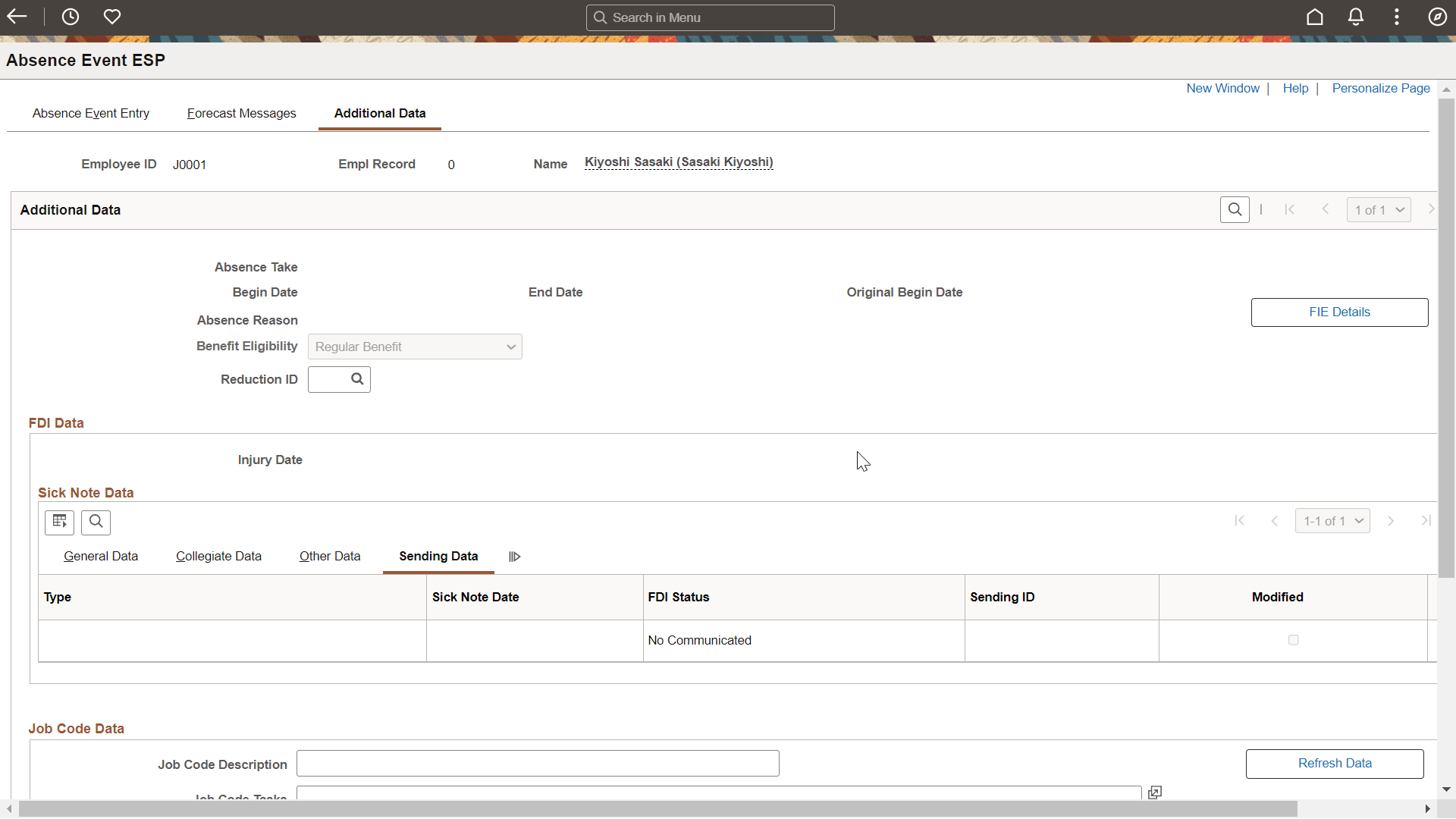

This example illustrates the fields and controls on the Additional Data page - Sending Data tab. You can find definitions for the fields and controls later on this page.

Additional Data

Field or Control |

Description |

|---|---|

Absence Take |

Displays the absence take entered on the Absence Event Entry page. The Additional Data page is mandatory for the following absences if you are reporting FDI using PeopleSoft Global Payroll for Spain:

Note: This page is also useful for recording cases of multiple maternity absence. This is represented by the absence take MATERNIDAD with an absence reason of MLT. |

Begin Date and End Date |

These fields display the begin and end dates of the absence entered on the Absence Event Entry page. |

Original Begin Date |

This field displays the original begin date of the absence entered on the Absence Event Entry page. Note: If you entered two rows with the same absence take on the Absence Event Entry page that are more than 6 months apart and you link them with the same Original Begin Date, you will receive a warning when you try to save the event. To ensure that the system uses the correct Base Reguladora Diaria (BRD), you should enter relapsed absences greater than 6 months apart as separate absence events. |

Absence Reason |

Select a reason for the absence. Note: Not all reasons are available for all absence takes. For example, NRM and MLT are available only for the MATERNIDAD absence take. Valid reasons are:

|

Number of children |

Enter the number of children associated with the multiple maternity absence. Note: This field appears when you select MLT in the Absence Reason field. |

Benefit Eligibility |

Specify if benefits should be calculated for the absence event. Select one of the following options:

|

|

Special Situation |

This field identifies if the temporary disability (IT) corresponds to any of the new special situations covered by the law Ley Orgánica 1/2023:

Note: This field is displayed just in case of absence type DIS. |

|

FIE Details |

Click the FIE Details button. This displays the Review Employee FIE Data page where view the absence information sent by INSS through the FIE file. |

|

Reduction ID |

This field is used to assign a reduction to the employee when they are absent. This will be utilised, for example, for employees over the age of 62 who are absent from work due to IT issues. According to Spanish legislation, the employer is entitled to a decrease in payments throughout the absence time. This field will be populated automatically based on the reductions definition. If there are various reduction alternatives available to the employee, the end user will be able to choose the most convenient one from the values presented in the prompt. |

FDI Data - General Data tab

Use the fields in this group box to select an injury date and enter information about the different note types that must be tracked in the FDI medical report text file.

When creating absences:

The absence events are created using Component Interface, which is similar to creating them manually. The only difference is that absences created automatically will have the field Entry Source=Third Party.

For all absences with type: DIS, the system also generates the sick note, which is required for the FDI economic data communication (DE).

Note: System identifies if the absence is managed by self-Insurance company or not, by using information contained in the FIE file. In particular, the field ‘Entidad Responsable’ of the segment DIT. When that field is informed with value 666 EMPRESA COLABORADORA, we won’t create any sick note as the expectation is that company will have the information to create the PA, PC, PB notes.

Field or Control |

Description |

|---|---|

Injury Date |

Enter the specific date on which the injury or accident occurred. Note: This field is relevant only for AT/EP absence takes. |

Type |

Select a note type. In case of temporary disability, the valid values are:

Other values are:

|

Sick Note Date |

|

Number |

Enter the order of a series of confirmation notes. For example, enter 1 for the first confirmation note, 2 for the second confirmation note, and so on. Note: Because confirmation notes are the only notes that can be received more than once over the course of a temporary disability, this field does not apply to other note types. |

Discharge Reason |

Select the reason for a medical discharge. Note: This field is available for data entry only when the note type is PA - Medical Discharge. |

Collegiate Data tab

Field or Control |

Description |

|---|---|

Type |

Displays the note type selected in the General Data tab. |

Sick Note Date |

Displays the sick note date as specified in the General Data tab. |

Practice Province |

Enter the two-digit code that represents the state portion of the ten-digit ID of the physician overseeing the treatment of the disabled employee. If you do not enter a value in this field, but enter a value in the Collegiate Province and Collegiate Nbr fields, you will receive a warning when you click Save. |

Collegiate Province |

Enter the two-digit code that represents the registered state portion of the ten-digit ID of the physician overseeing the treatment of the disabled employee. |

Collegiate Nbr |

Enter the six-digit code that represents the physician-specific portion of the ten-digit ID of the physician overseeing treatment of the disabled employee. Note: After entering Practice Province and Collegiate Province, if you do not enter any collegiate number in this field, system automatically assigns the value 999991. |

Health Area Id Code (CIASS) |

Enter the ten-digit area identifier code. If you enter a code in this field, you do not need to enter values in the Practice Province, Collegiate Province, or Collegiate Nbr fields. |

Sending Data tab

Field or Control |

Description |

|---|---|

Type |

Displays the note type selected in the General Data tab. |

Sick Note Date |

Displays the sick note date as specified in the General Data tab. |

FDI Status |

Displays the status of the FDI file. The valid values are:

Note: If the status is Included in FDI or FDI Sent Confirmed, the Sending ID field shows the identifier of the transmission and you can select the Modified check box to edit the information in the Sick Note. Once edited, the FDI status changes to No Communicated. |

Sending ID |

Displays the identifier of the communication. This needs to be a unique identifier. The system generates this ID when you run the Create FDI File process on the Create FDI File ESP page. Note: The sending ID enables you to track the transfer of data to the social security agency. |

Modified |

Select to indicate that you have modified information related to a note after the note has been confirmed and sent to the social security agency. When you select the Modified check box, the system deselects the Confirmed check box and you can reprocess and resend the medical note data on the Create FDI File ESP page. Note: You can also un-confirm the data contained in an FDI medical report text file by clicking the Unconfirm button on the FDI Confirmation ESP page of the FDI Confirmation ESP (GPES_FDI_SEND) component. |

Job Code Data

Use the fields in this group box to collect information about the Job Code and tasks performed by the employee. By using this information, the medical system is able to track the temporary disability more effectively.

|

Field or Control |

Description |

|---|---|

|

Job Code Description |

Enter the description of the Job code of the employee. System retrieves the Job title of the Job code assigned to the employee in Job data component by clicking the Refresh data button. System allows the user to enter it manually as well. |

|

Job Code Tasks |

Enter the description of the tasks performed by the employee. Click the Refresh Data button to default this value from the Job Code tasks setup. System retrieves the Description of the tasks assigned to the employee Job Code. System allows the user to enter it manually as well. |

|

Refresh Data |

Click this button to retrieve information about the Job Code Descriptions and Job Code tasks from the Job Code Setup. |

Economic Data / FDI Data

Use the fields in this group box to record information about the disabled employee's work status and social security contributions. The system populates these fields automatically when you click the Search button. The values are retrieved from the record GPES_CNTRB_RSLT, which contains data generated by the payroll process and stored using the writable array SS WA CNTRB.

If the values don't exist or if you want to report values that are different from the ones that are stored in the system, you can enter or update them manually.

Field or Control |

Description |

|---|---|

Days/Bases Override |

Specify how the system uses the data in the Economic Data / FDI Data group box. Values are:

|

Full/Part Time |

Indicates the full-time or part-time status of the employee. |

Contribution Days |

Shows the number of days that the employee made social security contributions in the month prior to the absence that should be used for the calculation of the daily regulatory base. Depending on the type of employee (Full or part time) and the type of absence, the system will use a different period. In case of full time employees system will retrieve contributing days while in case of part time employees system will retrieve natural days in the period. |

Common Contingency Base |

Shows the social security contribution base in the month prior to the absence that should be used for the calculation of the daily regulatory base. Depending on the type of employee (Full or part time) and the type of absence, the system will use a different period. |

Contribution Overtime |

Shows the social security average daily contribution base due to overtime in the 12 months prior to the begin date of the absence. |

|

Subsidy Daily Base |

Shows the daily regulatory base that will be used for the calculation of the subsidy. It is calculated by dividing the Contributing base by the Contributing days. In case of Subsidy calculated based on Professional Contingencies base, it also adds the average of the overtime in the last 365 days. |