Generating the Model 345 File Report

This topic provides an overview of the Model 345 file generation and discusses how to create the 345 Model file.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_RC_TAX_345 |

Run the Model 345 application engine process (GPES_TAX_345), generating the Model 345 file and the related summary file. |

|

|

Complementary 345 Selection |

GPES_PP_EMPL_ASS |

Select the employees whom the system will process. Use this page only if you select to process a complementary type of statement. |

The Model 345 file is a report that contains all of the pension plan contribution data pertaining to a selected fiscal territory and calendar year for all employees with collective pension plans when the company is the promoter of the pension plan. Companies must generate and submit this file once at the beginning of each year for the preceding year within the legally established timeframe.

PeopleSoft Global Payroll for Spain enables you to generate the file version of the Model 345 in the required format. You can use the Create 345 Model File ESP component (GPES_RC_TAX_345) to generate a file version of the Model 345 report to reflect the contributions made by the company to employees' pension plans. The file contains each employee who has a pension plan within a selected fiscal territory and calendar year.

The Model 345 application engine process (GPES_TAX_345) also generates a summary page file. The summary report is a text file that states the total companies, total employees, and total contributions that were processed. Companies use this information to manually complete the official model that is presented to the tax office together with the Model 345 file.

To retrieve data, the Model 345 application engine process:

Locates every pension plan with a plan type of collective and effective date year equal to the calendar year report parameter.

Locates all employees who are assigned to these pension plans for which the effective date year is equal to the calendar year report parameter.

Searches for the data required for the Model 345 file for each of these employees.

Checks whether to include disability data in the Model 345 file as specified for an employee in the Disability >= 65% field on the Payee Pension Plan ESP page.

Generates the Model 345 file and summary page file to the location that you specify in the report parameters.

The process performs these tasks for each company that you list in the Company field on the Reporting Type tab on the Create 345 Model File ESP page.

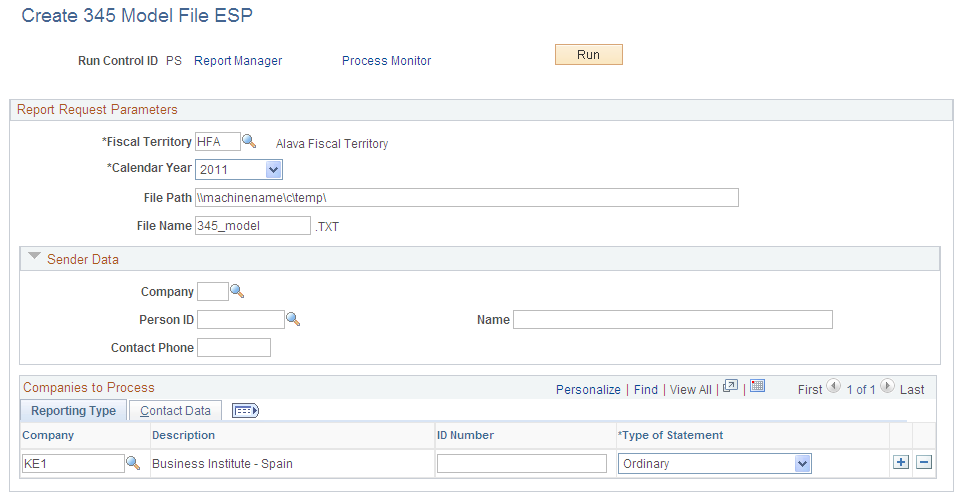

Use the Create 345 Model File ESP page (GPES_RC_TAX_345) to run the Model 345 application engine process (GPES_TAX_345), generating the Model 345 file and the related summary file.

Navigation:

This example illustrates the fields and controls on the Create 345 Model File ESP page. You can find definitions for the fields and controls later on this page.

Report Request Parameters

Field or Control |

Description |

|---|---|

Fiscal Territory |

Select the state fiscal territory for which you are generating the model file. The system prompts you to select from the available tax locations. Note: If you select the HE (State Fiscal Territory) value in this field, the Sender Data group box becomes unavailable. |

Calendar Year |

Select the calendar year for which you are generating the model file. |

File Path |

Enter the path where you want the process to store the model file. |

File Name |

Enter the file name that you want the process to use for the model file. The system stores the data in text (.txt) format. |

Sender Data

Companies can manage their own tax reporting or give that responsibility to another company. In cases in which one company is sending information for other companies, use this group box to enter contact data for the company that is sending the information. Then use the Contact Data tab in the Companies to Process group box to enter the contact information that is specific to each company. If you are sending data for your own company only, leave this group box blank and enter contact information only on the Contact Data tab.

Note: This group box is unavailable if you select the HE value in the Fiscal Territory field.

Field or Control |

Description |

|---|---|

Company |

Enter the name of the company that is sending the model file. |

Person ID |

Enter the ID of the person who is sending the model file. |

Name and Contact Phone |

Enter the name and contact phone number of the person who is sending the model file. |

Companies to Process - Reporting Type

Field or Control |

Description |

|---|---|

Company |

Select the companies for which you are sending the model file. The process creates a report for each company that you specify. |

Description |

Displays the name of the selected company. |

ID Number |

Enables you to manually enter the Número Identificativo de la Declaración for the report. |

Type of Statement |

Select the type of model statement that you want to generate. Values are: Ordinary: Select to process all employees for the selected calendar year. Complementary: Select to process specific employees who were not included in the processing of the ordinary statement. The system displays an Employees link to select the specific employees to process, and a Related ID Number field to enter the ID of the related model file previously generated through ordinary processing. Substitute: Select to generate a substitute model file to replace a previously generated file. Use this option when new information is available to send for employees of a previously generated file. The system displays a Related ID Number field to enter the ID of the related model file previously generated. |

Related ID Number |

The system displays this field when the statement type is either complement or substitute. Enter the ID of the previously generated model file that you want to complement with more employees or substitute with new data. |

Employees |

Click to access the Employees to Process page, where you can select the employees for the system to process. The system displays this link only if you select to process a complementary type of statement. When the system displays the Employees to Process page, use the EmplID field to select the employees whom you want to include in the model file. The system enables you to select only the employees who belong to the company being reported. |

Companies to Process - Contact Data

Use this tab to enter the contact information for each of the companies for which you are sending the model file.

Field or Control |

Description |

|---|---|

Employee ID |

Enter the ID of the person who is the contact for the model file at the company. |

Contact Name |

Enter the name of the person who is the contact for the model file at the company. |

Contact Phone |

Enter the contact phone number of the person who is the contact for the model file at the company. |