Managing Employee Pension Plan Assignments

This topic discusses how to maintain pension plans for employees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_PP_EMP |

Maintain pension plan assignments and contribution data for employees. Contribution data includes contributor, amount, and payment type (earning or deduction). |

|

|

Payment Page |

GPES_PP_PAYMENT |

Select each month for which you want the payroll process to realize contributions to the employee's pension plan for the specified contributor. |

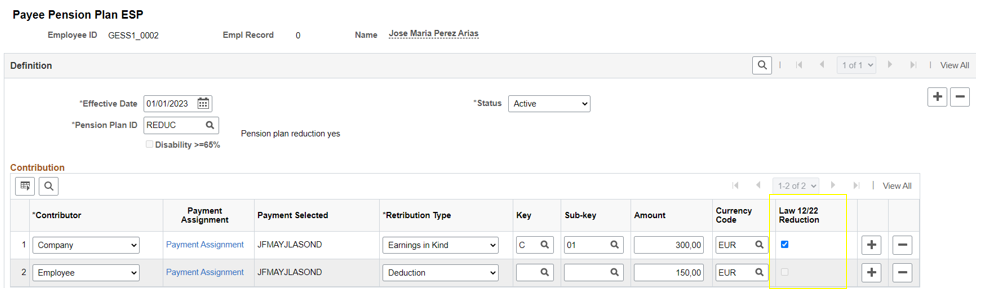

Use the Payee Pension Plan ESP page (GPES_PP_EMP) to maintain pension plan assignments and contribution data for employees.

Contribution data includes contributor, amount, and payment type (earning or deduction).

Navigation:

This example illustrates the fields and controls on the Payee Pension Plan ESP page. You can find definitions for the fields and controls later on this page.

Definition

Field or Control |

Description |

|---|---|

Effective Date |

Enter the date on which the employee assignment to the pension plan becomes valid. |

Status and Description |

Enter the status of the pension plan assignment. To end the assignment, you must make inactive the obsolete effective-dated row. |

Pension Plan ID |

Select the pension plan to which you are assigning the employee. Define pension plans on the Pension Plan page. When you select a pension plan, the system displays the description of the plan type as defined on the Pension Plan page. |

Disability >= 65% |

The system selects this check box automatically if the payee's handicap percent is greater than or equal to 65 percent, as defined for the payee in the Handicap Percent field on the Disability page. This is a special situation for pension plans that companies must report in the Model 345. |

Contribution

Use this group box to define the contribution details for the employee's pension plan.

Field or Control |

Description |

|---|---|

Contributor |

Select who is making contributions to the employee's pension plan—either the company or the employee. If both parties are making contributions, enter a distinct row for each contributor. |

Payment Assignment |

Click to access the Payment subpage. From this subpage, select the check box for each month that you want the payroll process to realize contributions to the employee's pension plan for the specified contributor. |

Payment Selected |

The system displays the months for which you have selected the contributor to make contributions using the Payment Assignment link. The system displays the first letter of the month for contributory payroll months and a dash for noncontributory payroll months. |

Retribution Type |

Select the payment type—whether the contribution amount is an earning or a deduction. The payroll element to which the payroll process writes the contribution value depends on the pension plan type, the contributor, and your selection here. The element can be an earning, earning in kind, or deduction. A separate topic explains the payroll elements. The Reviewing Delivered Earning and Deduction Elements topic explains the differences between the various payroll elements involved in pension plans. |

Key |

Enter the key value for the contribution. This value is necessary for the Model 345 file. You define keys on the Perception Keys ESP page. |

Subkey |

Enter the subkey value for the contribution. This value is necessary for the Model 345 file. You define subkeys on the Perception Keys ESP page. |

Amount |

Enter the monetary contribution amount that you want the payroll process to use for the employee's pension plan contribution during the affected months. |

Currency Code |

Enter the currency for the contribution amount. |

|

Law 12/22 Reduction |

This field is displayed only if the Law 12/22 Reduction checkbox is selected in the Pension Plan Definition page. If Contributor = Company, the field is defaulted to 'Y'. |