Managing Scholarship Holders

This topic discusses scholarship holder management.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

JOB_DATA_JOBCODE |

Enter information about a person's job, including status, employee class, shift, or standard hours. |

|

|

CONTRACT1 |

Add or update basic information about the contract between your organization and a worker, including the contract duration, type, content, and contribution ID. You must have previously set up contract template IDs on the Contract Template Table page. |

|

|

JOB_DATA3 |

Update a person's compensation information. |

|

|

GP_ED_PYE |

By payee, assign specific earning and deduction elements. |

A scholarship holder is a person who works for a company to acquire experience and professional training under a special labor relation with the company. Scholarship holders can work for a company with a research fellowship, without a research fellowship, or through a separate entity such as an educational center or foundation.

Scholarship holders with fellowships have a unique contractual relation with the company and require special treatment with respect to IRPF taxes and social security contributions. The amounts companies pay to fellowship scholarship holders are not considered salary and are free of IRPF taxation. However, companies must declare this information in IRPF tax reports. PeopleSoft Global Payroll for Spain enables you to declare this mandatory information in the Model 110, Model 111, Model 190, and Tax Deduction reports. Regarding social security contributions, PeopleSoft Global Payroll for Spain provides the necessary contribution ID as part of the social security scheme to account for fellowship scholarship holders. The scheme ID is 0111 and the social security contribution ID is 008. The contribution is maintained on the Contribution page of the Social Security Scheme Table component. You need to identify this employee as an Intern in the Empl Class field on the Job Information page.

Note: You can sometimes apply certain social security reductions for this collective (CD24, Bonificación i+d+I) for fellowship scholarship holders.

To manage scholarship holders without fellowships, you can set up these persons as normal employees with a special contract type 000, as these employees don’t need to sign a contract. Scholarship holders without fellowships can receive some compensation paid by the company or not.

Starting January 2024 (Disposición Adicional quincuagésima Segunda de la Ley General de la Seguridad Social), even in the case of scholarship holders not being paid, companies may need to calculate and pay Social Security contributions.

Peoplesoft delivers two contribution IDs to be used for these type of scholarship holders:

010: to be used for scholarship holders receiving compensation. Additionally, these sholarships should have informed the field Contribution Exclusion (Under Affiliation data in the component Update Contracts ESP) with value 986 (Training Program)

993: to be used for scholarship holders not receiving any compensation. Social Security contributions will be calculated based on the number of practices days in the month.

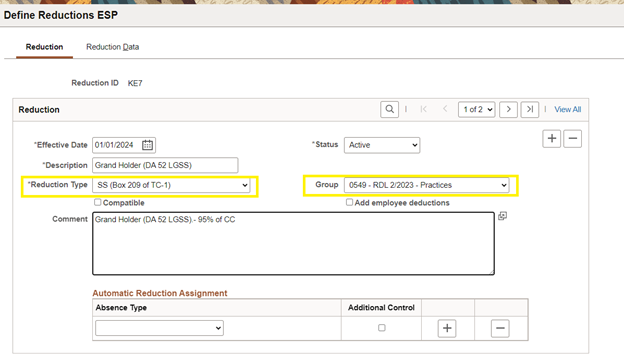

Companies can benefit from a Social Security reduction of 95% of Common contingencies contributions. Companies should create the specific reduction id, by selecting:

Reduction type: SS (Box 209 of TC-1)

Group: 0549- RDL 2/2023 -Practices

This example illustrates the fields and controls on the Define Reductions ESP page.

In the last case, to manage scholarship holders from a separate entity, you can handle these persons the same way that you would handle persons that another company provides as professionals.

To manage fellowship scholarship holders:

Set the Empl Class (employee class) field value to Intern on the Job Information page.

Set the Special Labor Relationship field value to Fellow Scholarship Holder on the Job Information page.

Enter values for the rate code BECAIN (scholarship holder) on the Compensation page.

Set the Scheme ID field value to 0111 on the Contract Payroll Data page.

Set the Social Security Contribution field value to 008 (fellowship scholarship holder) on the Contract Payroll Data page.

To override compensation entered through the rate code BECAIN in step 4 or to enter additional compensation for scholarship holders, assign the earning BECA INVESTGCN on the Element Assignment By Payee page.

To enter expenses for the scholarship holder, assign the earning GASTOS BECA on the Element Assignment By Payee page.

Process payroll.

Generate the affected reports monthly, quarterly, or yearly as required.

To manage scholarship holders without fellowship:

Set the Empl Class (employee class) field value to Intern on the Job Information page.

Set the Special Labor Relationship field value to Fellow Scholarship Holder on the Job Information page.

Enter values for the rate code BECAIN (scholarship holder) on the Compensation page if applicable to the employee

Set the Scheme ID field value to 0111 on the Contract Payroll Data page.

Set the Social Security Contribution field value to 010 or 993 on the Payroll Data page.

Enter the right value in field Contribution Exclusion (Under Affiliation data in the component Update Contracts ESP).

Assign Social Security reduction in the page Payroll data in the component Update contracts ESP.

To override compensation entered through the rate code BECAIN in step 4 or to enter additional compensation for scholarship holders, assign the earning BECA INVESTGCN on the Element Assignment By Payee page (if applicable).

To enter expenses for the scholarship holder, assign the earning GASTOS BECA on the Element Assignment By Payee page (if applicable)

Process payroll.

Generate the affected reports monthly, quarterly, or yearly as required.

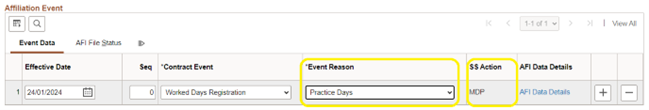

Effective January 2024, employers are required to report on a monthly basis the number of internship days completed by scholarship holders (without fellowship), who do not receive any compensation. To do so, the system provides two Social Security Actions - Action MDP: Practice Days Communication and Action EDP: Erase Practice Days.

Action MDP: Practice Days Communication

This action is available under Work Days Registration Contract Event.

This example illustrates the Affiliation Event page.

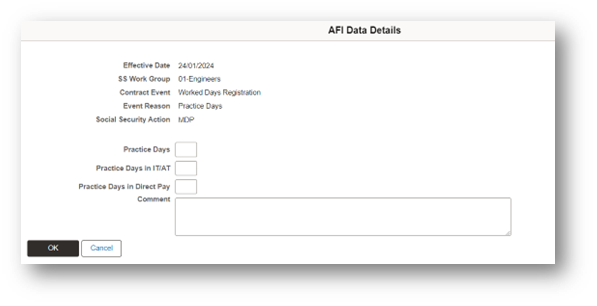

Click AFI Data Details. This displays the AFI Data Details modal.

AFI Data Details modal

|

Field |

Description |

|---|---|

|

Practice Days |

Enter the number of practice days in the month. Position in DJD Segment: 57 |

|

Practice Days in IT/AT |

Enter the number of theoretical practice days during a period in temporary disability within the month. Position in DJD Segment: 59 |

|

Practice Days in Direct Pay |

Enter the number of theoretical practice days during an absence period of direct payment within the month. Position in DJD Segment: 61 |

The system verifies that the sum of the days entered in these three fields does not exceed the number of days in the month.

If all of these values are zero, the system will print a value of N in position 63 of the DJD segment.

The system generates this type of communication when the user selects the option Worked Days Report on the Create AFI File Run Control page.

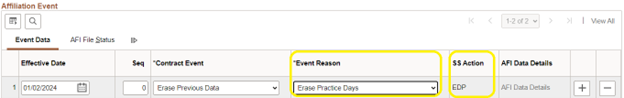

Action EDP: Erase Practice Days

This action is available under Erase Previous Data Contract Event. This event reason will not require any additional data. System generates the event with the month or year corresponding to the effective date of the event.

This example illustrates the Affiliation Event page.

This table describes the earning elements that are delivered as part of the scholarship holder functionality:

|

Earning Element |

Description |

|---|---|

|

BECA INVESTGCN |

Income of scholarship holder with research fellowship. You can include this earning through the Job Compensation page by using the rate code BECAIN. This earning is free of taxation and is not considered salary. The earning amounts, although not taxable, are included in IRPF tax reports Model 110, Model 111, and Model 190 under the corresponding perception key and subkey. |

|

GASTOS BECA |

Other earnings of fellowship scholarship holder such as travel expenses, maintenance, and so on. The earnings amounts, although not taxable, are included in IRPF tax reports Model 110, Model 111, and Model 190 under the corresponding perception key and subkey. |

These elements are automatically segmented and prorated when one is assigned to a payee on the Element Assignment by Payee or Payee Assignment by Element page. The assignment period must cover only a portion of the pay period and you must have defined the corresponding segmentation trigger.