Recording Stock Option Income

This topic discusses how to record stock option income for payees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_EMP_STOCKS |

Record stock option income for payees. |

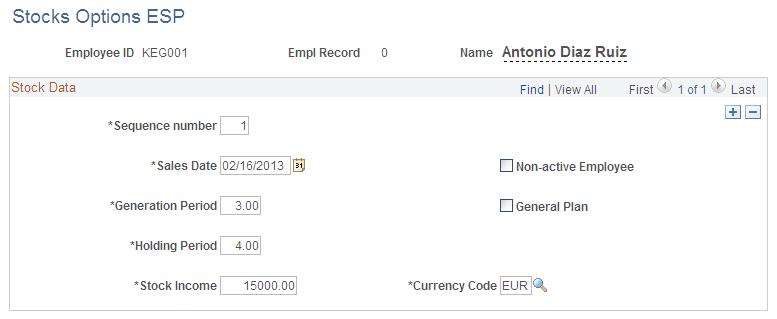

Use the Stocks Options ESP page (GPES_EMP_STOCKS) to record stock option income for payees.

Navigation:

This example illustrates the fields and controls on the Stocks Options ESP page. You can find definitions for the fields and controls later on this page.

Use this page to enter information regarding the sale of stock options. By entering stock sale information, you assign the ACCIONES_CIA earning to the payee. This earning drives the calculation of taxes and Social Security contributions resulting from the stock sale.

See Delivered Nonbasic Earnings.

Field or Control |

Description |

|---|---|

Sequence number |

Enter a sequence number for the stock sale. |

Sales Date |

Enter the date on which the payee sold the stock. The system uses this date as a reference point when calculating the payroll impact of the stock sale. |

Non-active Employee |

Select to indicate that the payee is not currently employed by the company who issued the stock options. |

Generation Period |

Enter the number of years over which the payee accrued the stock options that were sold. |

General Plan |

Select to indicate that the payee acquired the stock options through a general plan. |

Holding Period |

Enter the number of years for which the payee held the stock options that were sold. |

Stock Income |

Enter the income generated from the sale of the stock. |

Currency Code |

Enter the currency of the stock income. |