Reviewing and Updating System Information

To review tax ceilings, tax personal reductions, and tax family reductions, use the Calculation Variables ESP (GPES_TAX_VARIABLS) component. To review withholding segments, use the Withholding Segments ESP (GPES_TAX_BRKT_WHLD) component. To review ceiling brackets, use the Ceiling Bracket ESP (GPES_TAX_BRKT_CLNG) component. To review disability reductions, use the Disability Reduction ESP (GPES_TAX_BRKT_DSBL) component. To review fiscal territories and calculation data for the fiscal territory, use the Fiscal Territories ESP (GPES_TAX_LOCATN) component. To review the normalization schedule, use the Normalization Schedule ESP (GPES_TAX_CALENDAR) component. To set up garnishment elements, use the Garnishment Elements ESP (GPES_TAX_ELEMENTS) component. To review variable managers, use the View Variable Manager ESP (GPES_RATES) component.

This topic discusses how to review system information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_BRACKET_DATA |

Review ceiling brackets that define the minimum income required to pay tax, depending on the number of dependents. These values are for the state territory only. |

|

|

GP_BRACKET_DATA |

Review disability reduction rates that define disabled employees' reductions on tax. These values are for the historical territories only. |

|

|

GPES_TAX_LOCATN1 |

Set up a tax office location and link the tax location to a pay entity and a tax calendar. |

|

|

GPES_TAX_LOCATN2 |

Define data and check tax brackets used in tax calculations for the fiscal territory. |

|

|

GPES_TAX_CALENDAR |

Establish a schedule for the normalization process in a payroll calculation. |

|

|

GPES_TAX_ELEMENTS |

Set up the elements that store garnishment values that could be paid by employees. This data is considered during the tax calculation. |

Before the system calculates IRPF, ensure that the tax bracket and fiscal territories information is current. Also update the Normalization Schedule ESP page to calculate withholding while you run payroll. You can also run the IRPF percentage calculation separately by creating a specific calendar and calendar group for the IRPF percentage calculation.

PeopleSoft Global Payroll for Spain provides the following information in accordance with government regulations:

Fiscal territories and data for tax calculations.

Minimum annual contribution amounts.

Total contribution per taxable base.

Reduction amounts based on personal data (age and disability status), family data (number of dependents, disability status, and degree of dependency), and work situation (contract type and tax location).

PeopleSoft Global Payroll for Spain enables you to calculate tax percentage independently or while running the payroll process. Use the Normalization Schedule ESP page and the Fiscal Territories page to coordinate the tax calculation and payroll process.

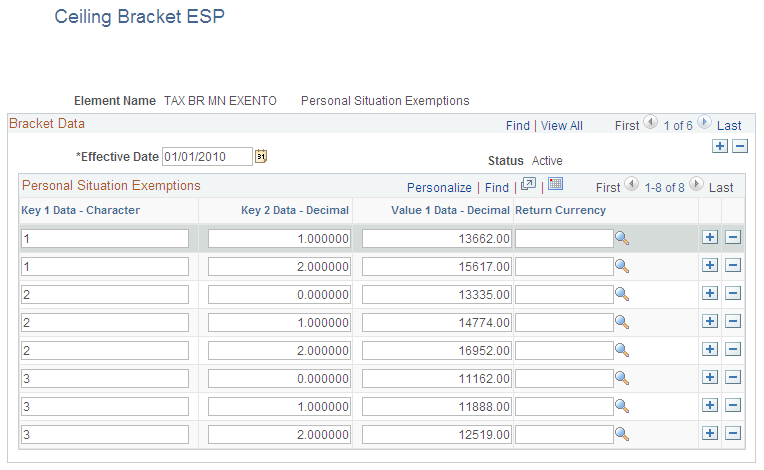

Use the Ceiling Bracket ESP page (GP_BRACKET_DATA) to review ceiling brackets that define the minimum income required to pay tax, depending on the number of dependents.

These values are for the state territory only.

Navigation:

This example illustrates the fields and controls on the Ceiling Bracket ESP page. You can find definitions for the fields and controls later on this page.

This page defines the ceiling brackets for the state territory only. This page does not apply to the historical territories.

Personal Situation Exemptions

Field or Control |

Description |

|---|---|

Key 1 Data - Character |

Indicates the family situation for the employee. Values are 1 - General Situation, 2 - Less than 1 year relationship, and 3 - Special Relationship. |

Key 2 Data - Decimal |

The number of dependent children. An employee's children are considered dependents if they are under the maximum age that is defined on the Fiscal Territory - Calculation Data page. |

Value 1 Data - Decimal and Return Currency |

The amount and currency for personal situation exemptions. |

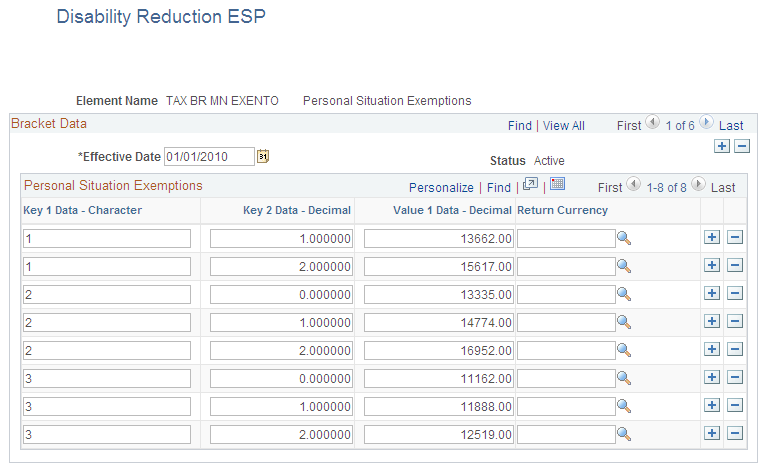

Use the Disability Reduction ESP page (GP_BRACKET_DATA) to review disability reduction rates that define disabled employees' reductions on tax.

These values are for the historical territories only.

Navigation:

This example illustrates the fields and controls on the Disability Reduction ESP page. You can find definitions for the fields and controls later on this page.

This page defines the reductions for disabled employees. This page does not apply to the state territory or the Navarra historical territory.

Field or Control |

Description |

|---|---|

Key 1 Data - Character |

Indicates the type of disability for the employee. Identifies the type of disability affecting the employee. Possible values are:

|

Key 2 Data - Decimal |

The total-taxable annual amount that is used to calculate the tax percentage. |

Value 1 Data - Decimal |

The percentage that can be subtracted from the calculated tax percentage. For example, someone affected by disability has a smaller tax percentage and pays less. |

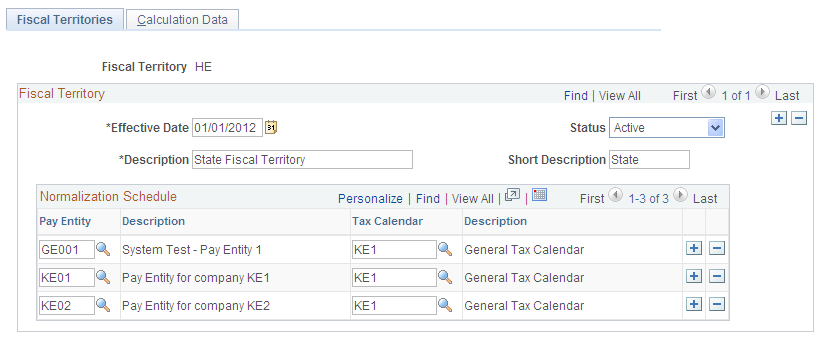

Use the Fiscal Territories page (GPES_TAX_LOCATN1 ) to set up a tax office location and link the tax location to a pay entity and a tax calendar.

Navigation:

This example illustrates the fields and controls on the Fiscal Territories page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the effective date to track the history of the tax location. |

Pay Entity |

Select the pay entities associated with the fiscal territory to which you are applying the normalization schedule. |

Tax Calendar |

Select the normalization schedule for the selected pay entity. This tells the system when to run the withholding percentage calculation for each fiscal territory during the payroll process. |

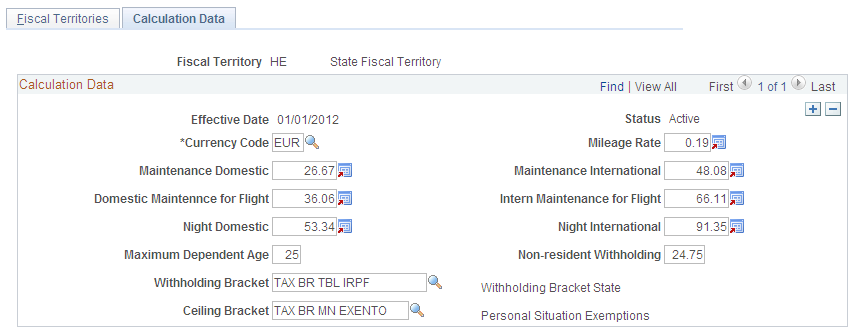

Use the Calculation Data page (GPES_TAX_LOCATN2 ) to define data and check tax brackets used in tax calculations for the fiscal territory. You can also use the page to define the withholding percentage for nonresidents for each fiscal territory.

Navigation:

This example illustrates the fields and controls on the Calculation Data page. You can find definitions for the fields and controls later on this page.

This page defines which brackets are used to calculate tax withholding percentages and various rates set by the fiscal territory. PeopleSoft Global Payroll for Spain delivers the data for each fiscal territory as system data. Oracle maintains and updates the values as the tax regulations change, but you can also update them manually.

Field or Control |

Description |

|---|---|

Mileage Rate |

Indicates the exempted amount per mile reimbursement for mileage. |

Maintenance Domestic |

The exempted daily amount reimbursement for domestic traveling maintenance. |

Maintenance International |

The exempted daily amount reimbursement for international traveling maintenance. |

Domestic Maintenance for Fligh (domestic maintenance for flight assistants) |

The daily amount that flight assistants can receive for domestic travel that is exempt from tax and social security contributions. Amounts that exceed this limit are subject to tax and social security contributions. |

Intern. Maintenance for Flight (international maintenance for flight assistants) |

The daily amount that flight assistants can receive for international travel that is exempt from tax and social security contributions. Amounts that exceed this limit are subject to tax and social security contributions. |

Night Domestic |

The exempted daily amount reimbursement for domestic overnight stays. |

Night International |

The exempted daily amount reimbursement for international overnight stays. |

Maximum Dependent Age |

The maximum age of fiscal dependents. |

Non-resident Withholding |

Enter the withholding percentage for nonresidents. If the payroll process identifies an employee as a nonresident, it applies this percentage to the employee's withholding instead of the withholding percentage that corresponds to IRPF taxes. |

Withholding Bracket |

The bracket used to calculate employees' withholding tax percentage. |

Ceiling Bracket |

The ceiling bracket that defines the minimum income required to pay tax, depending on the number of dependents. This field is displayed for the state territory only. PeopleSoft Global Payroll for Spain delivers the bracket TAX BR MN EXENTO with these values. Note: The Ceiling Bracket field appears only if you selected State Fiscal Territory (HE). |

Disability Bracket |

The bracket used to calculate the reduction in tax that applies for a disabled employee. This field is not displayed for the state fiscal territory. Note: The Disability Bracket field does not appear if you selected State Fiscal Territory (HE). It appears for all other fiscal territories. |

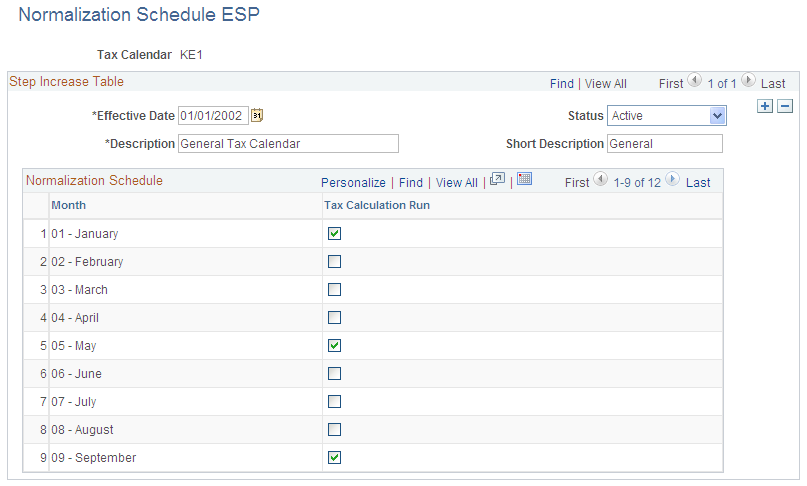

Use the Normalization Schedule ESP page (GPES_TAX_CALENDAR) to establish a schedule for the normalization process in a payroll calculation.

Navigation:

This example illustrates the fields and controls on the Normalization Schedule ESP page. You can find definitions for the fields and controls later on this page.

Normalization Schedule

Field or Control |

Description |

|---|---|

Tax Calculation Run |

Select the month that you want the tax percentage to be calculated during the payroll calculation. |

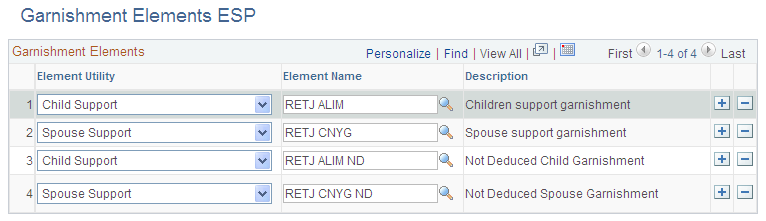

Use the Garnishment Elements ESP page (GPES_TAX_ELEMENTS) to set up the elements that store garnishment values that could be paid by employees.

This data is considered during the tax calculation.

Navigation:

This example illustrates the fields and controls on the Garnishment Elements ESP page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Element Utility |

Define the type of garnishment element. Values are Child Support and Spouse Support. |

Element Name |

Select the element that stores the garnishment value for an employee. |