Calculating Leave Without Pay and Daily Rate Deduction

Employees might take leave without pay during their working periods. One calendar daily rate is taken from salary for one day of unpaid leave. Unpaid leave is a taxable deduction.

LWOP can be taken anytime during the servicing period. One DAILY RT is reduced from the employee's monthly income for every single day of LWOP taken. The value of one DAILY RT equals:

(Annual Salary) / 365

365 is used even in the leap year.

Example

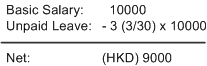

Three days of unpaid leave has been taken in April and the basic salary in April is 10000 HKD. The April monthly salary is calculated as:

A salary change can occur during unpaid leave. In this case, the unpaid leave is split into two segments: segment one is based on the old daily rate and segment two is based on the new daily rate.