Generating Inland Revenue Report Data

This section provides an overview of the Inland Revenue Report data creation process and discusses how to generate the IR56 report data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPHK_IR56_CREATE |

Run the process that captures information required for generating IR56 data and reports. After the process is initiated, the system identifies eligible employees and retrieves the information required for reporting. |

The Inland Revenue Report data creation process generates data for all Inland Revenue reports. The Inland Revenue Department has defined the report layout and the conditions that must be met while generating the IR56 reports. These conditions affect the way in which you generate and store the data in PeopleSoft tables.

The GPHK_IR56_TBL table stores the results of the data generated by the data creation process. This data is used for viewing and generating the IR56B electronic file and hard copy reports.

Note: The IR56 creation program maintains the creation date. During the printing of IR56 documents, if the system identifies a document as a replacement, the system retrieves the date when it created the earlier version and uses that as the submission date.

The PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Hong Kong. Instructions for running the query are provided in PeopleSoft HCM: Global Payroll.

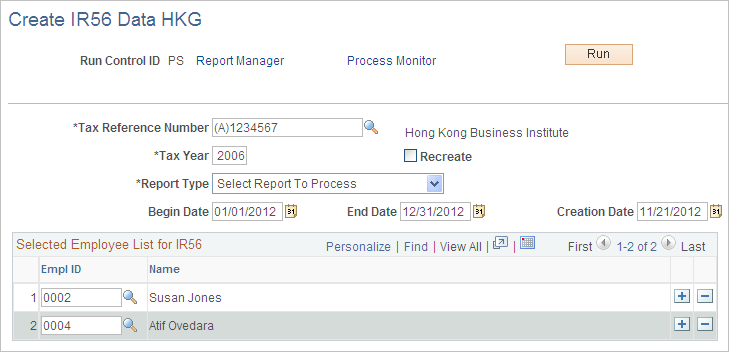

Use the Create IR56 Data HKG page (GPHK_IR56_CREATE) to run the process that captures information required for generating IR56 data and reports. After the process is initiated, the system identifies eligible employees and retrieves the information required for reporting.

Navigation:

This example illustrates the fields and controls on the Create IR56 Data HKG page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Reference Number |

Select the tax reference number representing the pay entity (or entities) for which the IR56 must be generated. IR56 reports all run by tax reference number, which has a major impact on the way the system creates and stores IR56 data. For every employee attached to the pay entity (sharing the tax reference number), the system combines amounts for each year to date element by currency code and stores them in the IR56 result tables. After the process is completed, you can use the IR56 Monetary Details page to enter adjustments to reflect the amount that should be reported on the IR56 documents. |

Tax Year |

Enter the period for which the report must be reported. Hong Kong has set the tax period to be April 1 to March 31. Enter the year with 4 digits (for example, 2006). Note: Although the tax year is not required for the IR56G and IR56F reports, you must still enter it. |

Recreate |

When you run the IR56 generation process for the first time, the value of this field does not matter. Data is generated for the selected employees or all eligible employees of the pay entity. When you initiate the process again with the same parameters, the Recreate check box determines the following: If you select the check box:

If you deselect the check box, records are generated for the select group only if they don't already have a record existing. The record created is identified as an original record. Note: The select group is the employee list entered on the run control page or the employees that are selected based on the criteria entered on the run control page for a specific pay entity. |

Begin Date and End Date |

These fields are required for the IR56F, IR56G, and IR56E reports. They enable you to narrow down the criteria of employee for whom the report should be generated. The begin and end dates are the tax period for which the employee received a particular amount. For an IR56F, employees whose termination dates occur during the specified date range are selected. For an IR56G, employees whose departure dates from Hong Kong occur during the specified date range are selected. For an IR56E, employees whose hire dates occur during the specified date range are selected. Unlike the IR56B and IR56M reports, in which balances for employees must be retrieved as of the end of the year, balances in this case are retrieved as of the period end date. The process identifies the last finalized pay calendar that is closest to the period end date and retrieves the balances for reporting. |

Selected Employee List for IR56

Field or Control |

Description |

|---|---|

EmplID (employee identification) |

You can initiate the data creation process for a specific set of employees by selecting one or more employees. Although you can select an employee ID, the process still decides if an employee is eligible to receive the selected IR56 document. For example, if you are running the process to create IR56B and you select an employee who has been terminated, the process ignores this employee. |

Working with Report Types

|

Report Type |

Processing |

|---|---|

|

Annual Return For Employees IR56B |

Employees who are active at the end of the tax year are selected for processing. Active employees are identified by their employee status. Values are: A: Active. P: Leave with pay. Q: Retired with pay. U: Terminated with pay. The value is matched with the current row in the JOB record for the employee. Because an employee can have multiple jobs, the status is checked against all of the job records for the employee being processed. An employee is considered active when at least one job record matches the previously mentioned employee status. |

|

Annual Return For Non-Employee IR56M |

Non-employees who are active at the end of the tax year are selected for processing. The same processing as IR56B occurs. |

|

Notify Employee Departing HKG IR56G |

Employees whose dates of departure from Hong Kong are during the period that you specify are selected for processing. |

|

Notifying New Employee IR56E |

Employees whose hire dates are during the period that you specify are selected for processing. |

|

Notifying Terminating Employee IR56F |

Employees who have been terminated during the period are selected for processing. Employees are considered terminated when all the concurrent jobs associated with their EmplIDs have been terminated. The Employee Status field in the JOB record identifies whether an employee is active or inactive. Valid employee status values to identify terminated employees are: A: Active. P: Leave with pay. Q: Retired with pay. U: Terminated with pay. An employee is considered inactive when all the job records match the previously mentioned employee status. The process ensures that the employee has not been issued an IR56B or IR56G for the same period of employment. |

Note: The employee status is only one of the parameters used to determine whether the employee is eligible to receive an IR56 report. The second parameter is the YTD balance that is maintained by payroll.