Setting Up Additional Mandatory Provident Fund Report Details

To set up additional Mandatory Provident Fund (MPF) report details, use the Deduction Recipients HKG (GPHK_RCP_CMN) component.

This section discusses how to set up additional mandatory provident fund report details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPHK_RECIPIENT_EXT |

Enter additional recipient information including that required for the MPF Remittance Statement. Additional information must be captured for each MPF scheme. Define the commission calculation method for one or more pay entities and associate each recipient with a file layout name. |

|

|

GPHK_MEMBERSHIP_NO |

Link employees to recipients using the employee's membership number. |

Use the Deduction Recipients HKG page (GPHK_RECIPIENT_EXT) to enter additional recipient information including that required for the MPF Remittance Statement.

Additional information must be captured for each MPF scheme. Define the commission calculation method for one or more pay entities and associate each recipient with a file layout name.

Navigation:

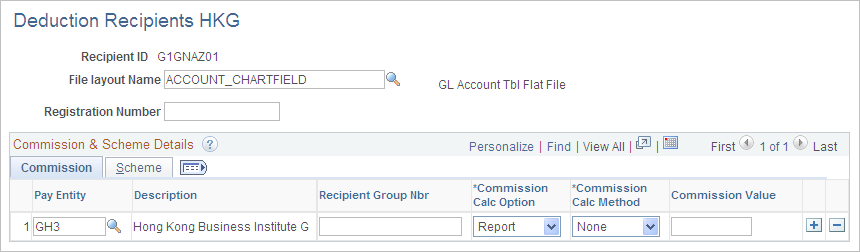

This example illustrates the fields and controls on the Deduction Recipients HKG page. You can find definitions for the fields and controls later on this page.

Note: Multiple views of this page are available on the tabs in the scroll area. We document fields common to all views first.

Common Page Elements

Field or Control |

Description |

|---|---|

File Layout Name |

Select the appropriate file layout from those you have created in Application Designer for the electronic files you submit to your recipients. |

Registration Number |

This is the MPF reference number and it appears on the MPF Remittance Statement. |

Pay Entity |

Enter the pay entity that is going to receive any commission payable by the recipient. If the commission is to be deducted from the payment due to the recipient, the debit to this pay entity's source bank will be reduced by the commission amount. |

Commission & Scheme Details

You can define the commission calculation method for one or more pay entities and associate each recipient with a file layout name.

Commission Tab

Field or Control |

Description |

|---|---|

Recipient Group Nbr (recipient group number) |

When a transaction takes place between the employer and the recipient, it is common to have a unique identification number representing the organization. Enter the unique identifier which the recipient has supplied to your pay entity. For payment to recipients, the group number is part of the unique lodgment reference that is part of each recipient EFT file. Associate a group number with the pay entity who will remit amounts to the recipient. This unique ID must be captured and maintained for the reports and electronic file supplied to the recipient. |

Commission Calc Option (commission calculation option) |

Commission is calculated either for reporting or for deducting the calculated amount (from the total amount transferred). Select the method used to calculate fee processing: Deduct (deduct commission): The system deducts the commission amount from the payment due to the recipient. Select a Commission Calc Method, either flat amount or percentage. Report (report only): The system reports the commission amount in the EFT file but doesn't deduct it from the payment. Once a recipient has been identified for processing and the total amount to be paid is known, the system calculates commission (if you have specified it) and deducts the amount or fee from the total amount. This step is carried out only if the setup at the recipient level (for the pay entity) has been set to "calculate and deduct commission." |

Commission Calc Method (commission calculation method) |

Enter the commission as a percent rate (Percentage) or flat amount (Flat Amt). If commission is to be deducted, the appropriate value is calculated and the newly calculated amount is written to the file layout object:

|

Commission Value |

The flat amount or percentage of the commission to be calculated. If you select Flat Amt or Percent as the Commission Calc Method, you must enter a value in the Commission Value field. Note: You should enter the value as a decimal (2 percent as 0.02). |

Scheme Tab

The fields in this page are for MPF reporting.

Field or Control |

Description |

|---|---|

Participation Number, Contact ID, and Contact Phone |

Just as recipients identify each employer with a group number, they also identify their employees, as a group, with a unique number that is also known as the participation number. |

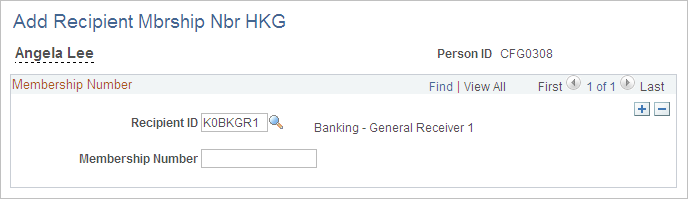

Use the Add Recipient Mbrship Nbr HKG page (GPHK_MEMBERSHIP_NO) to link employees to recipients using the employee's membership number.

Navigation:

This example illustrates the fields and controls on the Add Recipient Mbrship Nbr HKG page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Recipient ID |

When a transaction takes place between the employer and the recipient, it is common to have a unique identification number representing the organization. Enter the unique identifier that the recipient has supplied to your pay entity. |

Membership Number |

For reporting, employers must enter their MPF membership details for each of their employees. Just as recipients identify each employer with a group number, they also identify their employees (associated with the employer) with a unique number that is also known as the participation number. The membership number is used on the reports and electronic file supplied to the recipient. |