Submitting the Remittance Statement

This section provides an overview of MPF remittance statements and discusses how to submit remittance statements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPHK_MPF1_RC |

Generate reports on employers’ and employees’ (mandatory and voluntary) MPF contributions for companies during the specified contribution period. |

The GPHKMPF1 Remittance Statement enables you to report on mandatory and voluntary MPF contributions that were deducted for the contribution period for the MPF provider. The statement is used to inform the trustee of the amount of MPF contributions paid for relevant employees.

If an employee changes pay groups in the pay period, the employee is reported only once under the most recent pay group. Active employees, excluding those who haven't been enrolled yet (under 18 or less than 60 days employment), are included in the statement even if they have no relevant earnings for the month. Employees with no relevant MPF earnings are included in the existing employees section of the report.

MPF contribution amounts are printed for each type of MPF deduction. Contributions for employees with different contribution periods (such as weekly and monthly) are reported in separate remittance statements.

As it is possible to have multiple pay groups with the same remittance period, you can enter multiple pay groups on the run control.

To provide for reporting terminated employees' MPF contributions, change the calendar payment date to the appropriate date, then run payroll for terminated employees through a group list. Having done this, you can generate the remittance statement for terminated employees because the report is generated by payment date and group list.

However, if you must run it for continuing employees, set the appropriate calendar payment date before running the payroll so that you can generate the report with the regular payment date and regular group list, excluding the terminated group list.

Note: While service providers might specify their own remittance statements, the MPF Authority specifies the content and format of the remittance statement with which the service provider must comply. The remittance statement has, therefore, been defined in accordance with the content and format of the statement specified by the MPF Authority.

The statement is sorted by recipient name (MPF provider), because while in most organizations there is only one provider, it is possible for an organization to use multiple MPF providers.

Legislation requires the employer to make MPF contributions within 10 days of the employee's termination date during regular periods. Therefore, you must generate the Remittance Statement within 10 days of termination.

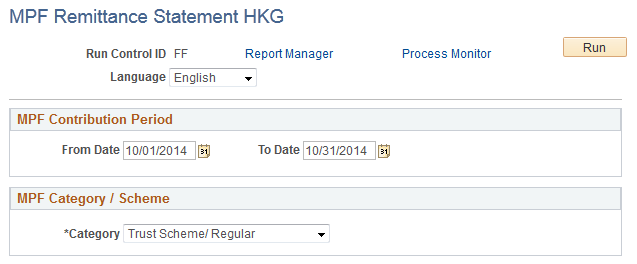

Use the MPF Remittance Statement HKG page (GPHK_MPF1_RC) to generate reports on employers’ and employees’ (mandatory and voluntary) MPF contributions for companies during the specified contribution period.

Navigation:

This example illustrates the fields and controls on the MPF Remittance Statement HKG page.

MPF Contribution Period

Field or Control |

Description |

|---|---|

From Date and To Date |

Specify the contribution period for which the report is run. |

MPF Category / Scheme

Field or Control |

Description |

|---|---|

Category |

Select the report you want to run. Valid values are: Industry Scheme/ Casual: report for casual workers who joined the industry scheme. Casual workers are those who are employed on a day to day basis or for a fixed period of less than 60 days in the construction or catering industry. Trust Scheme/ Regular: report for non-casual workers who joined the trust scheme. |