Entering Commuting Allowance Data

This section provides an overview of how to set up commuting allowance data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_CM_PYE_DATA |

Enter commuting allowance amounts. Define the data by total amount or by commuting routes for each employee. |

Before you can process commuting allowance in the payroll run, you must enter some data that establishes limits on the monthly nontaxable commuting allowance and define the commuting allowance amounts for individual employees.

Update the current statutory allowance on the Variables by Category page (only if the statutory limit has changed).

PeopleSoft delivers the default value of 100,000 JPY for the variable CM VR NTAX ALW MX.

Select the category CMTX when you access the Variables by Category page.

Enter the new value for the variable CM VR NTAX ALW MX on the Values tab of the Variables by Category page.

Enter the commuting allowance data for each employee on the Commuting Allowance page.

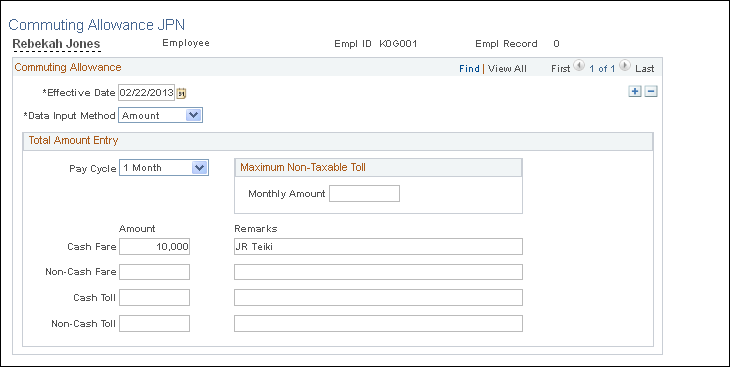

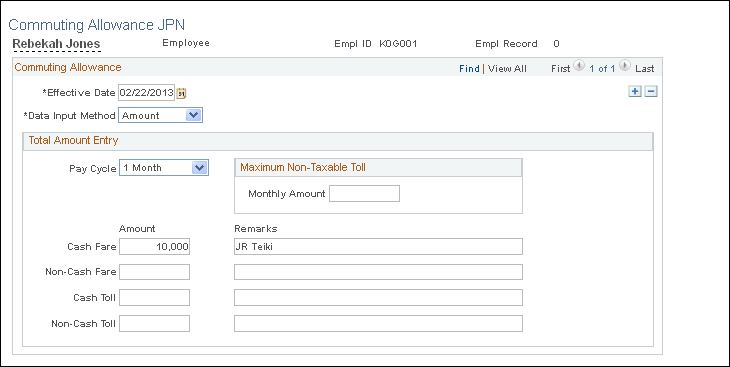

Use the Commuting Allowance JPN page (GPJP_CM_PYE_DATA) to enter commuting allowance amounts.

Define the data by total amount or by commuting routes for each employee.

Navigation:

This example illustrates the fields and controls on the Commuting Allowance JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Empl Record (employment record number) |

Displays the employment record number to which this allowance is applied. The nontaxable limit is applied to each employment record number rather than each employee. |

Data Input Method |

Select Amount to access the Total Amount Entry group box. |

Pay Cycle |

Select the frequency of the term of the commuting allowance for this employee: 1 Day, 1 Month, 3 Months, or 6 Months. All components of the commuting allowance must have the same pay cycle frequency. |

Amount |

Enter the amount of commuting allowance in each of the fields: Cash Fare, Non-Cash Fare, Cash Toll, and Non-Cash Toll. Fare refers only to the most reasonable commuting expense for the employee's commute, which is generally the cost of public transportation. Toll applies to all commuting allowances other than fare, including commuting ticket fare, mileage, toll, and first class fare. |

Remarks |

Enter a description of the commuting allowance item, such as the name of the transport facility, route, and so on. This is for your information only. |

Maximum Non-Taxable Toll

Field or Control |

Description |

|---|---|

Monthly Amount |

Determine this value on an individual basis for each employee. |

Access the Commuting Allowance JPN page

This example illustrates the fields and controls on the Commuting Allowance Details JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Empl Record (employment record number) |

Displays the employment record number to which this allowance is applied. The nontaxable limit is applied to each employment record number rather than each employee. |

Data Input Method |

Select Route to access the Commuting Route Section Entry group box. |

Pay Start Date |

Enter the first date on which this allowance is paid. The system will then calculate the commuting allowance based on the pay cycle. For instance, a six-month pay cycle beginning on January 1 would be paid in January and July. |

Pay Cycle |

Select the frequency of the term of the commuting allowance for this commuting route: 1 Day, 1 Month, 3 Months, or 6 Months. Each route section may have a different pay cycle frequency. |

Form of Payment |

Select either cash or non cash. |

Pay Type |

Select either Fare or Toll. Fare refers only to the most reasonable commuting expense for the employee's commute, which is generally the cost of public transportation. Toll applies to all commuting allowances other than fare, including commuting ticket fare, mileage, toll, and first class fare. |

Amount |

Enter the commuting allowance paid per cycle. |

Place From and Place To |

Enter the route's start and end point. |

Description |

Enter a description of the route. |