Global Payroll for Japan Reports: A to Z

This table lists the Global Payroll for Japan reports, sorted by report ID.

For more information about running these reports, refer to:

The corresponding topic in this product documentation.

PeopleTools: PeopleSoft Process Scheduler

PeopleTools: BI Publisher for PeopleSoft

PeopleTools: SQR Language Reference for PeopleSoft

For samples of these reports, see the Report Samples that are published with this online documentation.

|

Report ID and Report Name |

Description |

Navigation |

Run Control Page |

|---|---|---|---|

|

GPJPBA01 EFT Banking |

Generated as part of the EFT process, it prints the information transferred to the bank by the EFT process. |

|

GPJP_RC_BA01 |

|

GPJPIH01 Municipality Audit Rpt JPN Report |

Lists error messages for employees with invalid postal code and municipality code in their legal (or home) addresses. |

|

GPJP_RC_IH_AUD |

|

GPJPIH02 Mthly Inhabitant Tax Rpt JPN |

Provides the number of inhabitant tax collections and the total amount collected for each municipality for each pay period. |

|

GPJP_RC_IH_MNTH |

|

GPJPIT01 Withholding Tax Register |

Prints payroll data in the following categories: employee identification, salary data, bonus data, PTO data, former employment data, total amounts data, retirement allowance, and year-end adjustment data. |

|

GPJP_RC_IT_WHRG |

|

GPJPLA01 ANN - EI Exempt Report |

Lists employees who are exempt from labor insurance premium because of age. |

|

GPJP_RC_LA01 |

|

GPJPLA02 Basic Employment Insurance Rpt (basic employment insurance report) |

Provides the workers compensation and employment insurance wage information that you need to complete the Insurance Premium report that you must submit each May. |

|

GPJP_RC_LA01 |

|

GPJPLA03 Newly Enroll Employee File |

Generates a list of new employees. |

|

GPJP_RC_LA_PYE_RPT |

|

GPJPPP01 Pay Slip Generation |

Prints regular (salary) payslip, bonus payslip, retirement allowance payslip, or Tax Amount Difference report (year-end adjustment payslip). |

|

GPJP_RC_PP01 |

|

GPJPSC01 Monthly Std Remuneration (Rev) (monthly standard remuneration (revised)) |

Lists social insurance and remuneration information for all employees whose subject indicator is Occasional Revision. |

|

GPJP_RC_SC01 |

|

GPJPSC02 Monthly Std Remuneration (Reg) (monthly standard remuneration (regular)) |

Lists social insurance and remuneration information for all employees whose subject indicator is Regular Decision. |

|

GPJP_RC_SC03 |

|

GPJPSC03 Monthly Std Remuneration (Sum) (monthly standard remuneration (summary) |

Summarizes information about employees subject to regular decision and occasional revision. |

|

GPJP_RC_SC03 |

|

GPJPSC04 Pens Insurance Termination Rpt (pension insurance termination report) |

Lists employees who became ineligible for Employees' Pension Insurance premium due to reaching the age of 70. |

|

GPJP_RC_SC04 |

|

GPJPSC06 Bonus Payment Reports |

Print a bonus payment report. |

|

GPJP_RC_SC_BNS |

|

GPJPSC07 Social Insurance Check Report |

Create the social insurance premium report file. |

|

GPJP_RC_SC_CHK |

|

GPJPSC08 SI Summary Report |

Summarize information about the social insurance premium for all employees. |

|

GPJP_RC_SC_GRD |

|

GPJPUC01 Unemployment Certificate |

Print an unemployment certificate. |

|

GPJP_RC_UC_RPT |

|

GPJPWC01 Wage Certificate at 60 |

Print Wage Certificate at 60. |

Global Payroll & Absence Mgmt, Social Security / Insurance, Print Wage Cert at 60 JPN |

GPJP_RC_UC_RPT |

|

GPJPYE01 Withholding Tax/Wage Payment |

Reports income, deductions, and insurance premiums. Deliver this report to all employees after year-end adjustment has been processed and at midyear for terminating employees. You also deliver this report to tax offices for employees who meet specific criteria. |

|

GPJP_RC_YEAWHRPT |

|

GPJPYE01 Withholding Tax/Wage Payment |

This is the same SQR as the Withholding Tax Report, but with different parameters to select, sort, and report the data. |

|

GPJP_RC_YEAWGRPT |

|

GPJPYE02 Legal Payment Summary Report |

Contains information for the Legal Payment Summary report that you submit to the tax office. |

|

GPJP_RC_YEA |

|

GPJPYE03 Wage Payment Summary Report |

Contains information for the Wage Payment Summary report that you submit to municipalities. |

|

GPJP_RC_YEA |

|

GPJPYE04 Dependent Report YEA |

For manual data collection, print the report and distribute it to employees for review and update. For self-service data collection, print the report for record-keeping purposes after employees have updated their data in the PeopleSoft ePay transaction. |

|

GPJP_RC_YEA04 |

|

GPJPYE05 YEA - Ins and Spouse (YEA insurance and spouse) |

For manual data collection, print the report and distribute it to employees for review and update. For self-service data collection, print the report for record-keeping purposes after employees have updated their data in the ePay transaction. |

|

GPJP_RC_YEA05 |

|

E-file Wage Payment Rpt JPN |

The process retrieves each employee's Reporting Municipality Code based on Municipal Code (that is Payment Municipality Code) of the employee. |

|

GPJP_RC_YEAWGRPT |

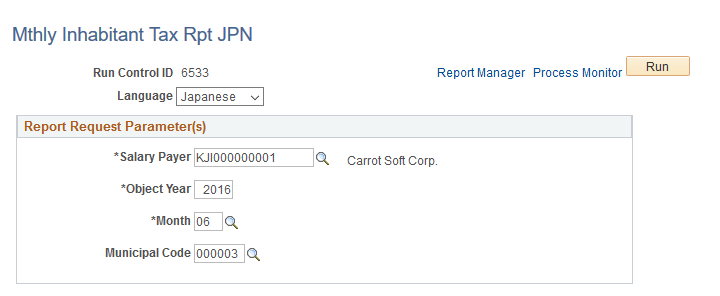

Use the Mthly Inhabitant Tax Rpt JPN (GPJP_RC_IH_MNTH) page which provides the number of inhabitant tax collections and the total amount collected for each municipality for each pay period.

Navigation:

This example illustrates the fields and controls of the Mthly Inhabitant Tax Rpt JPN page.

Field or Control |

Description |

|---|---|

Municipal Code |

Use the field to prompt and show the Payment Municipal Code. |

After payroll is finalized and appropriate adjustments are made, run processes (Load IH Tax Payment Data JPN, Maintain IH Tax File Data JPN and Create IH Tax File JPN) that create a banking file that summarizes inhabitant tax amounts sorted by municipal government. The municipal code used here is now Payment Municipality Code.

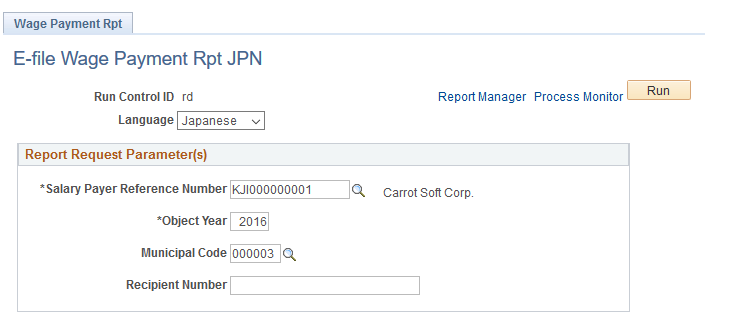

Use the E-file Wage Payment Rpt JPN process to retrieves each employee's Reporting Municipality Code based on Municipal Code (that is Payment Municipality Code) of the employee.

Navigation:

This example illustrates the fields and controls of E-file Wage Payment Rpt JPN page.

Note: The wage summary payment report and the wage payment paper report will have order by on reporting municipal code, The Wage Payment summary Report will show Reporting Municipal codes in the Report.

The changes to the wage payment report as part of My Number Act implementation are as follows:

Employee personal Number is displayed on the report.

Count of dependents, count of disabled dependents, count of non-resident employees.

List of dependents (Maximum count = 4) with their person number along with the non-resident flag circled.

If the count of dependents is more than four, the remaining dependents (non-juvenile) name along with text non resident (if the dependent is a non-resident) is displayed in the section above insurance values and Person number is displayed to the right of juvenile dependents section

If the count of Juvenile dependents is more than 4, the remaining dependents'(juvenile) name along with text "non resident" (if the dependent is a non-resident) is displayed in the section above insurance values and Person number is displayed to the right of juvenile dependents section below the Person numbers of the EXTRA Non-Juvenile Dependents.

The Corporate number of the establishment is displayed along with address and phone number.