Managing the Inhabitant Tax Payment File

This section provides an overview of the inhabitant tax payment file.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_RC_IH_T_LDE |

Request the load inhabitant tax data payment file process. |

|

|

GPJP_IH_TAX_DATA |

View and modify the inhabitant tax payment data by municipal code. |

|

|

GPJP_RC_IH_T_GEN |

Process request for creating Inhabitant Tax Payment file. |

Companies whose employees live in only a limited number of municipalities may be able to successfully administer inhabitant tax payments directly to municipal government offices. On the other hand, larger companies often use banking services to administer inhabitant tax payments on their behalf. Companies that decide to use these banking services report this to the municipal governments. PeopleSoft Global Payroll for Japan enables you to create a file to facilitate inhabitant tax payments by banks. This feature supports the standardized format that is defined by the Regional Banks Association of Japan.

After payroll is finalized and appropriate adjustments are made, you run a process that creates a banking file that summarizes inhabitant tax amounts sorted by municipal government. The file contains data for both the salary-based inhabitant taxes and the retirement allowance-based amounts. You submit this information to a single bank that transfers these tax payments to the respective municipal governments. Companies must transfer the file by the tenth day of each month following the calculation and deduction of inhabitant taxes.

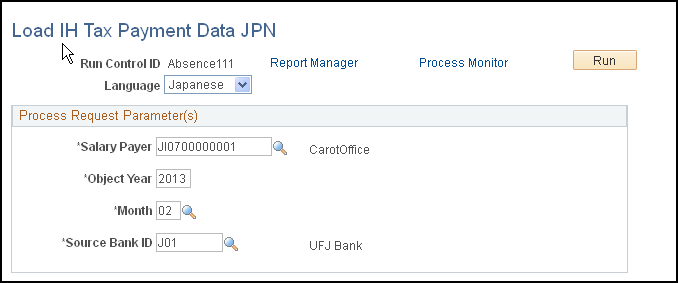

Use the Load IH Tax Payment Data JPN page (GPJP_RC_IH_T_LDE) to request the load inhabitant tax data payment file process.

Navigation:

Global Payroll & Absence Mgmt, Payment Processing, Load IH Tax Payment Data JPN, Load IH Tax Payment Data JPN

Load IH Tax Payment Data JPN page

This example illustrates the fields and controls on the Load IH Tax Payment Data JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Salary Payer |

Select the Tax Establishment ID for which to load the inhabitant tax payment file. |

Object Year |

The year tax is paid. |

Month |

The month for which the tax is paid. For example, you select June for the inhabitant tax that was deducted in June and must be paid by July 10. |

Source Bank |

Select the source bank. |

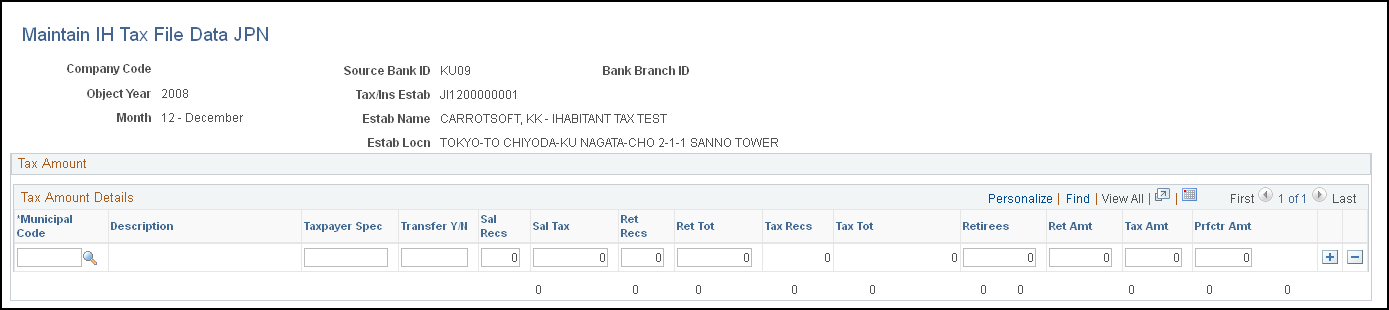

Use the Maintain IH Tax File Data JPN page (GPJP_IH_TAX_DATA) to view and modify the inhabitant tax payment data by municipal code.

Navigation:

This example illustrates the fields and controls on the Maintain IH Tax File Data JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Municipal Code |

Displays the Municipal Code ID from the Municipality Table page . |

Description |

Name of the municipal government. |

Taxpayer Spec (taxpayer specified) |

Taxpayer specified number. |

Transfer Y/N |

Transfer flag. |

Sal Recs (salary records) |

Number of tax records from salary. |

Sal Tax (salary tax) |

Tax amount from salary. |

Ret Recs (retirement records) |

Number of tax records from retirement allowance. |

Ret Tot (retirement total) |

Tax amount from retirement allowance. |

Tax Recs (tax records) |

Total number of tax records. |

Tax Tot (tax totals) |

Sum of tax amounts from salary and tax amounts from retirement allowance. |

Retirees |

Number of retired employees. |

Ret Amt (retirement amount) |

Amount of retirement allowance. |

Tax Amt (tax amount) |

Municipal tax amount. |

Prfctr Amt (prefecture amount) |

Prefecture amount. |

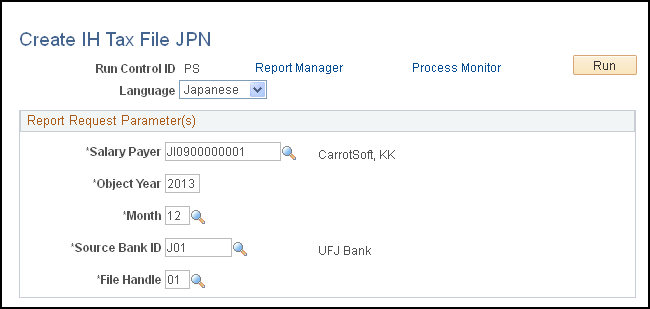

Access the Create IH Tax File JPN page

This example illustrates the fields and controls on the Create IH Tax File JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Salary Payer |

Select the Tax Establishment ID. |

Object Year |

The year tax is paid. |

Month |

The month tax is paid. |

Source Bank ID |

The bank from which the funds will be paid. |

File Handle |

Select the output format. |

Note: The prerequisite for running this process is to have source data is already loaded. If the data is not loaded, an error message will be generated.