Setting Up Tax and Insurance Establishments

This section provides an overview of tax and insurance establishments and discusses how to define tax establishments and related activities.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_TAX_ESTAB |

Define tax establishments. Record the establishment numbers assigned to your organization by income tax agencies. Provide address and additional information related to each establishment. |

|

|

GPJP_TAX_ESTAB2 |

Define social insurance establishments. Record the establishment numbers assigned to your organization by the social insurance agencies. Provide address and additional information related to each establishment. |

|

|

GPJP_TAX_ESTAB3 |

Define labor insurance establishments. Record the establishment numbers assigned to your organization by the labor insurance agency. Provide address and additional information related to each establishment. |

The Tax Establishment table holds the establishment numbers assigned by the income tax, social insurance, and labor insurance agencies. These numbers might apply to your entire organization or to parts of your organization. You must set up each establishment number and provide some additional data for each before you begin to process payrolls.

These topics discuss how to define establishment IDs. Later topics explain how to relate these establishment IDs to individual employees.

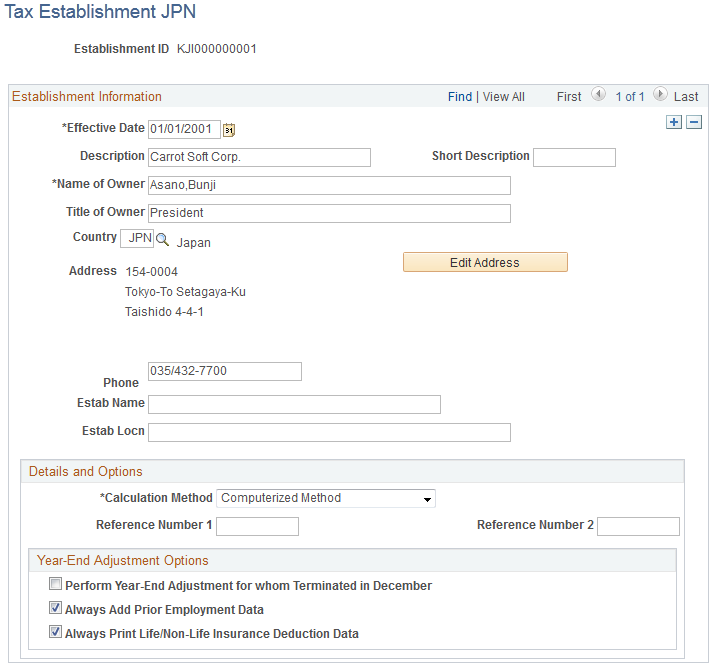

Use the Tax Establishment JPN page (GPJP_TAX_ESTAB) to define tax establishments.

Record the establishment numbers assigned to your organization by income tax agencies. Provide address and additional information related to each establishment.

Navigation:

This example illustrates the fields and controls on the Tax Establishment JPN page. You can find definitions for the fields and controls later on this page.

Details and Options

Field or Control |

Description |

|---|---|

Calculation Method |

Select whether this salary payer (income tax establishment) calculates income tax by the computer calculation or tax table lookup method when an employee's income tax type is KOU. Valid values are Computer and Table. |

Reference Number 1 and Reference Number 2 |

Enter up to two reference numbers to associate with the tax establishment. These numbers can be used during e-file reporting. |

Year-End Adjustment Options

Field or Control |

Description |

|---|---|

Perform Year-End Adjustment for whom Terminated in December |

The default setting for this check box is deselected. Select this check box if your organization's policy is to perform the Year-End Adjustment for the payees who were terminated before the payment date in December. |

Always Add Prior Employment Data |

The default setting for this check box is selected. If you deselect this check box, the system does not include the sum of salary, withheld tax, the deducted Social Insurance premiums by the previous employer with the sum of those amounts from the current employer, if the payee, who terminates in mid-year, was judged not-subject to Year-End Adjustment. |

Always Print Life/Non-Life Insurance Deduction Data |

The default setting for this check box is selected. If you deselect this check box, the system does not print Life/Non-Life insurance deduction data on the Withholding Tax Report, if the payee, who terminates in mid-year, was judged not-subject to Year-End Adjustment. |

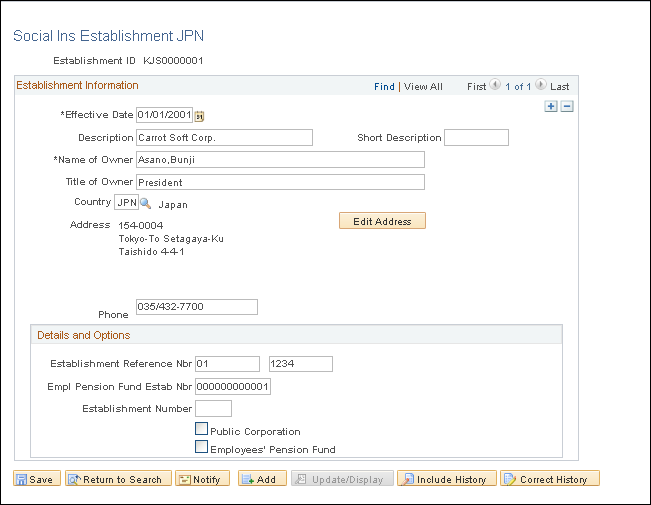

Use the Social Ins Establishment JPN (social insurance establishment) page (GPJP_TAX_ESTAB2) to define social insurance establishments.

Record the establishment numbers assigned to your organization by the social insurance agencies. Provide address and additional information related to each establishment.

Navigation:

This example illustrates the fields and controls on the Social Ins Establishment JPN page. You can find definitions for the fields and controls later on this page.

Details and Options

Field or Control |

Description |

|---|---|

Establishment Reference Nbr (establishment reference number) |

Enter the number assigned to the establishment by the social insurance agency. This value is used for reporting purposes. |

Empl Pension Fund Estab Nbr (employee pension fund establishment number) |

Enter the number assigned to this establishment by the employee pension fund. |

Establishment Number |

Enter the establishment number assigned by the government. |

Public Corporation |

Select this option to indicate that members of this social insurance establishment work at a public corporation. When this option is selected and the payee has data on the social insurance dependent data table (GPJP_SC_DEP_DTA), the system will trigger a flag on the Enrollment report indicating that the Health Insurance Dependent report should be submitted. |

Employees' Pension Fund |

Select this option to indicate that the members of this social insurance establishment are enrolled in the employee pension fund. This field, in addition to the payee's sex, determines the type used for various SI reports. |

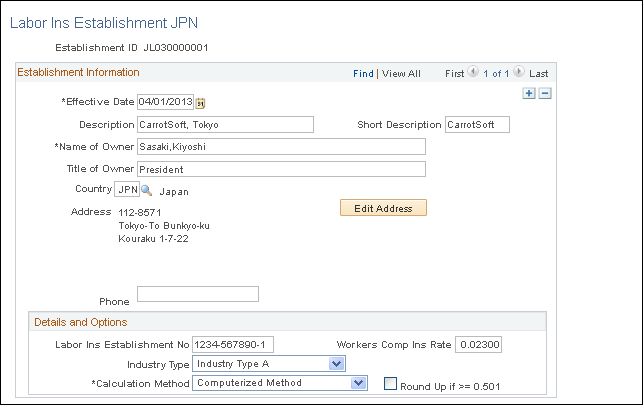

Use the Labor Ins Establishment JPN (labor insurance establishment) page (GPJP_TAX_ESTAB3) to define labor insurance establishments.

Record the establishment numbers assigned to your organization by the labor insurance agency. Provide address and additional information related to each establishment.

Navigation:

This example illustrates the fields and controls on the Labor Ins Establishment JPN page. You can find definitions for the fields and controls later on this page.

Establishment Information

Field or Control |

Description |

|---|---|

Title of Owner |

Enter the establishment owner's title. This value is used for reporting purposes. |

Details and Options

Field or Control |

Description |

|---|---|

Labor Ins Establishment No |

Enter the labor insurance establishment number for your establishment. |

Calculation Method |

Select whether this labor insurance establishment calculates labor insurance by the computer calculation or table lookup method. Valid values are Computer and Table. |

Industry Type |

Select whether this labor insurance establishment is a Type A, Type B, or Type B(Cs) (construction) industry. |

Workers Comp Ins Rate |

Enter the worker compensation insurance rate. |

Round Up if >= 0.501 |

The default setting for this check box is deselected. If this check box is deselected, the system discards the fraction in the employment insurance premium regardless of the fraction amount. If you select this check box, the payee's contribution to employment insurance is rounded up if the fraction is greater than or equal to 0.50; it is rounded down if the fraction is less than 0.501 |