Setting Up the Inhabitant Tax Table

This section provides an overview of the Pre-Load Inhabitant Tax process and the related activities.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

QRY_SELECT |

Identify and correct blank municipality codes on the Define Postal Codes JPN table. Run the Blank Municipality Audit Report query to identify postal codes that do not have a municipality code in the Define Postal Codes JPN table. |

|

|

Municipality Audit Rpt JPN Page |

GPJP_RC_IH_AUD |

Audit and correct postal code errors. Run the Municipality Audit report, which lists error messages for employees with invalid postal codes in their legal (or home) addresses. |

|

GPJP_RC_IH_MUN1 |

Run the Pre-Load Inhabitant Tax process to load the employee, municipality, and recipient numbers for the object year into the Inhabitant Tax table. |

The Pre-Load Inhabitant Tax process (GPJP_IHMUN1) selects employees by the specified salary payer reference number. It loads their municipality codes and recipient numbers into the Inhabitant Tax table with the effective date of June 1 of the object year. You can view and update or correct the results of this process on the Maintain Inhab Tax Data JPN page.

Municipality Code

The process selects the municipality code in the Define Postal Codes JPN table based on the postal code that is in the employee's legal address record as of January 1 of the object year. If the employee does not have a legal address, the process uses the postal code that is in the home address record.

Employment Record Number

If a row of Inhabitant Tax data already exists, then the employment record of the new row is updated with the employment record of the old row. If no row exists, then the record that has a tax type of KOU is selected for tax deductions for the newly inserted row. If no record with tax type KOU exists, then the minimum Job Record with a Pay System Flag of GP is selected for tax deductions for the newly inserted row.

Recipient Number

The process loads each employee's recipient number in the following way:

Implementation year.

The process enters the employee ID as the recipient number. You must correct the recipient number manually if the recipient number is different from the employee ID.

Subsequent years.

The process looks up the municipality code of the object year. It compares that municipality code with the employee's municipality code existing in the Inhabitant Tax record of the previous year.

If the municipality codes do not match, the process assigns an employee ID.

If the municipality codes match, the process carries forward the recipient number.

Cautions About Running the Process

Before running this process, be sure to run the Blank Municipality Audit Report query and the Municipality Audit Rpt JPN Report, and correct all postal code errors.

You can run this process only once for each salary-payer reference number and object year. If you try to run it a second time, the process halts with an error message.

Auditing and Correcting Postal Code Errors

Run the Municipality Audit Rpt JPN report to find postal code errors in employee address records as of January 1 of the object year. When looking up the postal code, the process first looks to the legal address. If the employee does not have a legal address, the process looks to the home address.

|

Error Message |

Correction |

|---|---|

|

Municipality Code does not exist on Municipality Table. |

If the code is valid, add it to the Municipality table and associate it with the postal code on the Define Postal Codes JPN table. |

|

Postal Code does not exist on the Define Postal Codes JPN Table. |

Correct the employee's postal code on the Personal Address table. |

|

Unregistered Postal Code. |

The postal code is missing from employee address data. Add the postal code to the employee's data in the Personal Address table. |

Use the Query Manager page (QRY_SELECT) to identify and correct blank municipality codes on the Define Postal Codes JPN table.

Navigation:

Run the Blank Municipality Audit Report query to identify postal codes that do not have a municipality code in the Define Postal Codes JPN table.

To identify and correct blank municipality codes on the Define Postal Codes JPN table:

Search for the GPJP_AUDIT_BLANK_MUNIC query.

Run the query.

View the list of postal codes for which the municipality code is blank.

Note: Correct the missing municipality codes on the Define Postal Codes JPN table before running the Pre-Load Inhabitant Tax process.

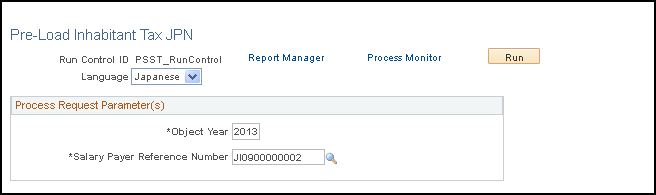

Use the Pre-load Inhabitant Tax JPN page (GPJP_RC_IH_MUN1) to update the municipality codes and recipient numbers by running the Pre-Load Inhabitant Tax process (GPJP_IHMUN1), which loads the employee, municipality, and recipient numbers for the object year into the Inhabitant Tax table.

Navigation:

This example illustrates the fields and controls on the Pre-Load Inhabitant Tax JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Object Year |

The default is the current year. |

Salary Payer Reference Number |

The process selects all employees who are reported to the municipality for the salary payer reference number that is entered here. |