Assigning BIKs to an Employee

After you define BIK types, you assign them to employees and maintain them.

This section discusses how to assign BIKs to an employee.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

COMPANY_PROPERTY |

Assign property codes, issuance, and return dates to an employee. |

|

|

GPMY_BIK_AMOUNTS |

Enter the eligible benefits along with their amounts and their start and end dates. |

|

|

GPMY_BIK_ELIGIBLE |

Enter the eligible benefits and their start and end dates. |

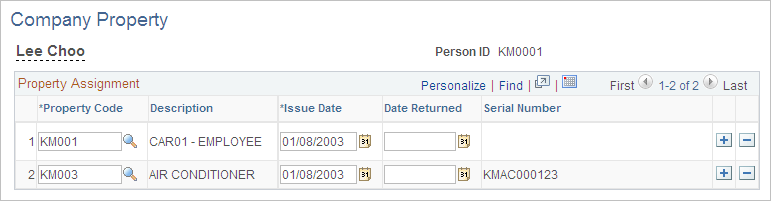

Use the Company Property page (COMPANY_PROPERTY) to assign property codes, issuance, and return dates to an employee.

Navigation:

This example illustrates the fields and controls on the Company Property page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Property Code |

Enter the Property Code. |

Issue Date |

Enter the date that the company property is issued to the employee. |

Date Returned |

Enter the date when the property is returned by the employee. |

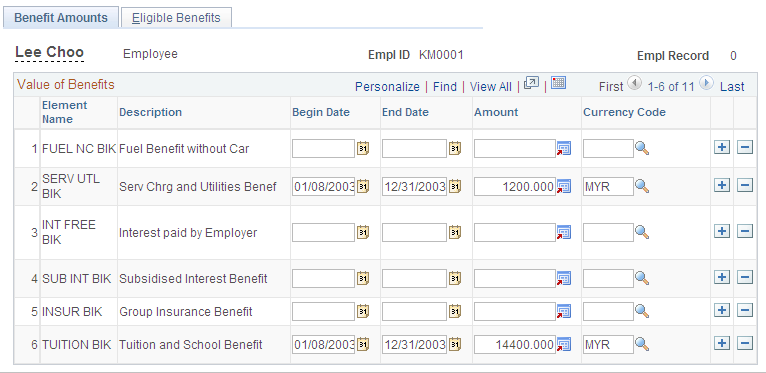

Use the Benefit Amounts page (GPMY_BIK_AMOUNTS) to enter the eligible benefits along with their amounts and their start and end dates.

Navigation:

This example illustrates the fields and controls on the Benefit Amounts page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Begin Date |

Enter the start date of the entitlement. |

End Date |

Enter the end date of the entitlement or the employee's termination date. Enter proration in calendar days using the begin and end dates. The system will not calculate the BIK if the end date is before the segment end date. Termination dates are automatically considered entitlement end dates. Note: No proration is needed for the following BIKs: group insurance benefit (INSUR BIK), interest paid by employee (INT FREE BIK), recreation and club membership (RECREAT BIK), service charge and utilities benefit (SERV UTIL BIK), and tuition and school benefit (TUITION BIK). For these benefits, the begin and end dates should span the entire year. |

Amount |

Enter the amount of the entitlement. Note: When you enter the housing BIK, the system can compare the BIK to the payee's gross income. Enter the BIK as a percentage of the gross using earning HOUS BIK PCT or as an amount using earning HOUS BIK AMT. You can enter both to make the system calculate and choose the lesser value. |

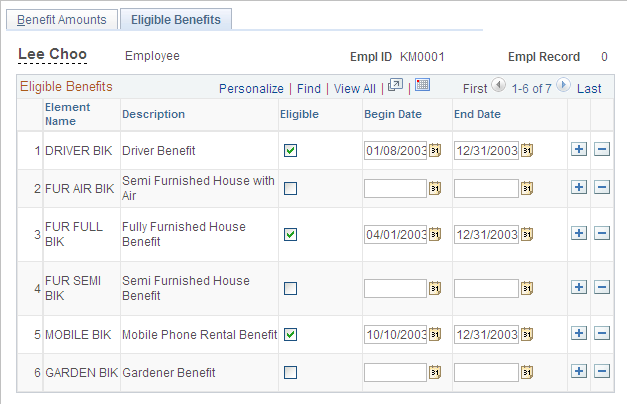

Use the Eligible Benefits page (GPMY_BIK_ELIGIBLE) to enter the eligible benefits and their start and end dates.

Navigation:

This example illustrates the fields and controls on the Eligible Benefits page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Eligible |

Select if the employee is eligible for the benefit. |

Begin Date |

Enter the start date of the entitlement. |

End Date |

Enter the end date of the entitlement or the employee's termination date. Enter proration in calendar days using the begin and end dates. The system will not calculate the BIK if the end date is before the segment end date. Termination dates are automatically considered entitlement end dates. |

Note: Benefit amounts are derived from Global Payroll Earning elements.