Identifying Company Tax Details

To set up identification of company tax details, use the Tax Number Table MYS (GPMY_TAX_TBL) and Statutory Region Table MYS (GPMY_STAT_REG) components.

This section discusses how to identify company tax details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

COMPANY_TABLE2 |

Set up default company information; for example, the Malaysian reference and registration numbers that are used by various statutory reports. |

|

|

GPMY_STAT_REG |

Maintain statutory regional information for EPF, SOCSO, and taxation reporting. |

|

|

GPMY_TAX_TBL |

Maintain employer contact information for tax reporting. |

|

|

GPMY_TAX_ORG_NBR |

Associate a tax reference number with an organizational unit, such as a company, pay group, location, establishment, or department. |

|

|

Tax Reference Number Details Page |

GPMY_TAX_ORG_SEC |

View employer details that are associated with the tax reference number. |

Use the Default Settings page (COMPANY_TABLE2) to set up default company information; for example, the Malaysian reference and registration numbers that are used by various statutory reports.

Navigation:

Field or Control |

Description |

|---|---|

Reference Number |

Enter the company reference number, which is a number that the government of Malaysia assigns to an organization to uniquely identify it. This number is also the Company C File Number. This number is used in Annual Statement of Tax Deductions - Malaysian CP159 report (GPMYTX05). |

Registration Number |

Enter the Company Registration Number, which is a number that the government of Malaysia assigns to an organization to uniquely identify it. The Registration Number is used in CP39 Monthly Statement of Tax Deductions - Electronic form (GPMYTX04). |

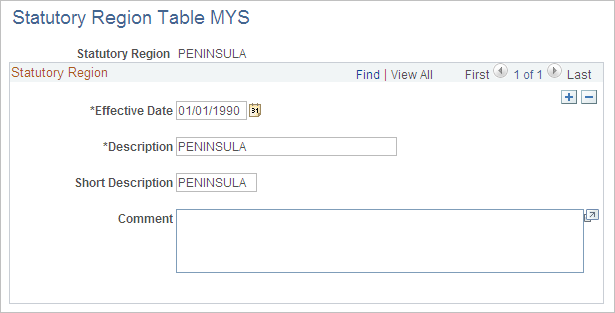

Use the Statutory Region Table MYS page (GPMY_STAT_REG) to maintain statutory regional information for EPF, SOCSO, and taxation reporting.

Navigation:

This example illustrates the fields and controls on the Statutory Region Table MYS page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Statutory Region |

Enter the statutory region. This region is reported on the following forms: EPF Form 6, SOCSO Form 8A, SOCSO Form 8B, CP39 Monthly Statement of Tax Deductions - Electronic form, and Employee Tax Refund Form - Malaysian CP159A/PCB2(II). |

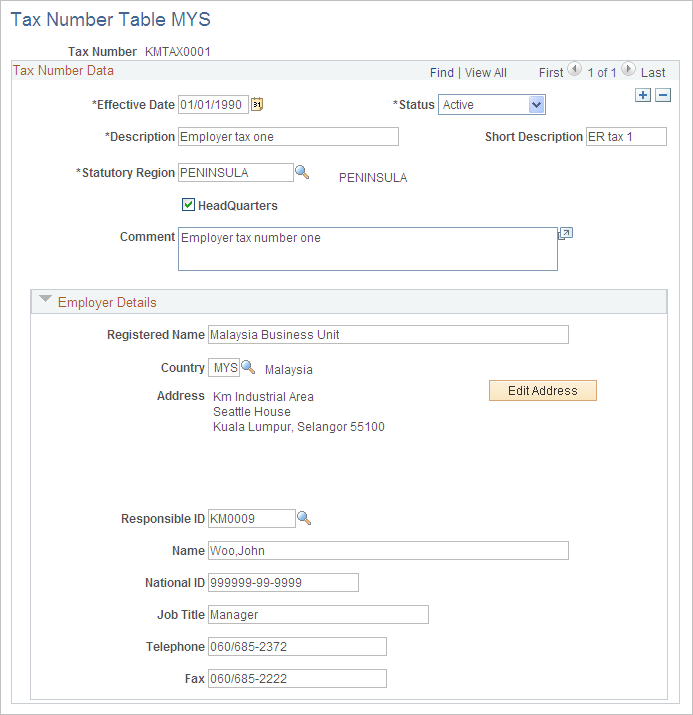

Use the Tax Number Table MYS page (GPMY_TAX_TBL) to maintain employer contact information for tax reporting.

Navigation:

This example illustrates the fields and controls on the Tax Number Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Registered Name |

Enter the employer's official name. |

Address |

Enter the employer's address. |

Responsible ID |

Enter the employee ID of the organization's tax contact. |

Name |

Enter the name of the organization's contact person for taxation inquiries. This name appears as the company contact in all reports that are submitted to the Department of Inland Revenue. |

National ID |

Enter the contact person's national ID. |

Job Title |

Enter the job title of the company contact for taxation inquiries. This information appears in all the reports that are submitted to the Department of Inland Revenue. |

Telephone and Fax |

Enter the telephone and fax number of the company contact for taxation inquiries. This information appears in all reports that are submitted to the Department of Inland Revenue. |

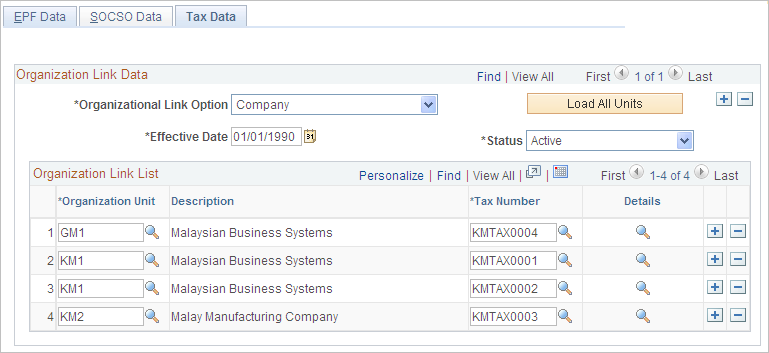

Use the Tax Data page (GPMY_TAX_ORG_NBR) to associate a tax reference number with an organizational unit, such as a company, pay group, location, establishment, or department.

Navigation:

This example illustrates the fields and controls on the Tax Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Organizational Link Option |

Select an organizational link. Options are: Company, Pay Group, Location, Establishment, and Department. |

Load All Units |

Click to insert a list of all possible organizational units into the organization link list. You can then specify the tax references number for each unit. |

Effective Date and Status |

Enter the effective date and status of the organization link. If the organizational link option changes, all the organizational units are deleted and all existing organizational link options become inactive. |

Details |

Click to view the Tax Reference Number Details page, which displays the employer details that are associated with the tax number. |