Defining PTU (Participacion a los Trabajadores de las Utilidades)

To define the adjustment factor and maximum days for PTU, use the Pay Groups MEX (GPMX_PARM_PYGRP) component. To define PTU parameters and identify PTU elements and payees, use the Define PTU - Profit Share MEX (GPMX_PARM_COMPANY) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_PTU_GP_PYGRP |

Set the adjustment factor and maximum days for profit-sharing at the pay group level. |

|

|

GPMX_PTU_COMPANY1 |

Define PTU parameters at the company level. |

|

|

GPMX_PTU_COMPANY2 |

Identify the PTU elements and payees. Identify the earnings and deductions used for profit sharing, assign profit sharing elements to accumulators, and exclude ineligible employees from the profit sharing process. |

To define and run the PTU process:

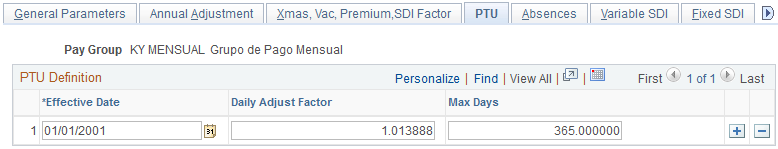

Define the adjustment factor and maximum days for PTU (profit-sharing) on the PTU page.

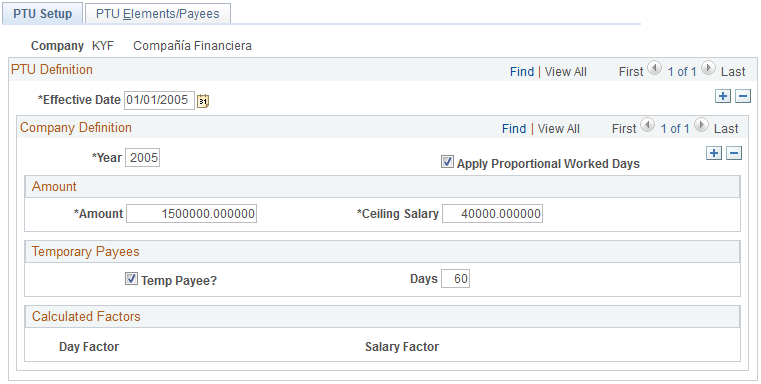

Define PTU parameters on the PTU Setup page.

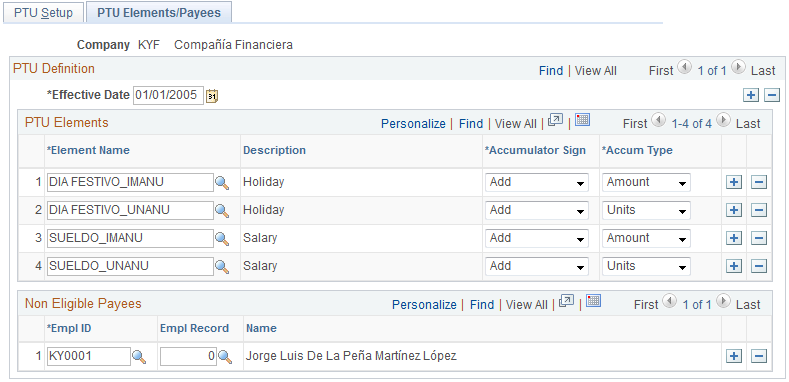

Identify PTU elements and payees on the PTU Elements/Payees page.

Run the PTU process on the Calculate PTU-Profit Share MEX page.

Note: Running the PTU process is discussed in another topic.

See Running the PTU (Profit Sharing) Process.

Understanding the Adjustment Factor and Maximum Days for PTU

The PTU page enables you to:

Standardize the number of PTU (profit-sharing) days across all pay groups in your company, regardless of the calendar used for each group.

For example, suppose that you have a monthly pay group based on a 360 day per year calendar (in which all months are defined as having 30 days), and a weekly pay group based on a 365 day calendar (using actual calendar days). To bring the number of profit-sharing days for the monthly pay group up to 365, enter a daily adjustment factor on the PTU page for the monthly pay group. Multiply this amount by 360 to bring the number of days up to 365. In this example, the amount is 365 / 360 (= 1.0138888).

Define the maximum number of days that can be used in the profit-sharing calculation.

Use the PTU page (GPMX_PTU_GP_PYGRP) to set the adjustment factor and maximum days for profit-sharing at the pay group level.

Navigation:

This example illustrates the fields and controls on the PTU page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Daily Adjust Factor (daily adjustment factor) |

Enter the multiplication factor needed to adjust the number of PTU days for the specified pay group. For example, if your pay group is based on a 360-day-per-year calendar, and you want to adjust the calendar to 365 days, enter 1.013888 (365 / 360). |

Max Days (maximum days) |

Enter the maximum number of days that can be included in the profit-sharing calculation. For example, you might decide to pay an employee's vacation balance at the moment of termination. At this point, the employee might have more than 365 PTU days. In this case, if the earnings that you use to pay the vacation balance are part of the profit-sharing process, you can reduce the PTU days to 365 (or any other amount). |

Use the PTU Setup page (GPMX_PTU_COMPANY1) to define PTU parameters at the company level.

Navigation:

This example illustrates the fields and controls on the PTU Setup page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Year |

Enter the year for which you are processing your profit sharing earnings. |

Apply Proportional Worked Days |

Select this check box if the ceiling salary used to calculate PTU earnings should be adjusted to reflect the number of days that an employee actually works. For example, if the ceiling salary is 240,000, and an employee works 250 days during the year, the ceiling salary for that employee is reduced proportionally—that is, it is set to 164,383.56 ((240,000 / 365) × 250). |

Amount |

Enter the amount to be shared. |

Ceiling Salary |

Enter the maximum amount of an employee's salary that can be used to calculate the employee's portion of PTU earnings. To determine the amount, calculate the salary of the union employee with the highest wages, add 20 percent to this amount, and enter the total in the Ceiling Salary field. If an employee who is eligible for profit sharing makes more than the amount that you enter here, profit sharing is capped at this amount. |

Temp Payee? (temporary payee) andDays |

Select Temp Payee? to include all temporary employees in your profit sharing plan. To limit the temporary employees who can participate in the plan, select Temp Payee? and enter the number of days that temporary employees must work at your company to participate in profit sharing. For example, if you selectTemp Payee? and enter 60 in theDays field, only temporary employees who work 60 days or more are included in the PTU plan. |

Day Factor |

Displays the PTU Total for all Employees/Worked Days Total for all Employees. This figure is calculated automatically when you run the PTU process. |

Salary Factor |

Displays the PTU Total for all Employees/Salary Sum Total for all Employees. This figure is calculated automatically when you run the PTU process. |

Use the PTU Elements/Payees page (GPMX_PTU_COMPANY2) to identify the PTU elements and payees.

Identify the earnings and deductions used for profit sharing, assign profit sharing elements to accumulators, and exclude ineligible employees from the profit sharing process.

Navigation:

This example illustrates the fields and controls on the PTU Elements/Payees page. You can find definitions for the fields and controls later on this page.

PTU Elements

Field or Control |

Description |

|---|---|

Element Name |

Enter the earnings and deduction accumulators to include in the PTU process. |

Accumulator Sign |

Select an accumulator sign. Values are: Add: Adds the earnings and deduction accumulators specified in theElement Name field to the PTU base. Subtract: Subtracts the earnings and deduction accumulators specified in theElement Name field from the PTU base. |

Acum Type (accumulator type) |

For each element that you specify in the Element Name field, select Amount or Units. Important! When you define an earnings element that you know must be included in the PTU process, create year-to-date accumulators storing both amounts and units for that element. (You can set up an accumulator for units only if the element includes a unit component in its definition.) Otherwise, you will not have the flexibility to accumulate both units and amounts. |

Non Eligible Payees

Enter the employee ID and employee record number for employees who do not qualify for inclusion in the profit sharing process.