Setting Up Absences

To define absences, use the Pay Groups MEX (GPMX_PARM_PYGRP) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_ABS_PYGRP |

Define the absence parameters for a pay group. |

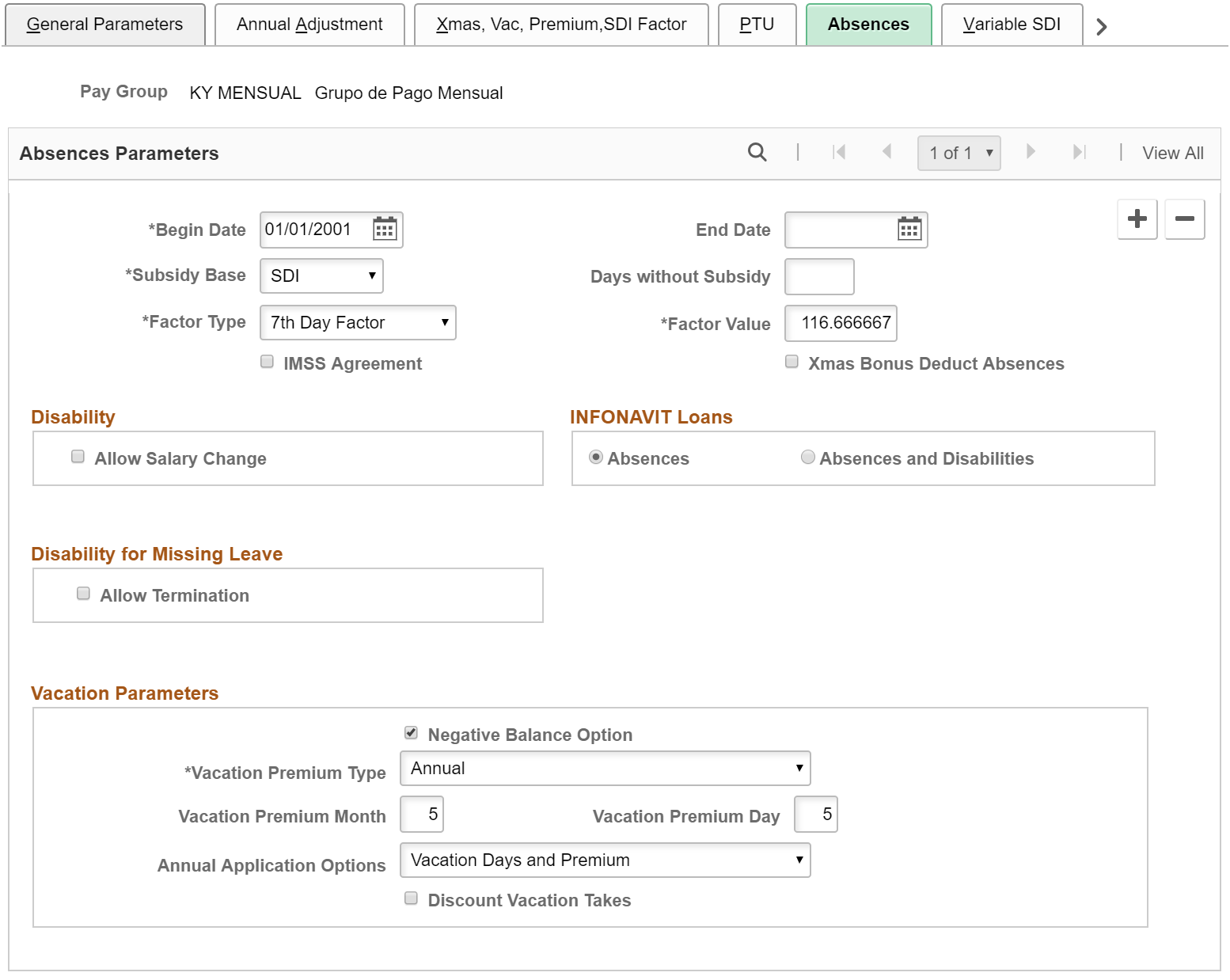

Use the Absences page (GPMX_ABS_PYGRP) to define the absence parameters for a pay group.

Navigation:

This example illustrates the fields and controls on the Absences page. You can find definitions for the fields and controls later on this page.

Absences Parameters

Field or Control |

Description |

|---|---|

Subsidy Base |

Select the subsidy base for disabilities. Values are Daily Salary, SDI, SDI Complement, and Without Subsidy. Your company can subsidize the difference between what IMSS pays employees and what their regular earnings are. The three most common methods are SDI, SDI Complement, and daily salary. For the SDI method, the company pays 100 percent of the SDI for the first three days of the disability and 40 percent of SDI from the fourth day on. This 40 percent will be capped up to the SDI. For the SDI Complement method, the 40 percent will be capped up to the difference between the 60 percent of SDI and the 100 percent of the daily rate. For the daily salary method, the company pays 100 percent of the daily salary for the first three days. From the fourth day on, the company pays the difference between the daily salary and what IMSS pays (usually 60 percent of SDI) capped up to the daily rate. |

Days without Subsidy |

Enter the number of days without a disability subsidy. Because the IMSS does not pay for the first three days of a disability, some companies pay for those days to cover the difference. |

Factor |

Select the factor for general absences. Values are 6th & 7th Day Factor, 7th Day Factor, Other, and Without Factor. For example, if an employee works Monday through Friday and is absent only one day, the employee receives a discount for the sixth and seventh days. Enter the amount of the factor in the field next to theFactor field. The absence is deducted using this factor. For example, if you select Without Factor, the amount equals 100 MXN. If you select 6th & 7th Day Factor, the amount equals 140 MXN. If you select 7th Day Factor, the amount equals 116.67 MXN. |

IMSS Agreement |

Select if your company has an agreement with IMSS to calculate disability subsidies. If you have an agreement with IMSS, your company pays the employee directly, and IMSS pays the subsidy to the company instead of the employee. This parameter will cause the earning SUB ENF CONV to appear instead of the other two subsidy earnings (SUB ENF 40% and SUB ENF 100%). This subsidy will be the same as paying employees their regular salary earnings. |

Xmas Bonus Deduct Absences |

Select this check box to have the payroll process deduct employee absences from the Christmas bonus payment calculation for payees in the specified pay group. The system inserts a row with the variable AG VR APLICA AUS and numeric value equal to 1 in the grid on the Pay Groups - Supporting Element Overrides page for the specified pay group. Deselect this check box to exclude employee absences from the Christmas bonus payment calculation. The system changes the numeric value of the variable to 0. By default this check box is deselected. |

Disability

Field or Control |

Description |

|---|---|

Allow Salary Change |

Select to enable salary changes for employees during disability. |

INFONAVIT Loans

Use this group box to define the kind of absences that affect the discount amount for INFONAVIT loans.

Field or Control |

Description |

|---|---|

Absences |

Select this option to indicate that the payroll process reduce the INFONAVIT loan discount by the absences that the payee has during the payroll process period. |

Absences and Disabilities |

Select this option to indicate that the payroll process reduce the INFONAVIT loan discount by the absences and disabilities that the payee has during the payroll process period. |

Disability for Missing Leave

Field or Control |

Description |

|---|---|

Allow Termination |

Select this option to enable termination for employees during disability. |

Vacation Parameters

Field or Control |

Description |

|---|---|

Negative Balance Option |

Select to enable employees to carry a negative absence balance. |

Vacation Premium Type |

Define the calculation method for the vacation premium. Values are: Anniversary: Employee is paid the entire vacation premium on the employment anniversary. Annual: Employee is paid the entire vacation premium on a specified date that you define. Proportional: Employee is paid the vacation premium on an as-used basis. For example, if an employee used three days of vacation in one month, out of a total of ten days vacation for the year, the employee receives 3/10 of the vacation premium in that month's pay. |

Vacation Premium Month |

If you select Annual as the Vacation Premium Type, enter the month that the vacation premium will be paid. Values are 01–12, depending on the number of the month. |

Vacation Premium Day |

If you select Annual as the Vacation Premium Type, enter the day that the vacation premium will be paid. Values are 01–31, depending on the day of the month. |

Annual Application Options |

If you select Annual as the Vacation Premium Type, the Annual Application Options field appears. Values are Vacation Premium and Vacation Days and Premium. In Global Payroll for Mexico, there are two different earnings codes, one for Vacation Take Days and another for Vacation Premium. If you select Vacation Premium , the earnings code for the Vacation Premium appears on that pay period. If you select Vacation Take Days and Vacation Premium, then two earnings codes will be generated—one for the Vacation Take Days and one for the Vacation Premium. |

Discount Vacation Takes |

If you select Annual as the Vacation Premium Type, the Discount Vacation Takes field appears. Select this check box if you want the vacation takes that occurred during the annual period to be discounted from either the vacation premium or the vacation days payment. |