Generating Year End Reports

This section discusses how to generate year end reports.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPIN_PR_RC |

Use to generate forms 3A, 5, 6, 12BA, 16, and 24. |

|

|

GPIN_FORM7_RC |

Use to generate form 6 half-year report of consolidated employer and employee insurance contributions. |

|

|

GPIN_24Q_RC |

Use to generate Form 24Q and related tax files for electronic submission. |

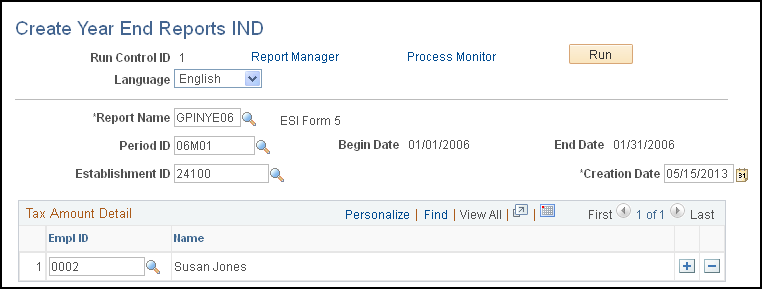

Use the Create Year End Reports IND page (GPIN_PR_RC) to use to generate forms 3A, 5, 6, 12BA, 16, and 24.

Navigation:

This example illustrates the fields and controls on the Create Year End Reports IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Report Name |

Select the report name. Define report names on the Report Setup page. |

Period ID |

Select the appropriate period ID. The begin date and end date appear as soon as you select the period ID. |

Payee Sort Option |

Select a sort order for the report. Options are:

Note: This field is available only when you select the following reports: Form 16, Form 3A, and Form 6A. |

Establishment ID |

Select an establishment ID only if you are running the Form 5 report. |

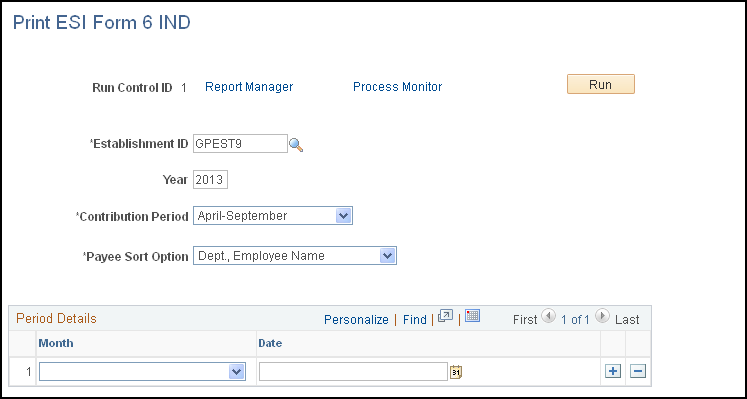

Use the Print ESI Form 6 IND page (GPIN_FORM7_RC) to use to generate form 6 half-year report of consolidated employer and employee insurance contributions.

Navigation:

This example illustrates the fields and controls on the Print ESI Form 6 IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Year |

Enter the fiscal year of the report period. |

Contribution Period |

Select the six-month period covering the social insurance contributions. |

Field or Control |

Description |

|---|---|

ESI Challan Number |

Enter the challan numbers with which the social insurance payments were made. |

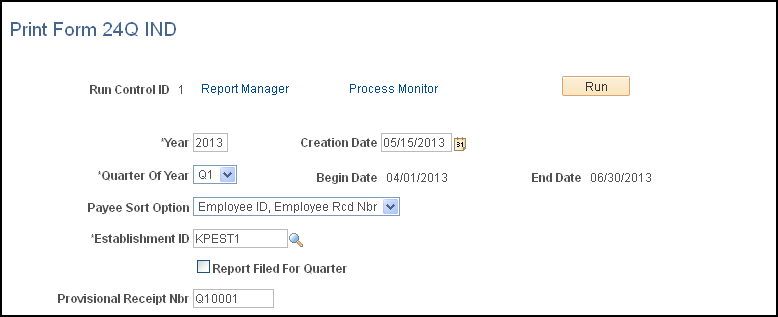

Use the Print Form 24Q IND page (GPIN_24Q_RC) to use to generate Form 24Q and related tax files for electronic submission.

Navigation:

This example illustrates the fields and controls on the Print Form 24Q IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Payee Sort Option |

Select a method to display employee information. Available options are Employee ID, Employee Rcd Nbr (employee record number) and Name, Employee Rcd Nbr. |

Report Filed for Quarter |

Select the Report Filed for Quarter check box if the answer to the question listed in the column 1 (e) of the Form 24Q is Yes. The question listed in the column 1 (e) is this: Has any statement been filed earlier for this quarter (Yes/No)? |

Provisional Receipt Nbr. (provisional receipt number) |

Enter the provisional receipt number that is available in Form 24Q, column 1 (f), if the answer to the column 1 (e) question is Yes. |