Maintaining Tax Declarations

This section provides information on how to enter the payee related information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPIN_TDS_GEN |

Enter the declaration of the payee's general tax information. |

|

|

GPIN_TDS_HRA |

Enter the declaration of the payee's house rent allowance information. |

|

|

GPIN_TDS_DEDN |

Enter the payee's deductions under chapter VI A. |

|

|

GPIN_TDS_OTH |

Enter the payee's other source of income. |

|

|

GPIN_TDS_EXEM |

Enter the payee's tax exemption information. |

|

|

GPIN_TDS_PERQ |

Enter the payee's perquisites details. |

|

|

GPIN_TDS_PREV |

Enter the payee's previous employment income information. |

Use the General Information page (GPIN_TDS_GEN) to enter the declaration of the payee's general tax information.

Navigation:

This example illustrates the fields and controls on the General Information page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Number of Children |

Enter the number of children for the payee. |

Employee Information

Field or Control |

Description |

|---|---|

Disabled |

Select if the payee is disabled. In some states (for example, Lakshadweep and Madhya Pradesh), profession tax exemption applies to payees who are disabled. To apply an exemption to the profession tax calculation, select this check box. The Generation Control Formula (GC FM) looks for employees with disabilities and calculates exemption if the particular state has the rule of exemption. |

Severe Disability |

Select if the payee has a severe disability. In some states, profession tax exemption applies to payees who are severely disabled. To apply an exemption to the profession tax calculation, select this check box. The GC FM looks for employees with severe disabilities and calculates exemption if the particular state has the rule of exemption. |

Senior Citizen |

Select if the payee is a senior citizen. In some states, profession tax exemption applies to payees who are senior citizens. To apply an exemption to the profession tax calculation, select this check box. The GC FM looks for senior citizen employees and calculates exemption if the particular state has the rule of exemption. |

Senior Citizen Parents |

Select if the payee’s parents are senior citizens. |

Dependent Information

Field or Control |

Description |

|---|---|

Disabled Dependent |

Select if the payee has a disabled dependent. |

Severely Disabled Dependent |

Select if the payee has a severely disabled dependent. |

Senior Citizen Dependent |

Select if the payee has a dependent that is also a senior citizen. |

Profession Tax

Field or Control |

Description |

|---|---|

Establishment ID |

Select the establishment ID that is related to the profession tax for the payee. |

Eligible for LWF(eligible for Labour Welfare Fund) |

Select to indicate that the payee is eligible for LWF deductions. This deduction can occur monthly, semiannually or annually depending on policies of each individual state. The deduction amount also varies from one state to another. |

State |

Enter the abbreviation of the state in which the payee resides. |

Income Tax

Field or Control |

Description |

|---|---|

Classification Code |

Select the proper classification code for the payee. |

Resident Status |

Select Non-Resident or Resident. |

Note: Professional Tax (PT) is a tax on employment, which is paid to state governments based on the employee’s region, their income slab, and other criteria. The employee’s disability and senior citizen status provides certain exemptions to the employee from PT. To calculate the exemptions correctly, the system looks at the check boxes on the Tax Detail pages. Additionally, the system uses the Generation Control Formula (GC FM) to retrieve these statuses and pass the information or values to the PT Exemption formula.

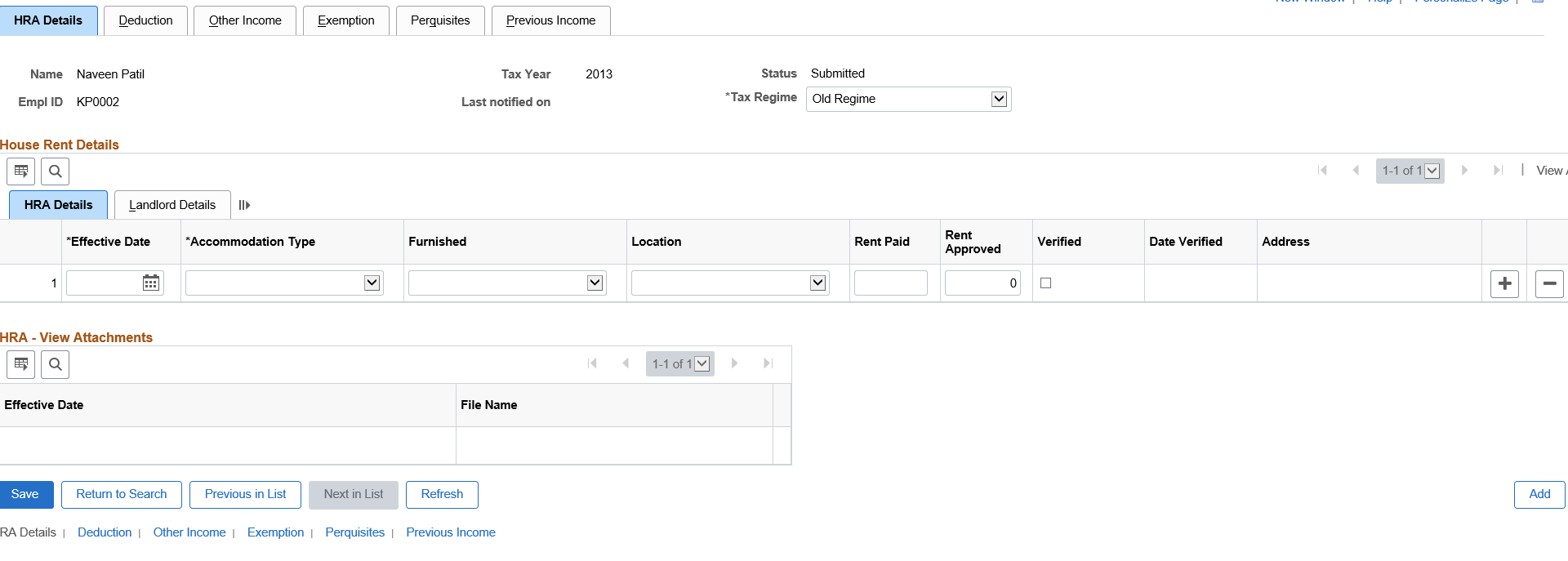

Use the HRA Details page (GPIN_TDS_HRA) to enter the declaration of the payee's house rent allowance information.

Navigation:

This example illustrates the fields and controls on the HRA Details page. You can find definitions for the fields and controls later on this page.

The HRA (House Rent Allowance) calculation accommodates the monthly HRA exemption.

Field or Control |

Description |

|---|---|

Tax Regime |

Tax regime associated with earnings/deductions. Payroll Administrator can reset or change the Tax Regime once the payee has submitted through Self Service “Tax Savings Declaration IND” page. Note: Payroll Administrator can reset or change the tax regime only when the Status is “Submitted”. If no tax declaration is submitted by the user, the TDS amount is calculated as zero. In this scenario, Administrator should provide the required value for tax regime through support element overrides TAX VR TAX REGIME at payee level. |

Accommodation Type |

Select what type of accommodation the employee currently uses: House Rent, Company Lease, or None. Select None if the payee is not eligible for HRA/CLA or if the payee resides in his own house. Note: The drop-down list values displayed for Accommodation Type are not based on the selected Tax Regime. |

Furnished |

Select the company lease accommodation type: Furnished, Un-Furnished, or Not Applicable. This is used for calculation of perquisites. This column is to be updated only if the Accommodation type is Company Lease. The type decides the extent of taxation of perquisite. |

Location |

Select whether the payee resides in a metropolitan area, such as Bombay, Calcutta, Chennai, or Delhi, or a nonmetropolitan area.

|

Rent Approved |

Enter the amount of rent that is paid by the employee using the code INR. |

Verified |

Select if the approved rent has been verified. |

Date Verified |

Displays the date the rent was verified. |

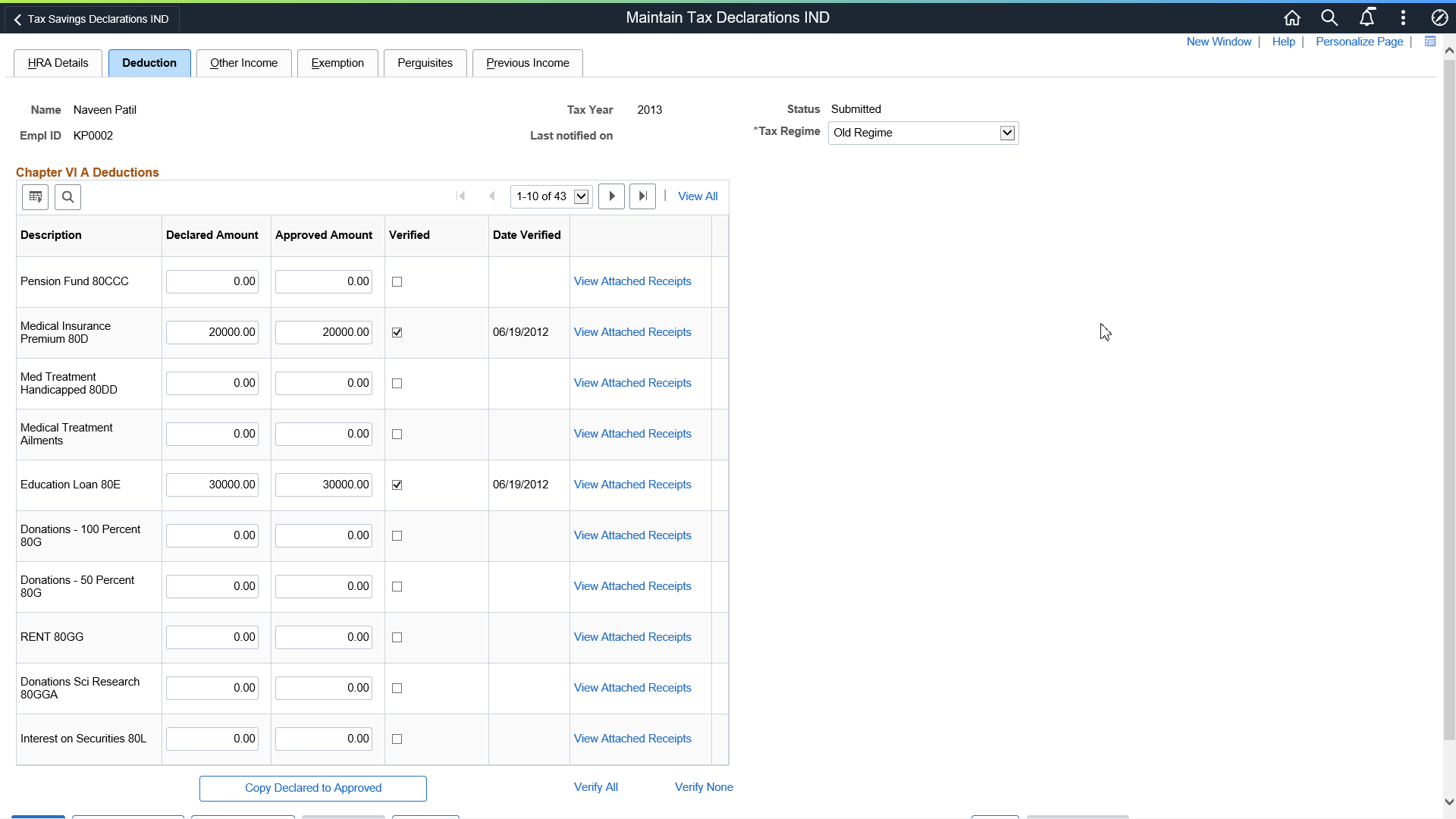

Use the Deduction page (GPIN_TDS_DEDN) to enter the payee's deductions under chapter VI A.

Navigation:

This example illustrates the fields and controls on the Deduction page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Description |

Displays the type of deduction. |

Declared Amount |

Enter the amount declared by the payee for the deduction type. |

Approved Amount |

Enter the amount that the payee can claim for the deduction from their gross total income. The payroll administrator enters the approved amount once the declared investment passes the verification process. |

Verified |

If the declared investment has completed the verification process, the payroll administrator selects this check box and the approved value is considered the final declaration for income tax computation. |

Date Verified |

Displays the date the amount was verified. |

Copy Declared to Approved |

After completing the verification process, a payroll administrator can click this button to copy all the declared investments to the approved column all at once instead of entering data manually. |

Verify All |

Click to verify all amounts. The system selects the Verified check box for all fields that have entries in the Declared Amount fields. |

Verify None |

Click to remove all the check marks in the Verified fields. |

Use the Other Income page (GPIN_TDS_OTH) to enter the payee's other source of income.

Navigation:

This example illustrates the fields and controls on the Other Income page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions in the previous section: Entering Deduction Information.

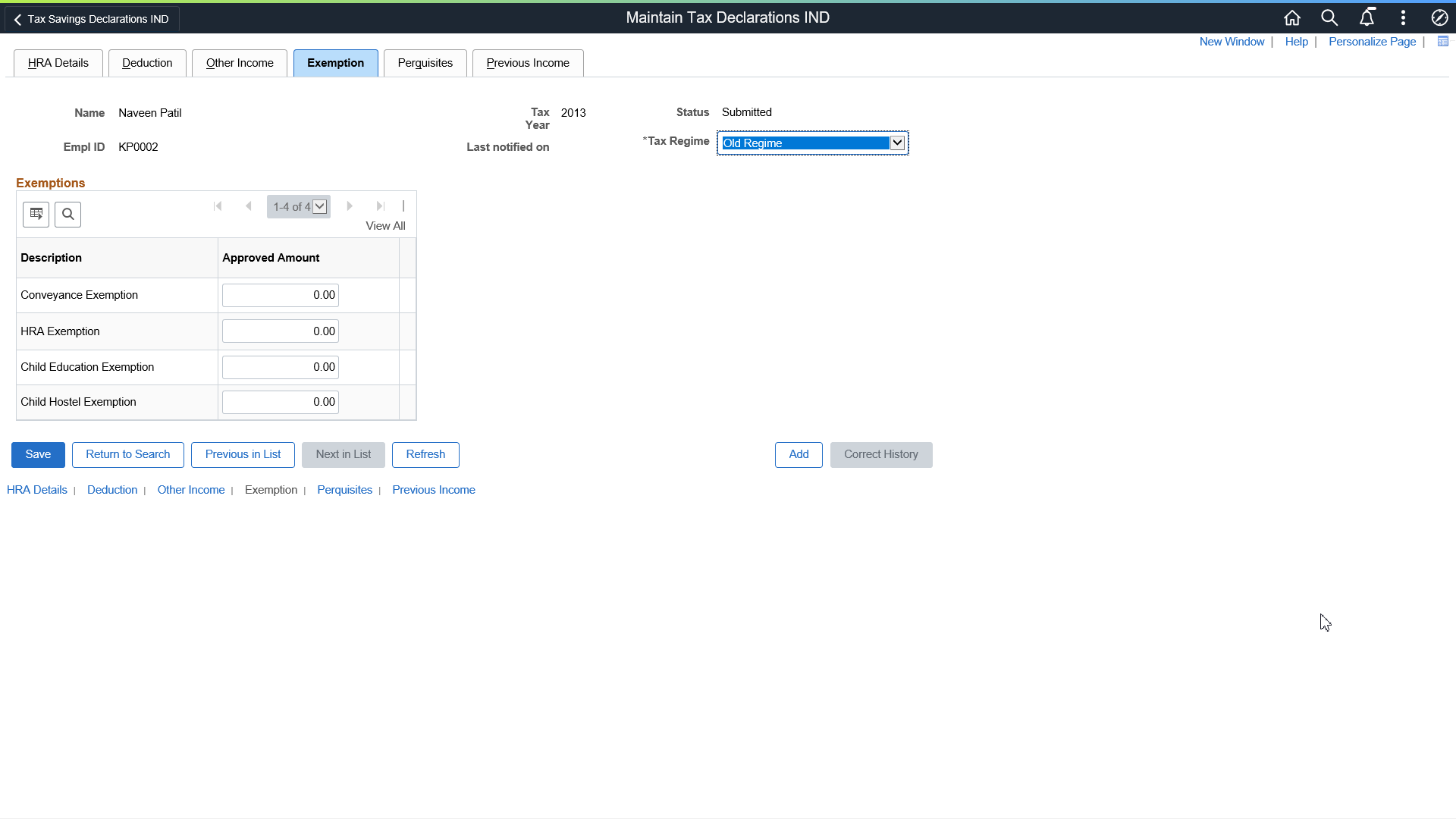

Use the Exemption page (GPIN_TDS_EXEM) to enter the payee's tax exemption information.

Navigation:

This example illustrates the fields and controls on the Exemption page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions in the Entering Deduction Information section.

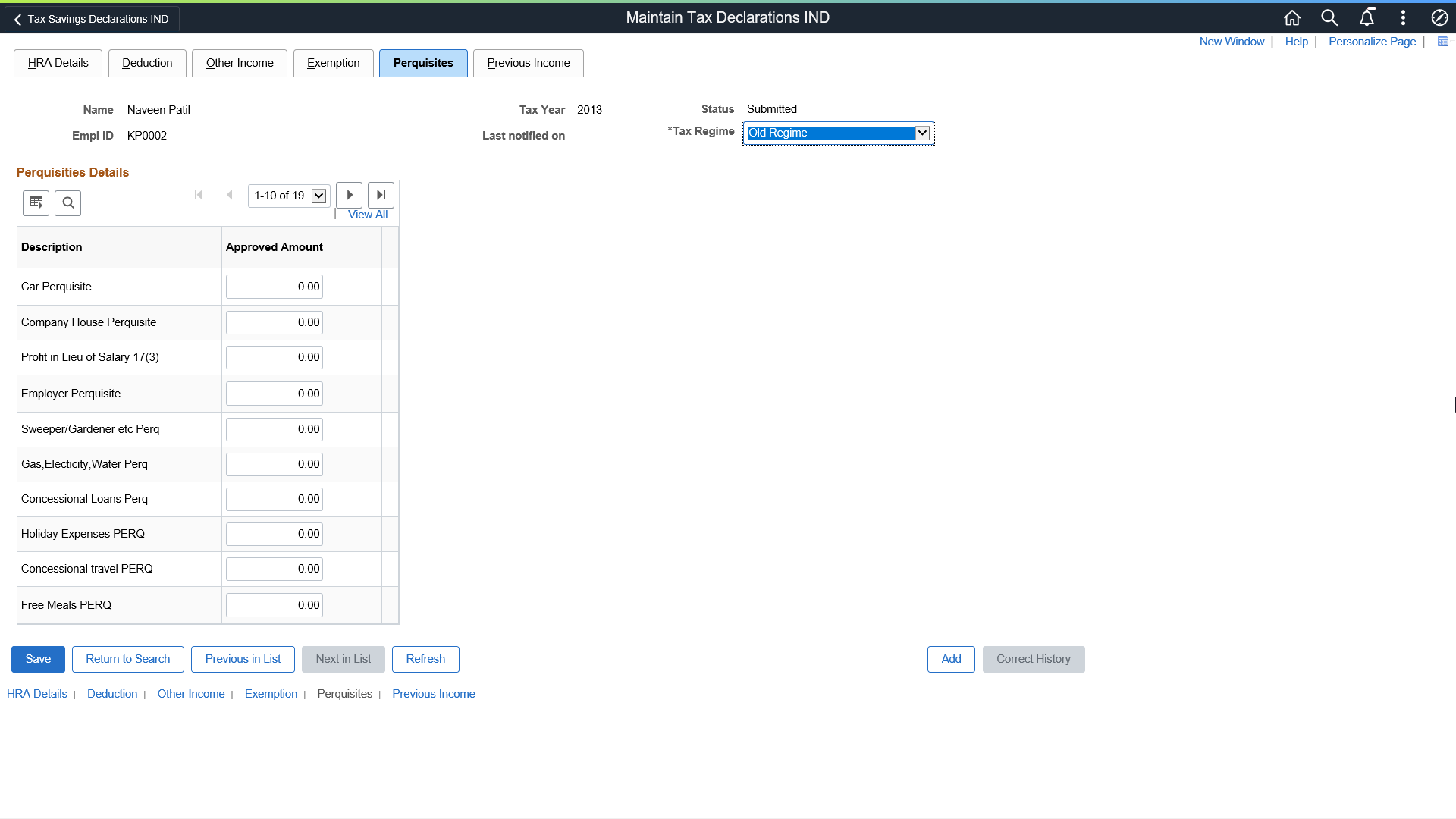

Access the Perquisites page (Global Payroll & Absence Mgmt, Payee Data, Taxes, Maintain Tax Declarations IND, Perquisites).

This example illustrates the fields and controls on the Perquisites page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions in the Entering Deduction Information section.

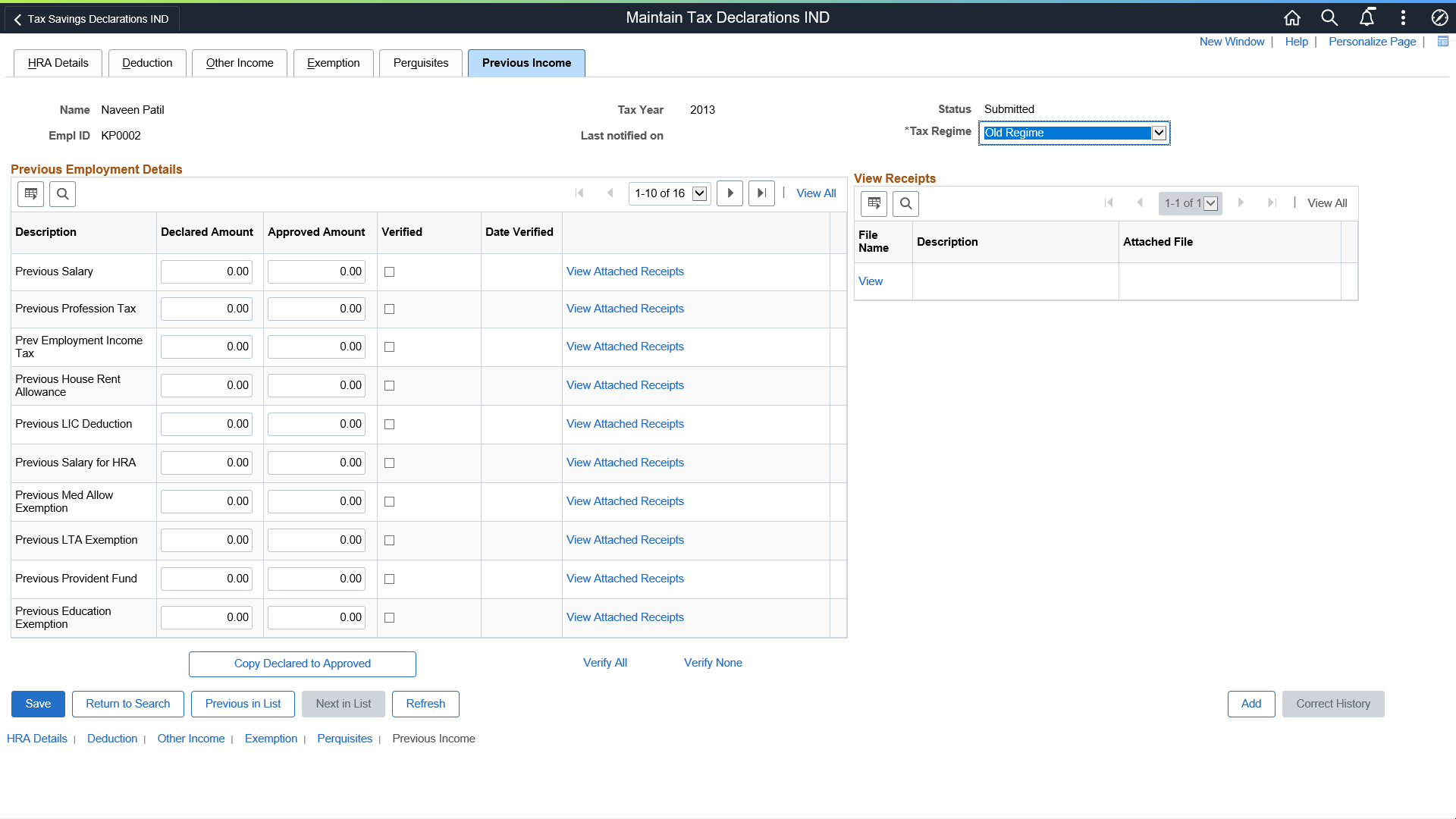

Use the Previous Income page (GPIN_TDS_PREV) to enter the payee's previous employment income information.

Navigation:

This example illustrates the fields and controls on the Previous Income page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions in the Entering Deduction Information section.