Setting Up Tax Information

This section includes a common elements section and provides information on how to set up tax deductions.

Common Elements Used in this Section

Field or Control |

Description |

|---|---|

Sequence number |

Enter a sequence number to indicate the sequence of elements for the page. |

Entry Type |

Select the element's entry type. |

Element Name |

Select the element name. Only those elements with the entry type that you select in the Entry Type column appear as choices. The corresponding description appears when you select the element name. |

Declaration Category |

Select the respective item such as Section 80C deductions under Chapter VI A, Section 80CCC, or Other income to list the entry type and element name under the correct category on the Tax Savings Declarations IND self service page. |

Tax Regime |

Select an appropriate tax regime applicable for Earnings or Deductions. Possible values are:

The default value for the Tax Regime is “New Regime” (effective 1st April 2023). This setup is used to enable the earnings/deductions for Employee Self Service “Tax Savings Declarations IND”. |

List in Self Service |

Payroll administrators have the option to list items or investments to display on the Tax Savings Declarations IND self service page. They also have the option to add or delete items when there is an introduction of a new deduction type or an amendment to the existing deduction provisions. |

Self Service Label |

Enter a description of the element. The description will be displayed on the Tax Savings Declarations IND self service page. |

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPIN_TDS_DEDN |

Set up information for deductions Under Chapter VI A. In addition you can enable self service functionality using this page. |

|

|

GPIN_TDS_EXEM |

Set up tax exemptions. |

|

|

GPIN_TDS_OTH |

Set up other income information. In addition you can enable self service functionality using this page. |

|

|

GPIN_TDS_PERQ |

Set up information for perquisites. |

|

|

GPIN_TDS_PREV |

Set up previous employment data. In addition you can enable self service functionality using this page. |

Note: The PAN number need to be updated in the employees Personal Information Page. If the mandatory filed of PAN information is not updated in the provided field, it triggers the tax calculation at a higher rate as mentioned in the Act.

To enter tax-related data as part of the setup and ongoing data maintenance:

Enter the income and profession tax-related information pertaining to the establishment.

Define the setup for payee tax declarations and previous employment.

You define the setup for each page in the Specify Tax Details IND component (GPIN_TDS_GEN).

Enter the declarations of a payee's general and house rent allowance tax information.

Enter the payee's rebate, previous employment, deduction, exemption, other sources, and perquisites tax information.

Note: Oracle provides tax element updates when amendments are made to the legislated rules governing income tax by the Central Finance Bill. However, for changes in slabs or rates, you must change the existing values to the amended rates or slabs.

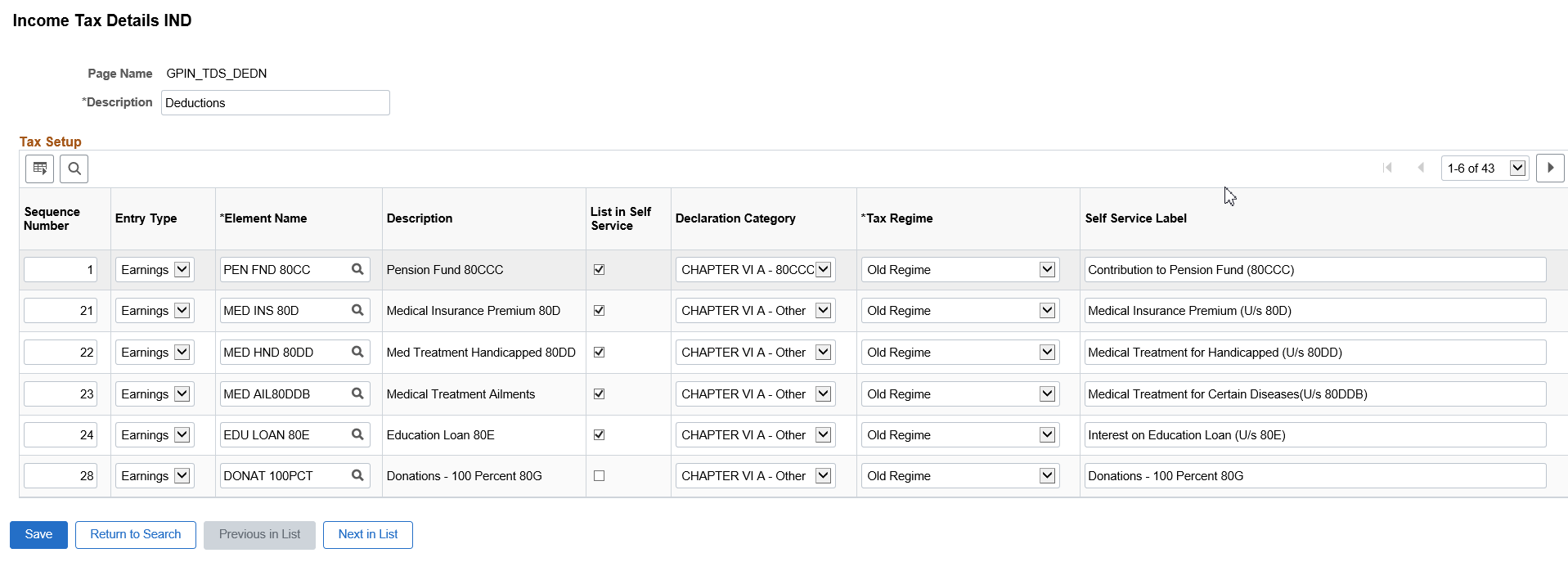

Use the Tax Setup – Deductions page (GPIN_TDS_DEDN) to set up information for deductions Under Chapter VI A.

Navigation:

This example illustrates the fields and controls on the Tax Setup – Deductions page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions under the Common Elements heading at the beginning of this section.

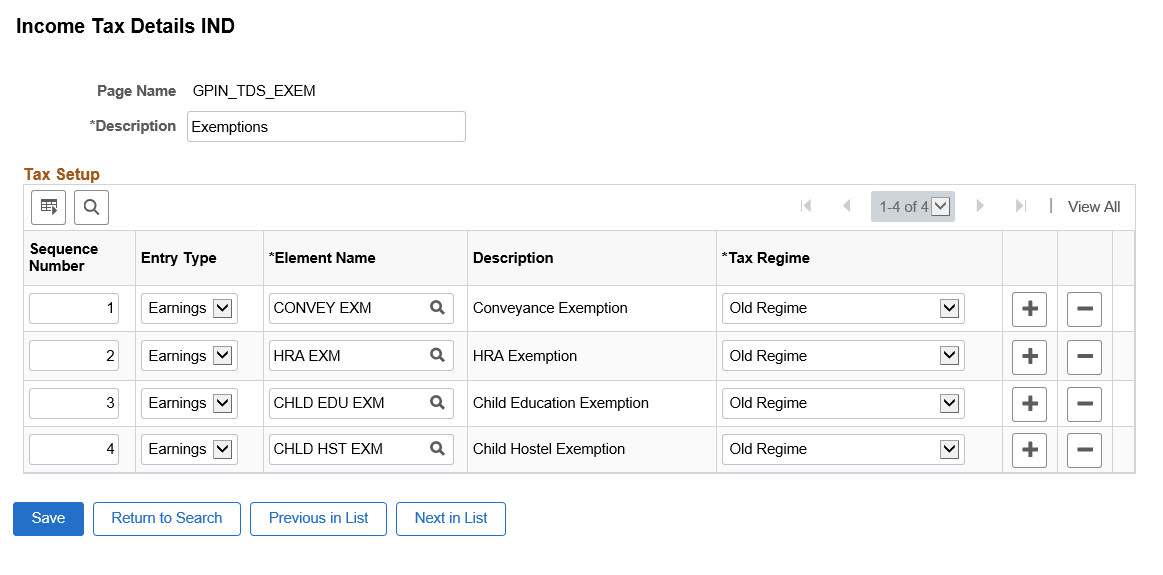

Use the Tax Setup – Exemptions page (GPIN_TDS_EXEM) to set up tax exemptions.

Navigation:

This example illustrates the fields and controls on the Tax Setup – Exemptions page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions under the Common Elements heading at the beginning of this section.

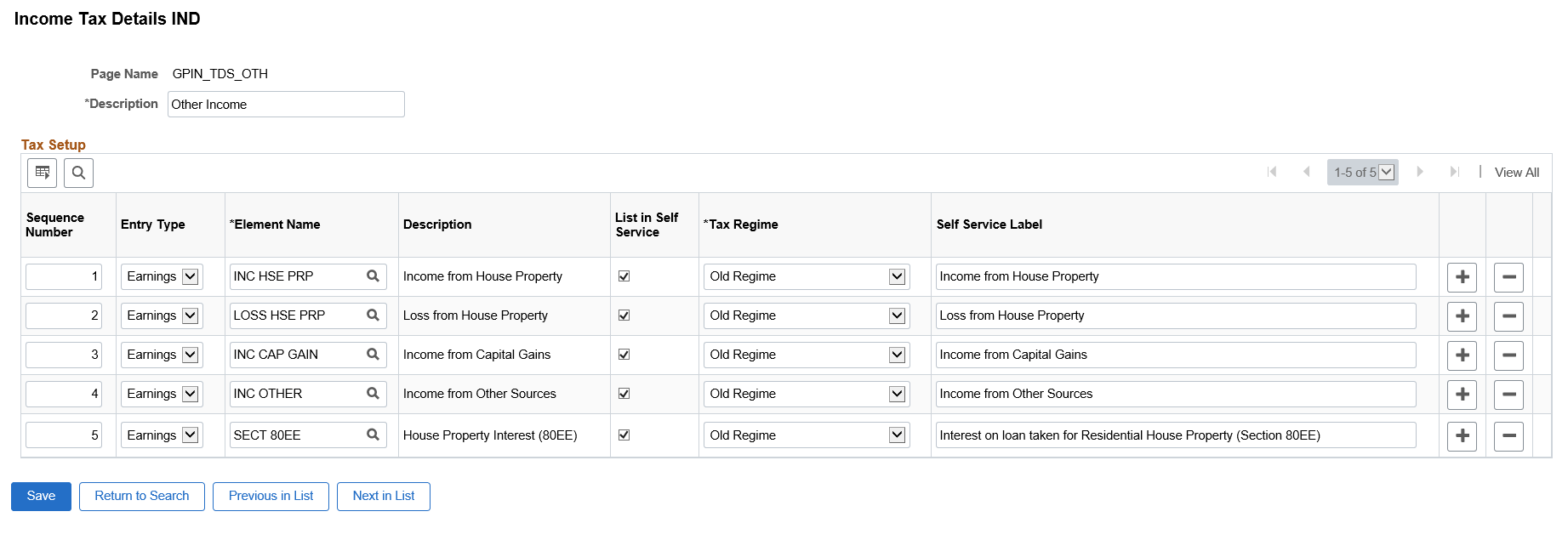

Use the Tax Setup – Other Income page (GPIN_TDS_OTH) to set up other income information.

In addition you can enable self service functionality using this page.

Navigation:

This example illustrates the fields and controls on the Tax Setup – Other Income page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions under the Common Elements heading at the beginning of this section.

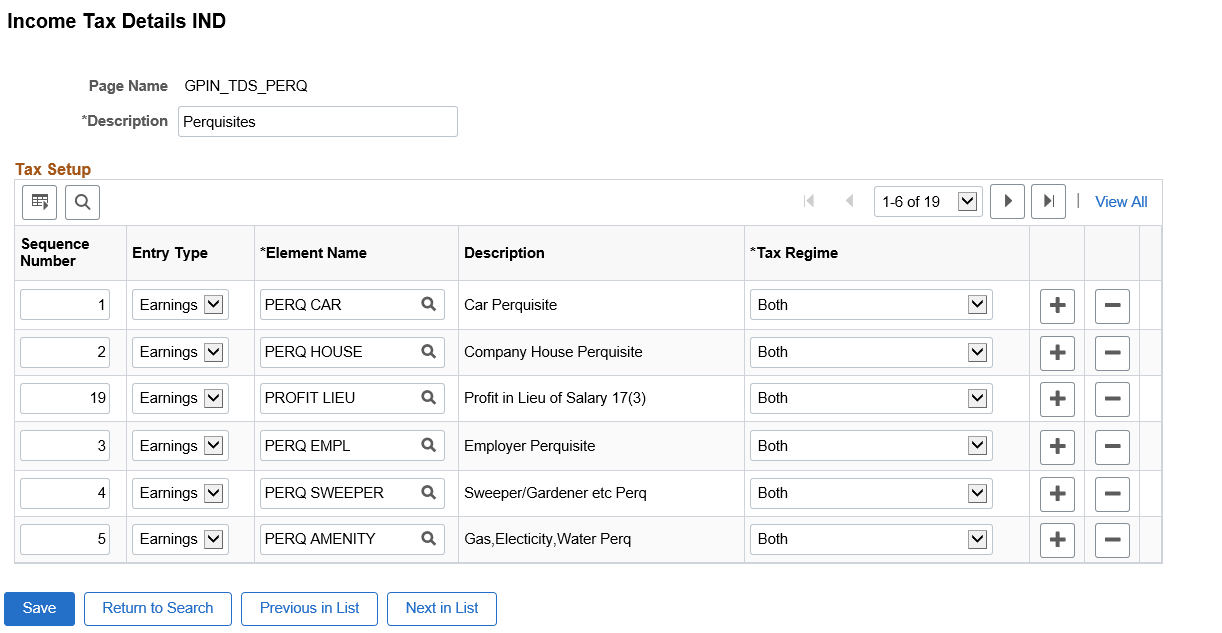

Use the Tax Setup – Perquisites page (GPIN_TDS_PERQ) to set up information for perquisites.

Navigation:

This example illustrates the fields and controls on the Tax Setup – Perquisites page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions under the Common Elements heading at the beginning of this section.

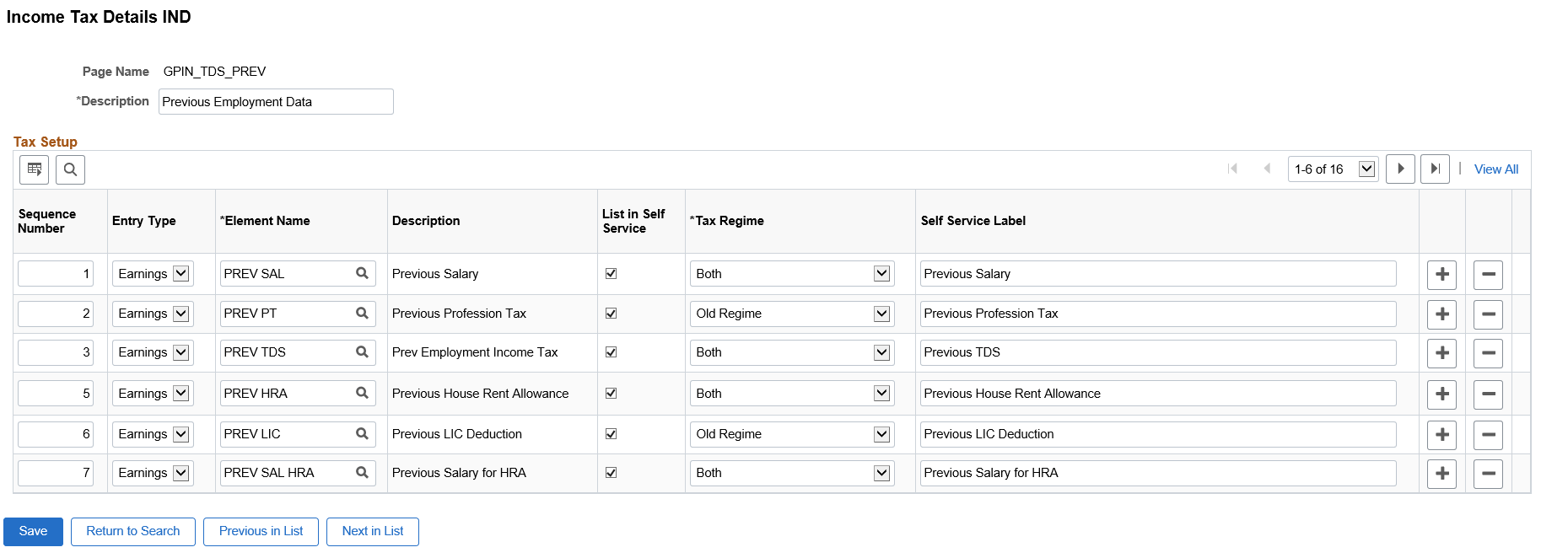

Use the Tax Setup – Previous Employment page (GPIN_TDS_PREV) to set up previous employment data.

In addition you can enable self service functionality using this page.

Navigation:

This example illustrates the fields and controls on the Tax Setup – Previous Employment Data page. You can find definitions for the fields and controls later on this page.

Note: See field descriptions under the Common Elements heading at the beginning of this section.