Reviewing and Maintaining IR21 and Appendix 1 Forms

This topic provides an overview of IR21 and Appendix 1 forms.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Employee Details Page |

GPSG_IR21_1 |

Review employee personal details and employer particulars. All fields on this page are display-only, except for the Issue Status field. |

|

GPSG_IR21_2 |

Enter an employee's employment records and details of their spouse and children (employment record IR21). |

|

|

GPSG_IR21_3 |

Enter income and deduction particulars, including other income and deductions details (income deductions IR21 a and b). |

|

|

GPSG_IR21_APP1_1 |

Enter employee residence and hotel accommodation details for the IR21 - Appendix 1 Form. |

|

|

GPSG_IR21_APP1_2 |

View other benefits details. |

After completing the setup as preparation for the generation of Inland Revenue forms and subsequently generating those forms, you can review the results and maintain those fields that are user maintainable as required. As the payroll may not have two years of data for an employee, you can manually enter those additional values that are required for the IR21 form. On each page of the component, most of the fields are populated from the database. You can maintain some fields online that the system populates.

Note: Values for the issue status are Awaiting (issue to the employee) and (already)Issued (to the employee) The system sets the issue status to awaiting when it first creates the record. When you print the IR21, the system changes the status to issued. The status should be awaiting whenever you want to print or reprint an Appendix 8A, IR8A/IR8S or IR21 form.

If you already issued one of the forms, change the status back to awaiting to reprint it. You should also change the status to awaiting before printing if the setting is issued, or you can select the Reprint Forms check box to reprint those that you already issued.

Online maintenance of all user-maintainable fields in this group is only possible for the awaiting status. You cannot maintain a form that you already issued to an employee. However, since you can change the status field from issued to awaiting, you can decide to enable changes to an issued form and then reissue it.

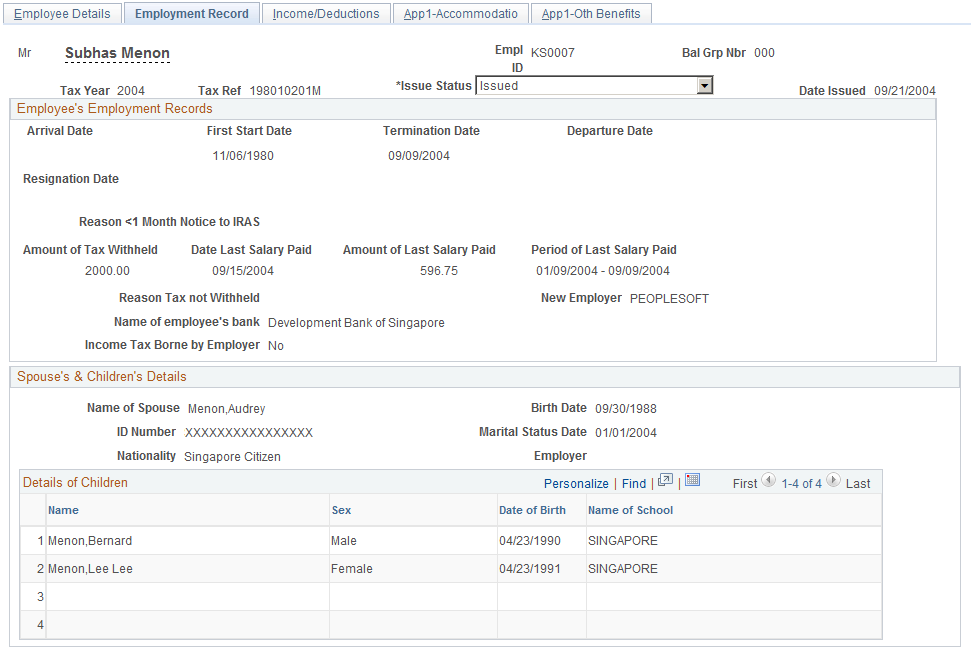

Use the Employment Record page (GPSG_IR21_2) to enter an employee's employment records and details of their spouse and children (employment record IR21).

Navigation:

This example illustrates the fields and controls on the Employment Record page.

Employee's Employment Records

Field or Control |

Description |

|---|---|

Arrival Date |

The date that the employee arrived in Singapore. This field is not applicable if the employee has been working in Singapore prior to employment with the company. |

First Start Date and Departure Date |

The start date is the employee's hire date and automatically populates from job data. The departure date is the date that the employee is due to leave Singapore. One month's notice must be given before this date to comply with IRAS guidelines. |

Termination Date and Resignation Date |

Enter the employee's last day of service in the Termination Date field. This automatically populates from job data. For example, if an employee tenders resignation on January 28, 2007, giving one month's notice, the termination date is February 27, 2007, even if the last day of service is earlier, after offsetting the remaining vacation leave entitlement. Enter the date that the employee tendered resignation in theResignation Date field. The IR21 form must be filed at least one month before a noncitizen employee quits or is about to cease employment or is leaving Singapore for any period exceeding three months. |

Reason <1 Month Notice to IRAS |

Enter the reasons if less than one month's notice is given before the employee's departure or termination. |

Amount of Tax Withheld, Reason Tax not Withheld, and New Employer |

Enter the amount of money that the employer retains pending tax clearance in the Amount of Tax Withheld field. An employer is required to withhold any money (including overtime pay, leave pay, allowances for transportation, entertainment, gratuities and lump sum payments, and so on) that is due to the employee. Examples include when the employer decides to end the employment or post the employee to an overseas location, or the employee notifies the employer of the intention to cease employment or depart from Singapore. Enter the reason that money is not withheld in the Reason Tax not Withheld field. Certain income and payments are exempted from tax or subjected to a reduced rate of withholding tax. If this field is populated, then theAmount of Tax Withheldfield is not accessible. If the employee works for another employer after they leave this company, enter the new employer name. You do not have to complete an IR21 form for foreign employees who are transferring to work in another company in Singapore because of restructuring, reengineering, merger, or takeover. |

Spouse's & Children's Details

This information populates particulars records of the employee's spouse and children in Section E of the IR21 form.

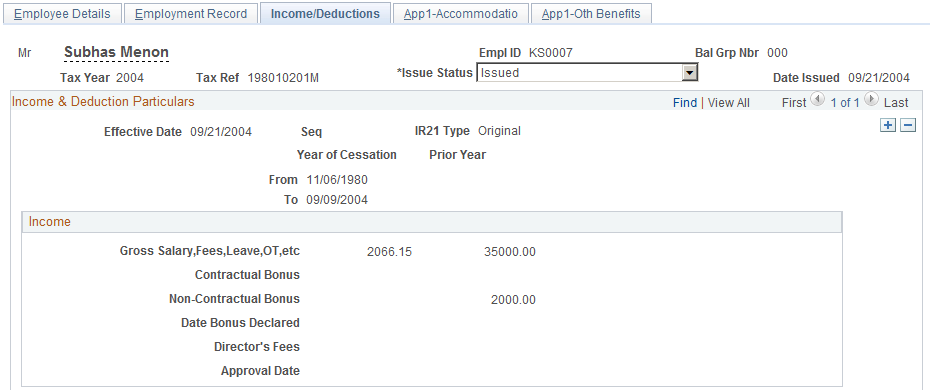

Use the Income/Deductions page (GPSG_IR21_3) to enter income and deduction particulars, including other income and deductions details (income deductions IR21 a and b).

Navigation:

This example illustrates the fields and controls on the Income/Deductions page (1 of 2).

This example illustrates the fields and controls on the Income/Deductions page (2 of 2).

Income & Deduction Particulars

Field or Control |

Description |

|---|---|

Effective Date andSeq (sequence) |

The date that you create the IR21 details and they are populated as a result of the Create IR21 Details process. Every time that you run the IR21 Create Details process, the system automatically assigns a sequence number. The current number reflects the total number of times that you ran the process. |

IR21 Type |

Indicates the status of the IR21 information:

|

Year of Cessation and Prior Year |

The income that is required for the IR21 is the amount that is due in the year of cessation and the year that is prior to the year of cessation. The system attempts to populate the from and to dates based on three tax years of data from the Job Data and IR8A tables (where applicable). For example, if the period of employment is from January 3, 1996 to March 31, 1999, details of income for the employee are reported separately for the period from January 1, 1999 to March 31, 1999, and those for the calendar year 1998. Any amount that is due, say for 1998 but paid in 1999, should be reported as 1998 income. |

Income

Field or Control |

Description |

|---|---|

Gross Salary, Fees, Leave, OT, etc |

Enter the total amount of income that is received by gross salary, fees, leave pay, wages and overtime, and the corresponding period that the income is received. The system attempts to populate the dates for the year of cessation and the year that is prior to the year of cessation based on two tax years of data from the Payroll and IR8A tables. |

Contractual Bonus, Non-Contractual Bonus and Date Bonus Declared |

Enter the full amount of the contractual bonus, which is paid or payable in the year of cessation and the prior year. This is due and payable under the terms of the contract of service. It is regarded as the employee's income in the year that is specified by the contract. This is usually the year in which the employee's services are rendered. For example, you should report the contractual bonus that is paid in 2007 for the services that are rendered in 2006 as 2006 income. Enter the full amount of the non-contractual bonus, which is paid or payable in the year of cessation and the prior year. This is due and payable at the discretion of the employer. It is regarded as the employee's income on the date that the employer decides that the bonuses are payable. Indicate the date on which the non-contractual bonus payment is declared payable in the Date Bonus Declared field. For example, when an employer decides in December 2006 to pay a non-contractual bonus in January 2007, you should report this bonus in the IR21 form as income for the year 2006. |

Director's Fees and Approval Date |

Enter the full amount of director's fees, which are paid or are payable in the year of cessation and the prior year. This is regarded as paid to the director on the date on which the fee is voted for and approved at a company's annual general meeting or extraordinary general meeting of that calendar year. Where the company holds more than one meeting during the calendar year to approve payments of director's fee for the same financial year, enter the approval date of the latest meeting that is held. |

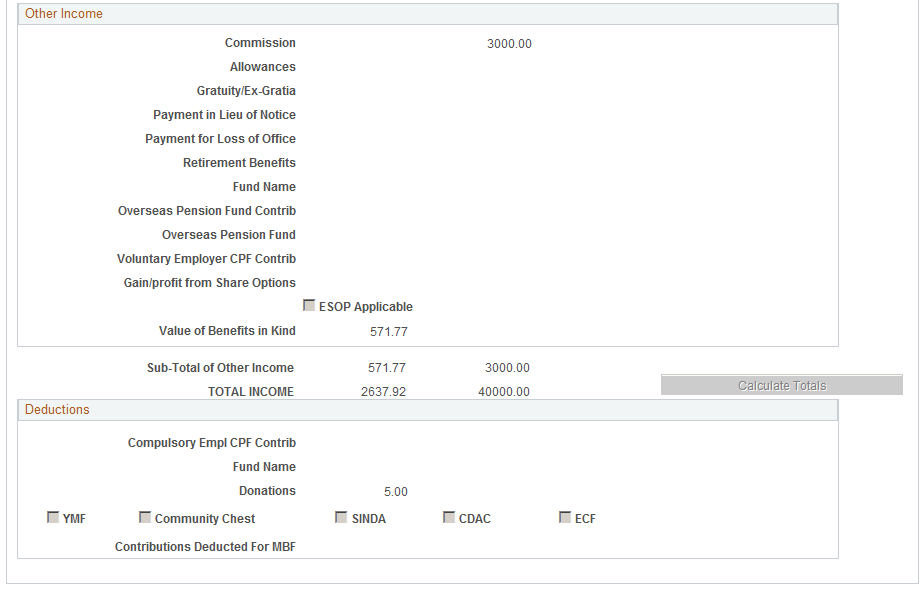

Other Income

Field or Control |

Description |

|---|---|

Commission |

Enter the gross commission, which is paid or payable in the year of cessation and the year that is prior to the year of cessation. The gross commission includes all earnings elements that are identified as commission. |

Allowances |

Enter the allowances, which are paid or payable in the year of cessation and the year that is prior to the year of cessation. An allowance generally refers to a regular cash payment that benefits the employee who is not required to account for it. |

Gratuity/Ex-Gratia |

Enter the gratuity or ex-gratia that is paid or payable in the year of cessation and the year that is prior to the year of cessation. This field includes all earnings elements that are identified as gratuity or ex-gratia. For example, tips that are given by a customer to a waiter for efficient service are taxable to the waiter, although the tips are gratuitous and the payer is a third-party. Enter additional details relating specifically to gratuity and compensation or gains or profit from share options on the IR8A/IR8S Form, IR8A Income page. |

Payment in Lieu of Notice |

Enter the payment in lieu of notice that is paid or payable in the year of cessation and the year that is prior to the year of cessation. This includes any payments that the employee receives following resignation or termination as compensation for not working the required notice period. |

Payment for Loss of Office |

Enter the payment for loss of office that is paid or payable in the year of cessation and the year that is prior to the year of cessation. This includes any amounts that are paid to the employee as compensation for the loss of employment. |

Retirement Benefits and Fund Name |

Enter the full amount of retirement benefits that are paid or are payable in the year of cessation and the year that is prior to the year of cessation. This amount includes gratuities, pension, commutation of pension, and lump sum payments from a pension or provident fund. Enter the name of the retirement fund. |

Overseas Pension Fund Contrib (overseas pension fund contribution) andOverseas Pension Fund |

In the overseas pension fund contributions field, enter the full amount of the employer's contributions to any pension or provident fund outside Singapore. Enter the amounts that are paid or are payable in the year of cessation and the year that is prior to the year of cessation. Such contributions by the employer are taxable as part of the employee's income. Enter the overseas fund name. |

Voluntary Employer CPF Contrib |

Enter the full amount of the excess voluntary contributions to CPF by the employer which are paid or are payable in the year of cessation and the year that is prior to the year of cessation. Employer's contributions that are more than the compulsory contributions under the CPF Act or are based on that part of the additional wages which exceeds 40 percent of the ordinary wages that are paid to an employee in any year, are taxable as the employee's income. Employer's contributions that are not compulsory under the CPF Act are considered voluntary contributions and are taxable as the employee's income. This includes employer's contributions to CPF for foreign employees (that is, those holding employment passes, professional visit passes, or work permits). |

Gain/profit from Share Options |

Enter the full amount of the gains or profits from share options that are paid or are payable in the year of cessation and the year that is prior to the year of cessation. Gains from share options (irrespective of whether the shares of a company are listed on the Singapore Stock Exchange) are taxable in the year that the option is exercised, assigned or released. |

ESOP Applicable |

Select the ESOP Applicable check box where a deferral of tax payment is granted on gains from a qualified ESOP scheme. Such deferral ceases to apply upon tax clearance, and all outstanding tax is due immediately. |

Value of Benefits in Kind |

Enter the full value of benefits in kind which are provided to the employee in the year of cessation and the year that is prior to the year of cessation. Two other forms may need to accompany an IR21 Under certain circumstances, the Appendix 1 form, which documents received benefits in kind, may need to accompany an IR21. |

Sub-Total of Other Income, TOTAL INCOME, and Calculate Totals |

Click the Calculate Totals button to calculate a subtotal of other income, representing items 4(a) to 4(j), and a total income. |

Deductions

Field or Control |

Description |

|---|---|

Compulsory Employee CPF Contr and Fund Name |

Enter the employee's compulsory contribution to a CPF (pension or provident fund). Enter the amounts that the employee provided in the year of cessation and the year that is prior to the year of cessation. Enter the name of the pension fund. |

YBF, Community Chest, SINDA, CDAC and ECF |

If these check boxes are selected, this indicates that deductions were taken during the year. |

Contributions Deducted For MBF |

Enter any contributions deducted for MBF. |

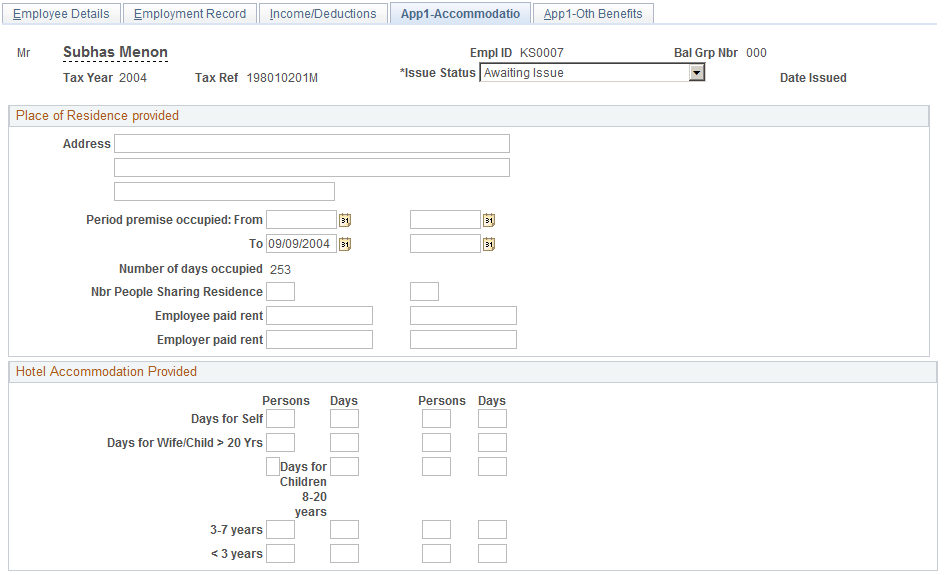

Use the App 1-Accommodatio (Appendix 1-Accommodation) page (GPSG_IR21_APP1_1) to enter employee residence and hotel accommodation details for the IR21 - Appendix 1 Form.

Navigation:

This example illustrates the fields and controls on the App 1-Accommodatio page.

Place of Residence Provided

Field or Control |

Description |

|---|---|

Address |

Enter the address of the employee's residence that is provided by the employer. If the employee's residence is part of an employment benefit in kind, enter the address details on the Appendix 8A—Place of Residence page also. |

Period premise occupied: From, To and Number of days occupied |

Enter the dates that the employee occupied the residence during the year of cessation and the year that is prior to the year of cessation. The dates that you enter on the Appendix 8a component dates appear by default. When you tab out of the date fields, the system automatically updates the number of days occupied. |

Nbr of people sharing residence (number of people sharing residence) |

Enter the number of employees that are living and sharing the residence during the year of cessation and the year that is prior to the year of cessation. (This excludes family members). The value that you entered on the Appendix 8a component appears by default. |

Employee paid rent and Employer paid rent |

The employee paid rent and the employer paid rent values that you set up on the Appendix 8a component appear by default. You enter the values for the year of cessation and the year that is prior to the year of cessation. You use these values in the calculation of the taxable benefit or taxable value of place of residence on the IR21 Form. |

Hotel Accommodation Provided

Field or Control |

Description |

|---|---|

Days for Self, Days for Wife/Child > 20 yrs, Days for Children 8-20 years, 3-7 years, and < 3 years |

The values that you set up on the Appendix 8a component appear by default. You use these values in the calculation of the taxable value of hotel accommodation that is provided by using the rates that are stored in the Benefit Rates table (or in Section B and C of the Appendix 8A Form). You enter the total number of persons (self, spouse, or child) and the number of days (period during which the accommodation is provided to these persons). |

Use the App 1-Oth Benefits (Appendix 1 Other Benefits) page (GPSG_IR21_APP1_2) to view other benefits details.

Navigation:

This example illustrates the fields and controls on the App 1-Oth Benefits page.

Other Benefits

Field or Control |

Description |

|---|---|

Benefit Type, Number in Year of Cessation and Value in Year of Cessation |

The benefit type and its description details for furniture and fittings, driver, and gardener; leave passage; motor car; and other benefit items are created and stored in the IRAS Benefit Rates SGP page. When generating the Appendix 1 details, the system calculates the value of the benefits in kind by using effective-dated rates that are stored in the IRAS Benefit Rates table. These rates reflect the rates that are detailed in section B of the IRAS Appendix 1 form. You create the unit or values for each benefit on the Appendix 8A component. For each benefit that you select, insert a new row and enter the values for the Year of Cessation and year that is prior to the year of cessation. You use these values in the calculation of the taxable value of the employee's benefit in kind items. |